Acceptable Forms and Occurrences for CA Individual E File 2019

What is the acceptable forms and occurrences for CA individual e file

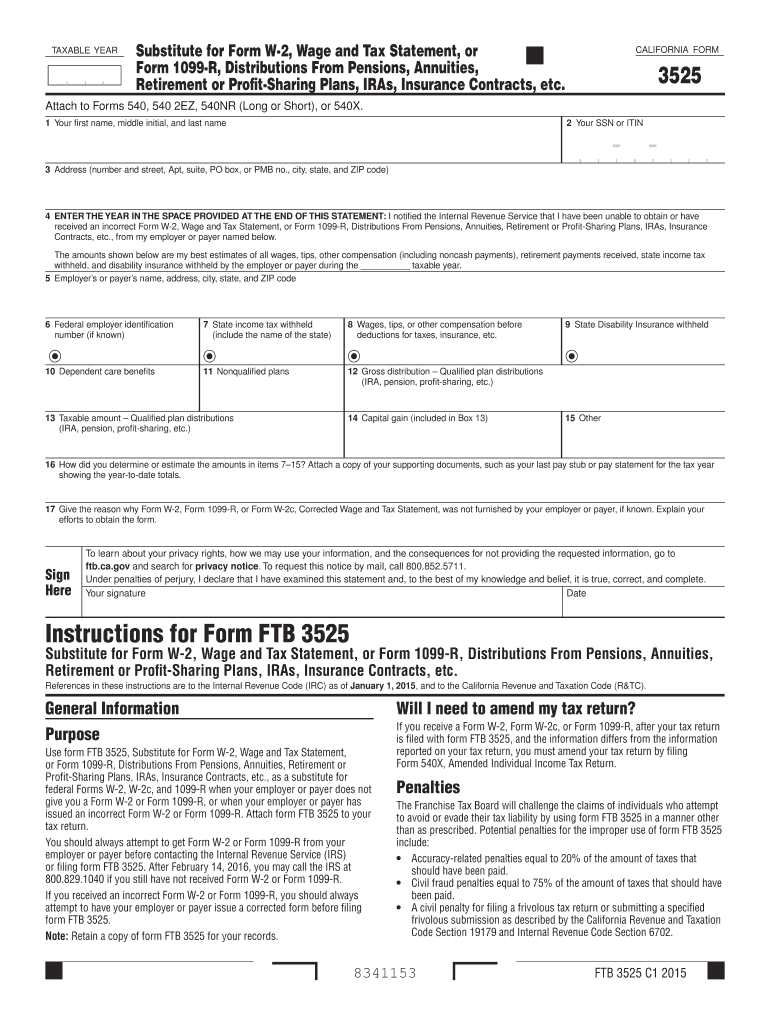

The acceptable forms and occurrences for CA individual e file refer to the specific documents and scenarios that California residents can utilize when filing their taxes electronically. These forms are designed to ensure compliance with state regulations while facilitating a smooth e-filing process. Common forms include the California 540 and 540NR, which cater to residents and non-residents, respectively. Understanding these forms is essential for accurate reporting and minimizing potential issues with the California Franchise Tax Board.

How to use the acceptable forms and occurrences for CA individual e file

Using the acceptable forms for CA individual e file involves several steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, select the appropriate form based on your residency status and income type. After that, complete the form accurately, ensuring all information aligns with your financial records. Finally, submit your completed form electronically through an approved e-filing platform, ensuring you receive confirmation of your submission for your records.

Steps to complete the acceptable forms and occurrences for CA individual e file

Completing the acceptable forms for CA individual e file involves a systematic approach:

- Identify the correct form based on your residency status (e.g., 540 for residents, 540NR for non-residents).

- Collect all relevant financial documents, including income statements and deductions.

- Fill out the form carefully, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a certified e-filing service.

- Keep a copy of the submitted form and confirmation for your records.

Legal use of the acceptable forms and occurrences for CA individual e file

The legal use of the acceptable forms for CA individual e file is governed by state tax laws and regulations. To be considered valid, the forms must be completed accurately and submitted within the designated filing deadlines. Additionally, electronic signatures must comply with the California Uniform Electronic Transactions Act (UETA) to ensure that the e-filed documents are legally binding. Utilizing a reliable e-signature platform can enhance compliance and security during the filing process.

IRS guidelines

IRS guidelines play a crucial role in the e-filing process for California residents. While the state has its own regulations, federal tax laws set the foundation for acceptable forms and occurrences. It is important to ensure that the information reported on California forms aligns with federal tax returns. This includes adhering to IRS deadlines, using the correct form numbers, and following guidelines for income reporting and deductions. Staying informed about any updates to IRS regulations can help taxpayers remain compliant.

Filing deadlines / important dates

Filing deadlines for CA individual e file are critical for avoiding penalties and interest on unpaid taxes. Typically, the deadline for filing individual tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension to file, but this does not extend the time to pay any taxes owed. It is essential to mark these dates on your calendar and ensure timely submission to maintain compliance.

Quick guide on how to complete acceptable forms and occurrences for ca individual e file

Complete Acceptable Forms And Occurrences For CA Individual E file effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the required form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Handle Acceptable Forms And Occurrences For CA Individual E file on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The easiest way to edit and eSign Acceptable Forms And Occurrences For CA Individual E file without hassle

- Obtain Acceptable Forms And Occurrences For CA Individual E file and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow manages all your document organization needs in just a few clicks from your preferred device. Edit and eSign Acceptable Forms And Occurrences For CA Individual E file and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct acceptable forms and occurrences for ca individual e file

Create this form in 5 minutes!

How to create an eSignature for the acceptable forms and occurrences for ca individual e file

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What are the Acceptable Forms And Occurrences For CA Individual E file?

The Acceptable Forms And Occurrences For CA Individual E file include a variety of tax documents such as Form 540, W-2s, and 1099s. It's essential to ensure these forms are properly filled out and submitted electronically for compliance. airSlate SignNow simplifies this process by allowing you to eSign and send these documents securely.

-

How does airSlate SignNow help with the CA individual e-file process?

airSlate SignNow streamlines the CA individual e-file process by providing a user-friendly platform for signing and sending your tax documents electronically. By utilizing our service, you ensure that you are using all Acceptable Forms And Occurrences For CA Individual E file efficiently. This results in faster processing and potential cost savings on filing fees.

-

Are there any fees associated with using airSlate SignNow for e-filing?

Yes, while airSlate SignNow offers a cost-effective solution for document eSigning, there may be fees associated with certain features and integrations. However, utilizing our service for the Acceptable Forms And Occurrences For CA Individual E file can often save you money compared to traditional methods. It's advisable to review our pricing plans to find the best fit for your needs.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow integrates seamlessly with a variety of accounting software, enhancing your workflow and ensuring that your Acceptable Forms And Occurrences For CA Individual E file are managed efficiently. These integrations allow you to import and export documents easily, saving you valuable time during tax season.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as customizable templates and automatic reminders to help you stay organized during the tax filing process. These tools ensure you are compliant with the Acceptable Forms And Occurrences For CA Individual E file, making your e-filing experience stress-free and efficient.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and employs advanced encryption to protect your sensitive tax information during eSigning. By using our platform for the Acceptable Forms And Occurrences For CA Individual E file, you can rest assured that your data is safe and the integrity of your documents is maintained.

-

Can I track my document status after sending for e-signature?

Yes, airSlate SignNow provides real-time tracking for documents sent for e-signature. This feature allows you to monitor the status of your Acceptable Forms And Occurrences For CA Individual E file, ensuring you're always informed about where your documents are in the signing process.

Get more for Acceptable Forms And Occurrences For CA Individual E file

Find out other Acceptable Forms And Occurrences For CA Individual E file

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors