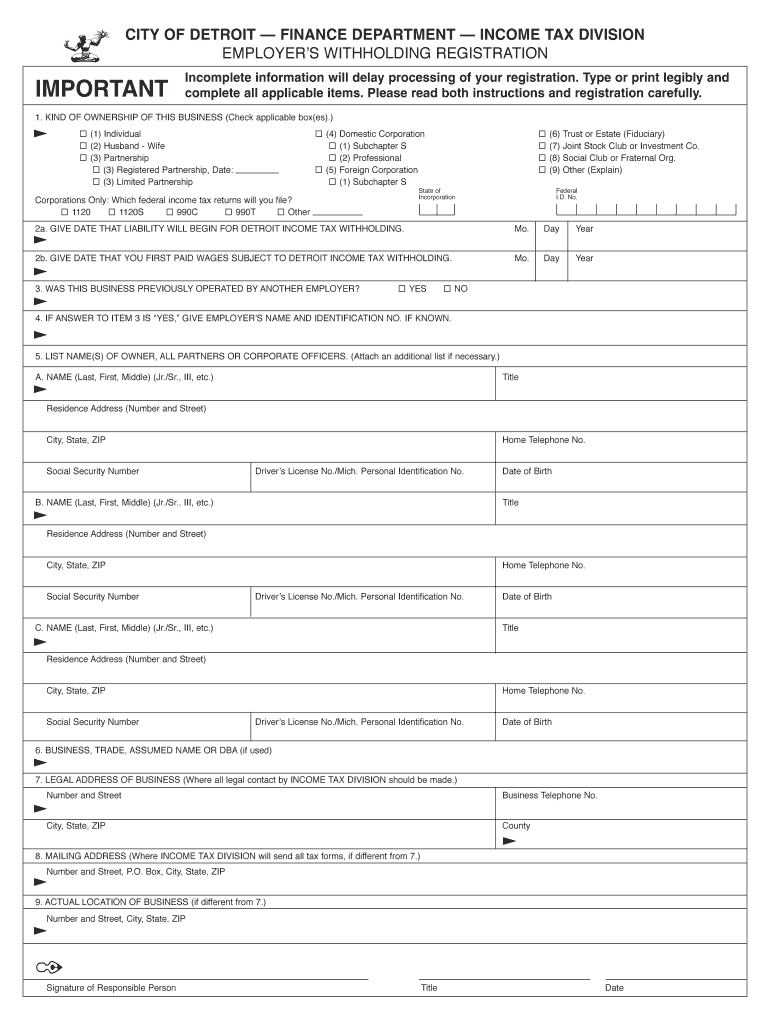

Form DSS4 City of Detroit Detroitmi

What is the Michigan ITD Withholding Form?

The Michigan ITD withholding form is a crucial document used by employers to report and remit state income tax withholding for their employees. This form, officially known as the MI ITD withholding form, is essential for ensuring compliance with Michigan state tax laws. It allows employers to calculate the amount of state income tax to withhold from employee wages and submit these amounts to the Michigan Department of Treasury. Understanding the purpose of this form is vital for businesses operating in Michigan to avoid penalties and ensure proper tax compliance.

Steps to Complete the Michigan ITD Withholding Form

Filling out the Michigan ITD withholding form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather Employee Information: Collect necessary details such as the employee's name, Social Security number, and address.

- Determine Withholding Amount: Use the Michigan withholding tables to calculate the appropriate amount to withhold based on the employee’s wages and filing status.

- Fill Out the Form: Accurately enter the gathered information and calculated withholding amount on the form.

- Review for Accuracy: Double-check all entries for errors to avoid issues with tax compliance.

- Submit the Form: Follow the appropriate submission method, whether online, by mail, or in person, to ensure timely processing.

Legal Use of the Michigan ITD Withholding Form

The legal use of the Michigan ITD withholding form is governed by state tax regulations. Employers must utilize this form to report and remit withheld state income taxes accurately. Failure to use the form correctly can lead to penalties, including fines and interest on unpaid taxes. It is crucial for employers to understand their obligations regarding this form to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines associated with the Michigan ITD withholding form to ensure timely filing and payment. Typically, the form must be submitted quarterly, with deadlines falling on the last day of the month following the end of each quarter. For example, the first quarter ends on March 31, and the filing deadline is April 30. Staying informed about these dates is essential for avoiding late fees and maintaining compliance with state tax laws.

Form Submission Methods

Employers have several options for submitting the Michigan ITD withholding form. These methods include:

- Online Submission: Many employers opt to file electronically through the Michigan Department of Treasury's online portal, which offers a convenient and efficient way to submit forms.

- Mail: Employers can also choose to send a physical copy of the form to the appropriate address provided by the state.

- In-Person Submission: Some employers may prefer to deliver the form in person at designated state offices.

Key Elements of the Michigan ITD Withholding Form

Understanding the key elements of the Michigan ITD withholding form is essential for accurate completion. The form typically includes sections for:

- Employer Information: This section requires details about the employer, including name, address, and tax identification number.

- Employee Information: Employers must provide information about each employee, including their name, Social Security number, and filing status.

- Withholding Amount: This part of the form specifies the amount of state income tax withheld from each employee's wages.

Quick guide on how to complete form dss4 city of detroit detroitmi 30446367

Complete Form DSS4 City Of Detroit Detroitmi smoothly on any device

Managing documents online has grown increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form DSS4 City Of Detroit Detroitmi on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest method to alter and eSign Form DSS4 City Of Detroit Detroitmi effortlessly

- Locate Form DSS4 City Of Detroit Detroitmi and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize crucial sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form DSS4 City Of Detroit Detroitmi and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form dss4 city of detroit detroitmi 30446367

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the Michigan ITD withholding form?

The Michigan ITD withholding form is a document required for businesses to report and remit state income taxes withheld from employees' wages. It ensures compliance with Michigan tax laws and helps employers manage their tax responsibilities effectively.

-

How can airSlate SignNow help me with the Michigan ITD withholding form?

airSlate SignNow simplifies the process of signing and sending the Michigan ITD withholding form. Our platform allows you to securely eSign the document and share it with relevant parties, streamlining your tax management processes.

-

Is there a cost associated with using airSlate SignNow for the Michigan ITD withholding form?

Yes, airSlate SignNow offers flexible pricing plans tailored to business needs, including options for handling the Michigan ITD withholding form. Our cost-effective solutions ensure you can manage your document signing and filing without breaking the bank.

-

What features does airSlate SignNow offer for managing the Michigan ITD withholding form?

airSlate SignNow provides various features for managing the Michigan ITD withholding form, such as customizable templates, automated workflows, and secure cloud storage. These tools enhance efficiency and ensure that your documents are easily accessible.

-

Can I integrate airSlate SignNow with other software for handling the Michigan ITD withholding form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enabling you to streamline workflows related to the Michigan ITD withholding form. This integration allows for better data management and helps in maintaining compliance with state tax requirements.

-

What are the benefits of using airSlate SignNow for tax-related documents like the Michigan ITD withholding form?

Using airSlate SignNow for tax-related documents like the Michigan ITD withholding form provides signNow benefits, including reduced processing time and enhanced accuracy. Our eSignature solution minimizes paperwork and keeps your records organized, improving your overall efficiency.

-

Is airSlate SignNow compliant with Michigan state laws regarding the ITD withholding form?

Yes, airSlate SignNow is designed to comply with Michigan state laws and regulations regarding the ITD withholding form. We ensure that all our processes adhere to legal standards, providing peace of mind while you manage your documents.

Get more for Form DSS4 City Of Detroit Detroitmi

- Form 5272

- Application for state emergency relief dhs 1514 state of form

- Cahaba gba redetermination form

- Change of action form sc department of education

- T rowe price qdro form

- Church bulletin pdf form

- Dmv 204e application for driving privilege or id card by mail form

- Camper health screening form posted june camper health screening form posted june

Find out other Form DSS4 City Of Detroit Detroitmi

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure