Form 199 2019

What is the Form 199

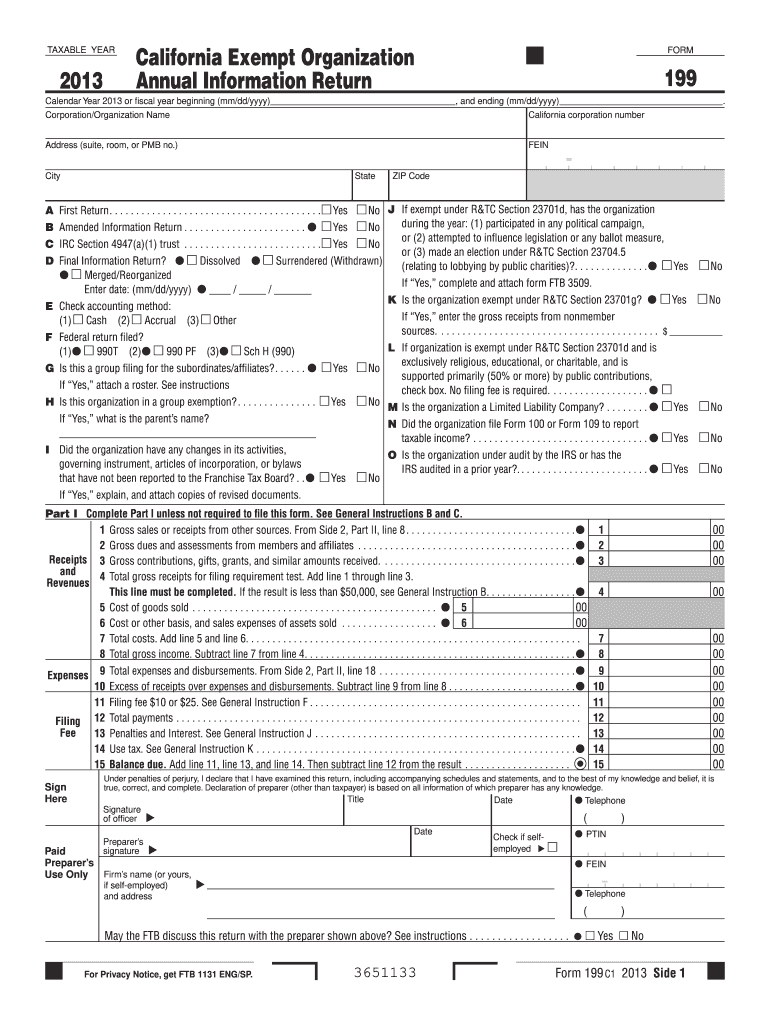

The Form 199 is a tax document used by certain entities in the United States, primarily for reporting purposes. This form is essential for businesses, including limited liability companies (LLCs) and corporations, that are required to provide specific financial information to the Internal Revenue Service (IRS). It serves as a declaration of income, deductions, and credits, allowing the IRS to assess tax liabilities accurately. Understanding the purpose and requirements of Form 199 is crucial for compliance and effective tax planning.

How to obtain the Form 199

Obtaining the Form 199 is a straightforward process. Businesses can access the form directly from the IRS website or through authorized tax preparation software. It is important to ensure that you are using the most current version of the form to comply with the latest regulations. Additionally, some tax professionals may provide the form as part of their services, so consulting with an accountant could be beneficial if you need assistance.

Steps to complete the Form 199

Completing the Form 199 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering your business information, including the entity type and financial data. Be sure to review the instructions provided with the form for specific line-item guidance. Finally, double-check all entries for accuracy before submission to avoid potential penalties.

Legal use of the Form 199

The legal use of Form 199 is governed by IRS regulations. To be considered valid, the form must be filled out completely and accurately, reflecting the true financial status of the entity. Any discrepancies or omissions can lead to legal issues, including audits or penalties. It is essential to retain copies of the completed form and any supporting documentation for your records, as these may be required for verification purposes by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 199 can vary based on the entity type and the specific tax year. Generally, the form must be submitted by the due date of the business's tax return. It is crucial to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important tax dates can help ensure timely submission and compliance with IRS requirements.

Penalties for Non-Compliance

Failure to file Form 199 on time or submitting inaccurate information can result in significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, inaccuracies can lead to audits and further scrutiny of your business's financial practices. Understanding these penalties emphasizes the importance of accurate and timely filing to maintain compliance and avoid unnecessary costs.

Quick guide on how to complete 2013 form 199

Effortlessly Prepare Form 199 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to quickly create, modify, and electronically sign your documents without delays. Handle Form 199 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Form 199 Seamlessly

- Find Form 199 and click on Get Form to initiate the process.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with specialized tools that airSlate SignNow offers.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal validity as a handwritten signature.

- Verify all information and click on the Done button to save your adjustments.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 199 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 199

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 199

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 199?

Form 199 is a crucial document used for corporations in certain states to file their tax returns. It is essential for businesses to accurately complete Form 199 to ensure compliance and avoid penalties. Utilizing airSlate SignNow can streamline the process of completing and signing Form 199 digitally.

-

How can airSlate SignNow help with Form 199 preparation?

airSlate SignNow simplifies the preparation of Form 199 by providing easy-to-use templates and tools. You can quickly fill out the required fields and save your progress for later, making the process efficient. Additionally, the platform allows you to securely eSign Form 199 to finalize your submission.

-

What are the pricing options for using airSlate SignNow for Form 199?

airSlate SignNow offers a variety of pricing plans tailored to meet different business needs when handling Form 199. Plans range from basic to advanced features, ensuring you only pay for what you need. You can start with a free trial to explore how airSlate SignNow can optimize your Form 199 preparation.

-

Is airSlate SignNow secure for signing Form 199?

Yes, airSlate SignNow employs robust security protocols to ensure that your Form 199 and other documents are safe. The platform uses encryption and secure servers, providing peace of mind as you electronically sign documents. Your data privacy is a priority when using airSlate SignNow.

-

Are there integrations available for airSlate SignNow when working on Form 199?

Indeed, airSlate SignNow seamlessly integrates with numerous applications that can assist with the completion of Form 199. You can connect your favorite tools, such as CRMs and cloud storage services, to enhance your workflow. This integration capability makes managing and submitting Form 199 much easier.

-

What benefits does airSlate SignNow offer for businesses handling Form 199?

Using airSlate SignNow for Form 199 offers numerous benefits, including increased efficiency, reduced errors, and faster turnaround times. The user-friendly interface enables your team to complete documents quickly. Additionally, electronic signatures provide a legally binding way to finalize your Form 199 without the hassle of paperwork.

-

Can I track the status of my Form 199 once sent through airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Form 199 after sending. You can see when it has been opened, viewed, and signed by the recipient. This transparency helps you stay organized and informed throughout the submission process.

Get more for Form 199

Find out other Form 199

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later