Form 593 C Real Estate Withholding Certificate California 2019

What is the Form 593 C Real Estate Withholding Certificate California

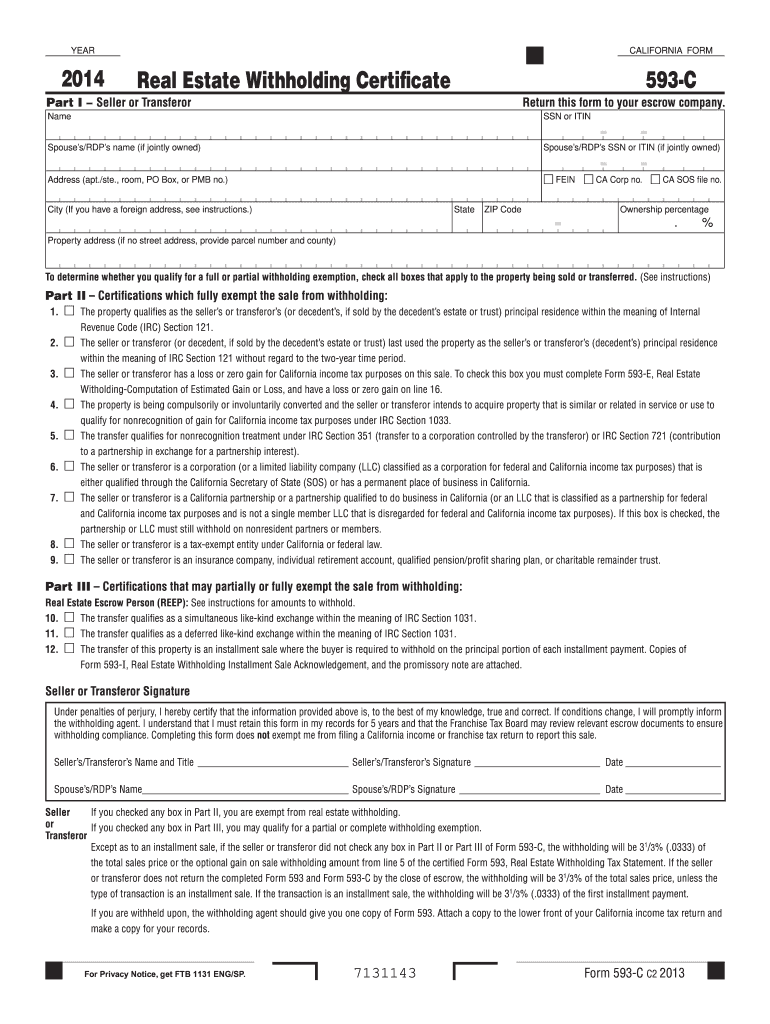

The Form 593 C Real Estate Withholding Certificate is a crucial document for California real estate transactions. It is used by sellers of real property to certify their eligibility for withholding exemptions under California law. This form ensures that the appropriate amount of withholding tax is applied to the sale proceeds, helping to prevent any tax liabilities that may arise from the transaction. Understanding this form is essential for both buyers and sellers in California's real estate market.

Steps to complete the Form 593 C Real Estate Withholding Certificate California

Completing the Form 593 C involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including the seller's details, property information, and the sale price. Next, fill out the form by providing the required data in the specified fields. After completing the form, review it carefully for any errors or omissions. Finally, ensure that both the seller and the buyer sign the form to validate it. Proper completion of this form is vital to avoid potential tax issues.

Legal use of the Form 593 C Real Estate Withholding Certificate California

The legal use of the Form 593 C is governed by California tax regulations. This form must be used when a seller is subject to withholding under California law. It serves as a declaration of any exemptions that may apply, such as the seller being a resident or qualifying for specific exemptions. Properly utilizing this form helps ensure compliance with state tax laws and protects both parties involved in the transaction from future legal complications.

Key elements of the Form 593 C Real Estate Withholding Certificate California

Key elements of the Form 593 C include the seller's name, address, and taxpayer identification number. Additionally, it requires information about the property being sold, including its address and sale price. The form also includes sections for the seller to indicate any applicable exemptions and to provide signatures from both the seller and buyer. These elements are essential for the form's validity and for ensuring that the correct withholding amount is calculated.

Filing Deadlines / Important Dates

Filing deadlines for the Form 593 C are critical to ensure compliance with California tax regulations. The form must be submitted to the California Franchise Tax Board along with the payment of any required withholding tax. Typically, this submission should occur at the time of the real estate transaction. It is advisable to check for specific deadlines that may apply based on the transaction date to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 593 C can be submitted through various methods, providing flexibility for users. It can be filed online through the California Franchise Tax Board's website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed directly to the appropriate tax authority or submitted in person at designated locations. Each method has its own advantages, and users should choose the one that best fits their needs.

Quick guide on how to complete 2014 form 593 c real estate withholding certificate california

Effortlessly Prepare Form 593 C Real Estate Withholding Certificate California on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It provides an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 593 C Real Estate Withholding Certificate California on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to Modify and Electronically Sign Form 593 C Real Estate Withholding Certificate California with Ease

- Obtain Form 593 C Real Estate Withholding Certificate California and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 593 C Real Estate Withholding Certificate California to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 593 c real estate withholding certificate california

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 593 c real estate withholding certificate california

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the Form 593 C Real Estate Withholding Certificate California used for?

The Form 593 C Real Estate Withholding Certificate California is used by buyers of California real estate to document the withholding and payment of tax on transactions involving real estate. This certificate helps ensure compliance with California tax laws when an individual or business sells property.

-

How do I properly fill out the Form 593 C Real Estate Withholding Certificate California?

Filling out the Form 593 C Real Estate Withholding Certificate California involves providing accurate information about the buyer, seller, and property sale details. It’s important to follow the instructions carefully to ensure all required fields are completed correctly, which can help prevent delays in processing.

-

What are the benefits of using airSlate SignNow for the Form 593 C Real Estate Withholding Certificate California?

Using airSlate SignNow for the Form 593 C Real Estate Withholding Certificate California provides an easy-to-use platform for electronic signatures and document management. It ensures that the process is quick, secure, and complies with legal regulations, making it a convenient choice for real estate transactions.

-

Is there a cost associated with using airSlate SignNow for the Form 593 C Real Estate Withholding Certificate California?

Yes, there are costs associated with using airSlate SignNow, but the pricing is designed to be cost-effective, allowing for unlimited eSigning and document management. This makes it an affordable option for those needing to handle the Form 593 C Real Estate Withholding Certificate California regularly.

-

Can I integrate airSlate SignNow with other applications for the Form 593 C Real Estate Withholding Certificate California?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications and platforms. This allows users to streamline workflows while managing the Form 593 C Real Estate Withholding Certificate California and other related documents efficiently.

-

How does airSlate SignNow ensure the security of the Form 593 C Real Estate Withholding Certificate California?

airSlate SignNow is committed to security and utilizes advanced encryption protocols to protect sensitive information. This ensures that your Form 593 C Real Estate Withholding Certificate California and other documents are secure throughout the eSigning process.

-

What features does airSlate SignNow offer for completing the Form 593 C Real Estate Withholding Certificate California?

airSlate SignNow provides a variety of features including customizable templates, collaborative editing, and automated reminders. These features make it easier to complete and track the status of the Form 593 C Real Estate Withholding Certificate California, ensuring a smooth transaction process.

Get more for Form 593 C Real Estate Withholding Certificate California

Find out other Form 593 C Real Estate Withholding Certificate California

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free