Srpmic Tax Form

What is the Srpmic Tax?

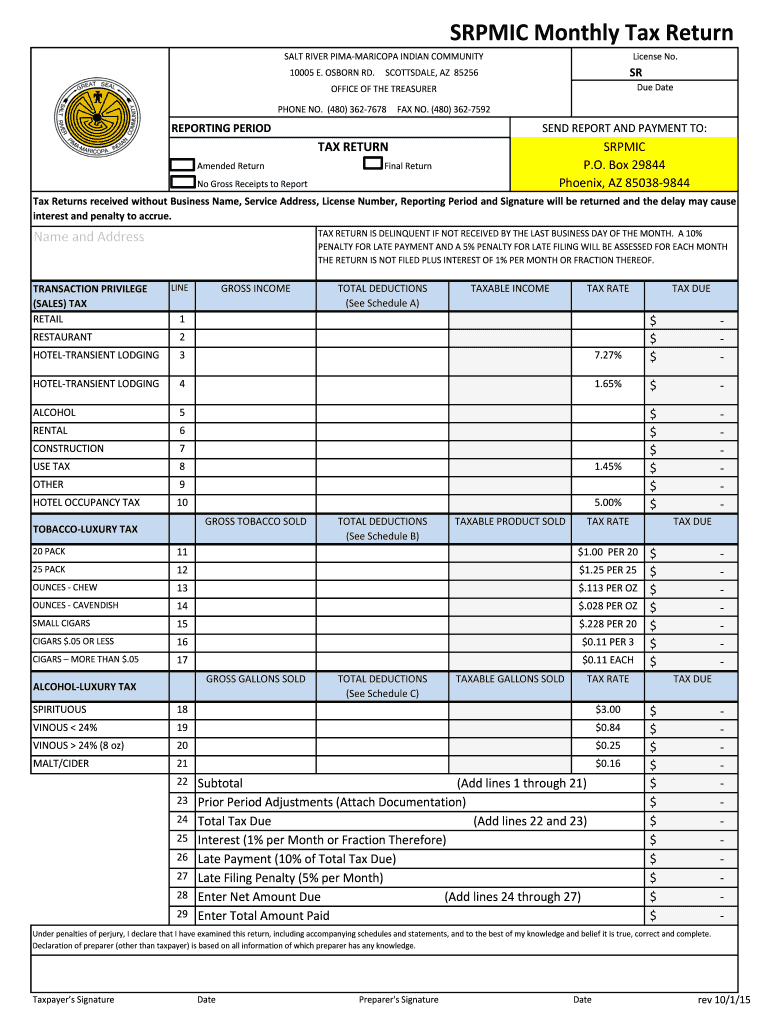

The Srpmic tax refers to the tax obligations imposed by the Salt River Pima-Maricopa Indian Community (SRPMIC) on its residents and businesses. This tax is designed to support local services and infrastructure within the community. The Srpmic monthly tax return is a specific form that individuals and entities must complete to report their taxable income and calculate their tax liabilities. Understanding the nature of this tax is essential for compliance and effective financial planning.

Steps to Complete the Srpmic Tax

Filling out the Srpmic monthly tax return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, complete the tax form by entering your income, deductions, and any applicable credits. It is vital to double-check all entries for accuracy. After completing the form, sign and date it, either electronically or manually, depending on your submission method. Finally, submit the return by the specified deadline to avoid penalties.

Required Documents

To successfully complete the Srpmic monthly tax return, certain documents are necessary. These typically include:

- Income statements such as W-2s or 1099s

- Previous tax returns for reference

- Documentation for any deductions or credits claimed

- Identification documents, if required

Having these documents ready will streamline the process and help ensure that all information is accurate and complete.

Form Submission Methods

The Srpmic monthly tax return can be submitted through various methods, allowing for flexibility and convenience. Options typically include:

- Online submission via an e-filing system

- Mailing a paper copy to the designated tax office

- In-person submission at local tax offices

Each method has its own requirements and deadlines, so it is important to choose the one that best fits your needs.

Legal Use of the Srpmic Tax

Understanding the legal framework surrounding the Srpmic tax is crucial for compliance. The tax is governed by the laws of the Salt River Pima-Maricopa Indian Community, which means it is subject to specific regulations and guidelines. Compliance with these laws ensures that the tax return is valid and that taxpayers avoid potential legal issues. Additionally, utilizing electronic tools for submission must align with eSignature laws to maintain the legal standing of the documents.

Penalties for Non-Compliance

Failure to file the Srpmic monthly tax return on time or inaccuracies in reporting can result in penalties. These may include fines, interest on unpaid taxes, or additional legal consequences. It is important for taxpayers to be aware of these penalties to avoid unnecessary financial burdens. Staying informed about filing deadlines and ensuring accurate submissions can help mitigate these risks.

Quick guide on how to complete srpmic tax

Complete Srpmic Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It provides an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Srpmic Tax on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Srpmic Tax without hassle

- Find Srpmic Tax and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Srpmic Tax and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the srpmic tax

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the srpmic tax return and why is it important?

The srpmic tax return is a critical document for members of the Salt River Pima-Maricopa Indian Community, detailing their income and tax obligations. It is essential for obtaining various benefits, meeting legal requirements, and ensuring compliance with local taxation laws. Properly filing your srpmic tax return can help you avoid penalties and take advantage of eligible credits.

-

How can airSlate SignNow assist with completing my srpmic tax return?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your srpmic tax return documents. With its secure eSignature capabilities, you can quickly gather signatures from multiple parties, ensuring that your returns are submitted in a timely manner. This streamlines the entire process, saving you both time and effort.

-

Is there a cost associated with using airSlate SignNow for srpmic tax return filings?

Yes, airSlate SignNow offers affordable pricing plans tailored to meet the needs of various users, including those needing to file a srpmic tax return. Our plans provide effective solutions without the burden of high costs, making it an economical choice for individuals and businesses alike. Explore our pricing options to find the best fit for your needs.

-

What features does airSlate SignNow offer for srpmic tax return processing?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage, all designed to simplify your srpmic tax return processing. The platform ensures that you can quickly prepare and sign necessary documents while maintaining security and compliance. These features contribute to an efficient filing experience.

-

Can I integrate airSlate SignNow with my existing financial tools for srpmic tax return?

Absolutely! airSlate SignNow can easily integrate with a variety of financial software and tools, enhancing your workflow for srpmic tax return preparation. This seamless integration allows you to import data, manage documents, and send for signatures without tedious manual processes, thereby increasing your productivity.

-

What are the benefits of using eSignatures for my srpmic tax return?

Using eSignatures for your srpmic tax return offers numerous benefits, including faster processing times and enhanced security. With airSlate SignNow, you can complete signature requirements quickly and efficiently, while also ensuring that your documents are safe from unauthorized access. This convenience ultimately helps streamline your entire tax filing process.

-

Is airSlate SignNow secure for submitting sensitive srpmic tax return information?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe option for submitting sensitive srpmic tax return information. Our platform utilizes advanced encryption and secure storage solutions to protect your data at all times. You can confidently manage your tax documents knowing that they are securely handled.

Get more for Srpmic Tax

Find out other Srpmic Tax

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now