Form 199 2017

What is the Form 199

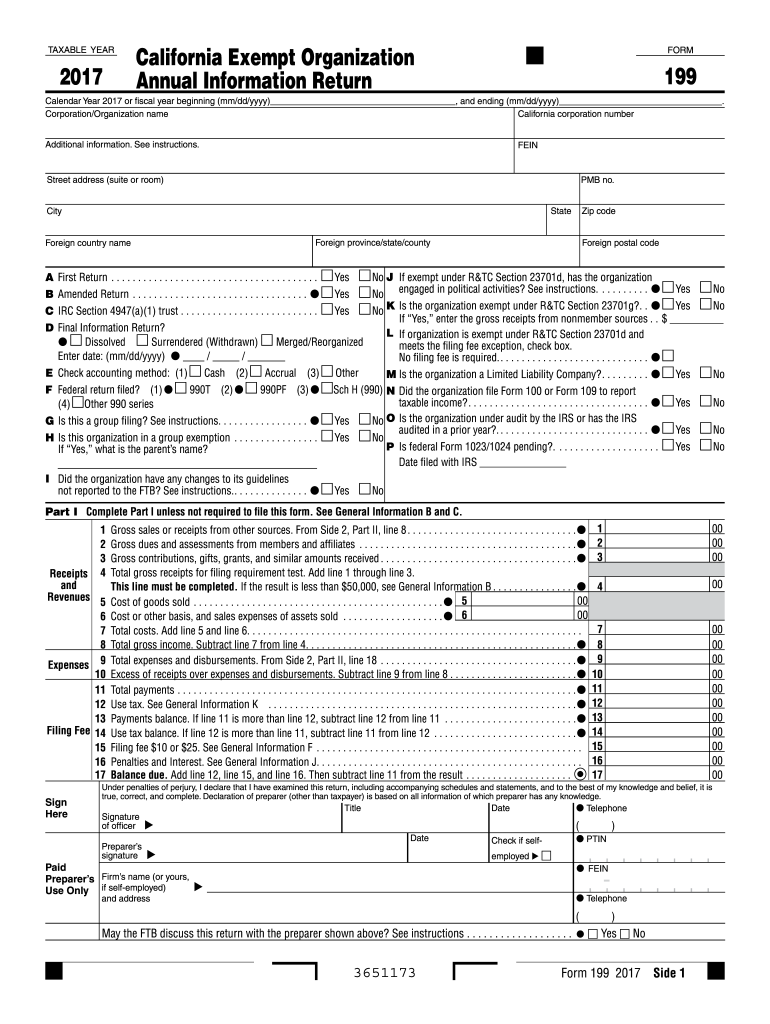

The Form 199 is a California tax document used by certain business entities to report income and calculate taxes owed to the state. Specifically, it is designed for limited liability companies (LLCs) and other business types that need to comply with California tax regulations. This form helps ensure that businesses accurately report their income and pay the appropriate amount of state taxes. Understanding the purpose and requirements of Form 199 is essential for compliance and effective tax management.

How to use the Form 199

To use Form 199, businesses must first gather all necessary financial information, including income, deductions, and credits. The form requires detailed reporting of all sources of income and expenses incurred during the tax year. Once the information is compiled, the business can fill out the form, ensuring that all sections are completed accurately. After completing the form, it must be submitted to the California Franchise Tax Board (FTB) by the specified deadline to avoid penalties.

Steps to complete the Form 199

Completing Form 199 involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the identifying information at the top of the form, including the business name and address.

- Report total income and list any deductions or credits applicable to the business.

- Calculate the total tax owed based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Form 199

Form 199 is legally required for certain business entities operating in California. It must be filed annually to ensure compliance with state tax laws. Failing to file this form can result in penalties and interest on unpaid taxes. It is crucial for businesses to understand their legal obligations regarding this form to avoid potential legal issues and ensure proper tax reporting.

Filing Deadlines / Important Dates

The filing deadline for Form 199 typically aligns with the state tax deadlines for businesses. Generally, it is due on the fifteenth day of the fourth month following the close of the taxable year. For example, if the tax year ends on December thirty-first, the form would be due by April fifteenth of the following year. It is important for businesses to mark these dates on their calendars to ensure timely filing and avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

Businesses can submit Form 199 through several methods. The most efficient way is to file online through the California Franchise Tax Board's website, which allows for quicker processing and confirmation of receipt. Alternatively, businesses can mail the completed form to the designated address provided by the FTB. In-person submissions may also be possible at certain FTB offices, although this option may vary based on location and availability.

Quick guide on how to complete form 199 2017 2019

Your assistance manual on how to prepare your Form 199

If you’re curious about how to complete and submit your Form 199, here are some brief guidelines on how to simplify your tax submission process.

To begin, you simply need to create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. With its editing features, you can toggle between text, checkboxes, and eSignatures, and revisit to update responses as necessary. Enhance your tax processing with advanced PDF editing, eSigning, and intuitive sharing.

Adhere to the following instructions to complete your Form 199 in a matter of minutes:

- Set up your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variants and schedules.

- Click Get form to open your Form 199 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any inaccuracies.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that filing on paper can increase return errors and postpone refunds. Naturally, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 199 2017 2019

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

Create this form in 5 minutes!

How to create an eSignature for the form 199 2017 2019

How to generate an electronic signature for the Form 199 2017 2019 online

How to make an eSignature for your Form 199 2017 2019 in Google Chrome

How to make an eSignature for putting it on the Form 199 2017 2019 in Gmail

How to make an eSignature for the Form 199 2017 2019 straight from your smartphone

How to generate an eSignature for the Form 199 2017 2019 on iOS

How to generate an eSignature for the Form 199 2017 2019 on Android

People also ask

-

What is Form 199 and why do I need it?

Form 199 is a tax form used by certain businesses to report their income and expenses. It is crucial for compliance with state regulations and ensures that your business remains in good standing. Using airSlate SignNow simplifies the process of sending and eSigning Form 199 securely, making it easier to manage your tax obligations.

-

How can airSlate SignNow help me with Form 199?

airSlate SignNow offers a streamlined solution for sending and eSigning Form 199. With our easy-to-use platform, you can quickly prepare your documents, collect signatures, and store them securely, ensuring that your Form 199 is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 199?

Yes, airSlate SignNow offers various pricing plans to accommodate your business needs. The cost-effective solutions are designed to help you manage documents like Form 199 without breaking the bank. Check our pricing page for detailed information on plans tailored for different workflows.

-

Can I integrate airSlate SignNow with other software for Form 199 management?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and Salesforce. This means you can easily manage your Form 199 alongside other business processes, enhancing efficiency and productivity.

-

What features does airSlate SignNow offer for handling Form 199?

airSlate SignNow provides a range of features for managing Form 199, including customizable templates, secure eSignature capabilities, and real-time tracking of document status. These features empower you to handle your tax forms with confidence and ease.

-

Is airSlate SignNow secure for submitting sensitive documents like Form 199?

Yes, airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry standards. Your Form 199 and other sensitive documents are protected throughout the signing process, giving you peace of mind.

-

How long does it take to complete Form 199 using airSlate SignNow?

Completing Form 199 with airSlate SignNow can be done in just a few minutes. The intuitive interface allows you to fill out and eSign your documents quickly, expediting the entire process so you can focus on other important tasks.

Get more for Form 199

- Nh schedule c nh form

- Hertz rental car information

- Tinetti performance oriented mobility assessment nyc

- Attachment to income and expense declaration placer ca form

- Security guard checklist form

- How to fill out illinois motorist report form

- Appendix 20 form fs 6500 25 request for verification fs usda

- Technology control plan itar us form

Find out other Form 199

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement