Tax Alaska Form

What is the Tax Alaska

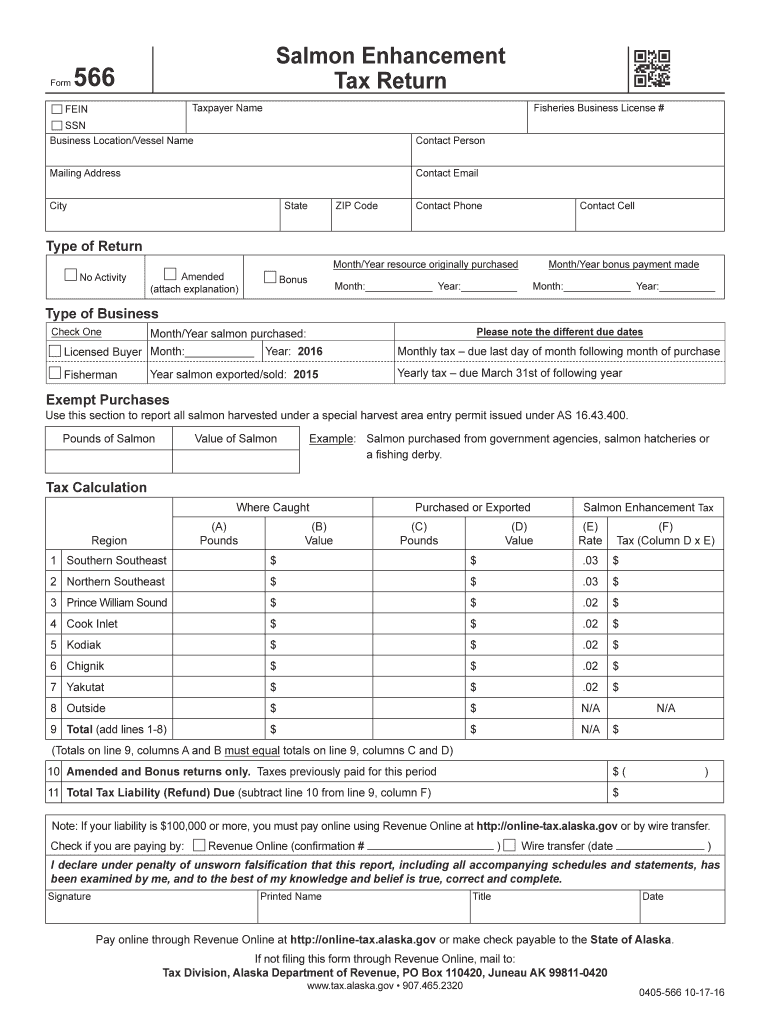

The Tax Alaska refers to specific tax forms and regulations applicable to residents and businesses operating in Alaska. These forms are essential for reporting income, claiming deductions, and ensuring compliance with state tax laws. Unlike many states, Alaska does not have a state income tax, which simplifies the tax process for individuals and businesses. However, residents may still be subject to other taxes, such as property tax and sales tax, depending on local regulations.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including income statements, previous tax returns, and any relevant financial records. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is crucial to review the form for any errors before submission. Finally, submit the completed form either online, by mail, or in person, depending on the preferred submission method.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted by the established deadlines. Using a reliable electronic signature solution can enhance the legal standing of the submitted form, as it provides a secure way to sign and authenticate documents. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws is essential for the legal validity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form vary depending on the specific type of tax being reported. Generally, individual tax returns must be filed by April fifteenth of each year. However, businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these deadlines to avoid penalties. Marking important dates on a calendar can help ensure timely submissions.

Required Documents

To complete the Tax Alaska form, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return

- Documentation of any tax credits claimed

Having these documents readily available will streamline the completion process and help avoid delays.

Form Submission Methods

There are multiple methods to submit the Tax Alaska form, each offering its own advantages. Forms can be submitted online through the state’s tax portal, providing a quick and efficient way to file. Alternatively, individuals may choose to mail their forms to the appropriate tax office or deliver them in person. Each method has specific instructions and deadlines, so it is important to follow the guidelines provided by the state.

Examples of using the Tax Alaska

Using the Tax Alaska form can vary based on individual circumstances. For instance, a self-employed individual may report income differently than a traditional employee. Additionally, a business may need to file for various taxes, including sales tax or property tax, depending on its operations. Understanding these examples can clarify how the Tax Alaska form applies to different taxpayer scenarios, ensuring compliance and accuracy in reporting.

Quick guide on how to complete tax alaska 6967147

Effortlessly Prepare Tax Alaska on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the appropriate format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without complications. Manage Tax Alaska on any device using airSlate SignNow's Android or iOS applications, and enhance any document-related workflow today.

How to Modify and Electronically Sign Tax Alaska with Ease

- Locate Tax Alaska and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tax Alaska to ensure smooth communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967147

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how can it help with Tax Alaska?

airSlate SignNow is a cost-effective electronic signature solution that enables businesses to send and eSign documents efficiently. For those dealing with Tax Alaska, it streamlines the document signing process, making tax filings and agreements faster and more accessible.

-

How much does airSlate SignNow cost for managing Tax Alaska documents?

The pricing for airSlate SignNow varies based on the plan selected, but it is generally designed to be budget-friendly for businesses managing Tax Alaska documents. With various tiers available, you can choose the best option that suits your needs while ensuring compliance and ease of use.

-

What features does airSlate SignNow offer for Tax Alaska compliance?

airSlate SignNow provides robust features such as secure eSignatures, document templates, and customizable workflows to ensure compliance with Tax Alaska regulations. These features enhance efficiency and reduce the likelihood of errors during tax documentation.

-

Can I integrate airSlate SignNow with other tools for Tax Alaska management?

Yes, airSlate SignNow integrates seamlessly with popular business applications, making it easier to manage Tax Alaska and related documents. This allows for a more streamlined workflow, connecting your tax-related processes directly to tools you already use.

-

Is airSlate SignNow secure for handling sensitive Tax Alaska documents?

Absolutely! airSlate SignNow employs advanced security measures, including data encryption and secure cloud storage, to protect your sensitive Tax Alaska documents. This ensures that your information remains confidential and safe from unauthorized access.

-

How does airSlate SignNow simplify eSigning for Tax Alaska?

airSlate SignNow simplifies the eSigning process for Tax Alaska by offering a user-friendly interface that makes it easy for both senders and signers. With just a few clicks, you can prepare documents for eSignature, saving time and enhancing the overall tax management experience.

-

What are the benefits of using airSlate SignNow for Tax Alaska?

Using airSlate SignNow for Tax Alaska can greatly enhance productivity by reducing the time spent on document handling and signatures. The platform also ensures compliance and accuracy in tax filing, allowing users to focus on their core business activities.

Get more for Tax Alaska

Find out other Tax Alaska

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online