California LLC Annual Franchise Tax $800LLC University 2021-2026

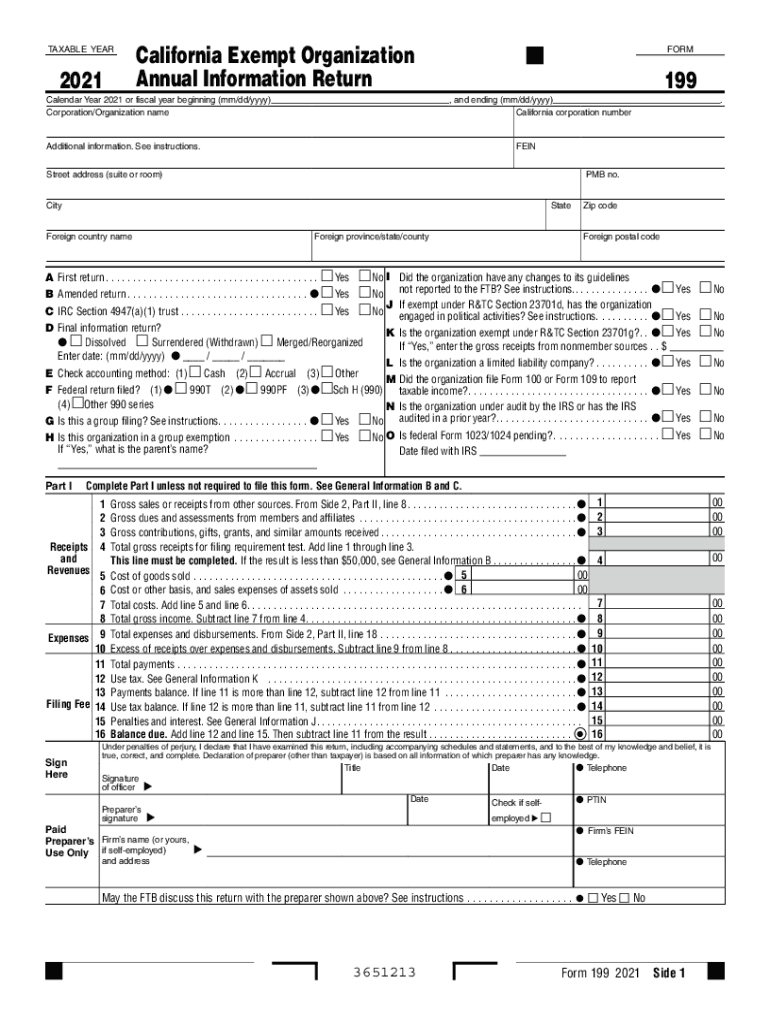

Understanding the California LLC Annual Franchise Tax

The California LLC Annual Franchise Tax is a mandatory fee that all limited liability companies (LLCs) must pay to the state of California. This tax is set at a flat rate of $800 and is due annually, regardless of whether the LLC is actively conducting business or not. It is essential for LLC owners to be aware of this obligation to maintain compliance and avoid penalties.

Steps to Complete the California LLC Annual Franchise Tax

Completing the California LLC Annual Franchise Tax involves several key steps. First, gather the necessary information about your LLC, including its name, address, and the California Secretary of State file number. Next, fill out the required forms, which can be done online or via paper submission. After completing the forms, ensure that you submit them along with the $800 payment by the due date to avoid any late fees.

Filing Deadlines / Important Dates

The filing deadline for the California LLC Annual Franchise Tax is typically the 15th day of the fourth month after the end of your LLC's tax year. For most LLCs operating on a calendar year, this means the tax is due on April 15. It is crucial to mark this date on your calendar to ensure timely payment and compliance.

Penalties for Non-Compliance

Failure to pay the California LLC Annual Franchise Tax can result in significant penalties. If the tax is not paid by the due date, the state may impose a late fee, which can increase over time. Additionally, non-compliance can lead to the suspension of your LLC's rights to conduct business in California, which can have serious implications for your company.

Required Documents

To file the California LLC Annual Franchise Tax, you will need specific documents, including your LLC's operating agreement, the California Secretary of State file number, and any previous tax returns if applicable. Having these documents ready will streamline the filing process and ensure accuracy in your submission.

Who Issues the Form

The California Franchise Tax Board (FTB) is the governing body responsible for issuing the forms related to the LLC Annual Franchise Tax. They provide guidelines and resources to assist LLC owners in understanding their tax obligations and ensuring compliance with state regulations.

Quick guide on how to complete california llc annual franchise tax 800llc university

Complete California LLC Annual Franchise Tax $800LLC University effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow supplies you with all the resources required to create, alter, and eSign your documents swiftly without delays. Manage California LLC Annual Franchise Tax $800LLC University on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to alter and eSign California LLC Annual Franchise Tax $800LLC University with ease

- Find California LLC Annual Franchise Tax $800LLC University and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Modify and eSign California LLC Annual Franchise Tax $800LLC University and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california llc annual franchise tax 800llc university

Create this form in 5 minutes!

How to create an eSignature for the california llc annual franchise tax 800llc university

The way to generate an e-signature for your PDF file in the online mode

The way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 2009 199?

airSlate SignNow is a digital solution that enables businesses to send and eSign documents effortlessly. With the introduction of updates noted in 2009 199, it has become even more user-friendly, allowing for seamless document management and signing.

-

How can I benefit from the 2009 199 features of airSlate SignNow?

The features introduced in 2009 199 enhance user experience by optimizing document workflows and eSignature processes. You'll save time and reduce errors, making your business operations more efficient and reliable.

-

What pricing plans are available for airSlate SignNow regarding the 2009 199 version?

airSlate SignNow offers multiple pricing plans to cater to different business needs, including the features from the 2009 199 update. Each plan is competitively priced, ensuring that you get a cost-effective solution for all your document signing needs.

-

Are there any integrations available for the 2009 199 version of airSlate SignNow?

Yes, the 2009 199 version of airSlate SignNow supports a variety of integrations with popular software tools. This allows businesses to streamline their document management processes and enhance collaboration across platforms.

-

Is airSlate SignNow secure, especially with updates from 2009 199?

Absolutely! airSlate SignNow prioritizes security, and the enhancements from 2009 199 include advanced encryption methods. Your documents and data are protected, giving you peace of mind while using the service.

-

Can I use airSlate SignNow on mobile devices, including the features from 2009 199?

Yes, airSlate SignNow is fully compatible with mobile devices. The improvements from the 2009 199 update make it easier than ever to manage and sign documents on the go, allowing you to stay productive from anywhere.

-

How does airSlate SignNow simplify document workflows, particularly with reference to 2009 199?

The 2009 199 update of airSlate SignNow signNowly simplifies document workflows by automating repetitive tasks. This allows users to focus more on their core business activities while streamlining the signing process.

Get more for California LLC Annual Franchise Tax $800LLC University

- Louisiana documents form

- Essential legal life documents for baby boomers louisiana form

- Essential legal life documents for newlyweds louisiana form

- Essential legal life documents for military personnel louisiana form

- Essential legal life documents for new parents louisiana form

- Louisiana statutory form

- Small business accounting package louisiana form

- Revocation of power of attorney for care of child or provisional custody by mandate louisiana form

Find out other California LLC Annual Franchise Tax $800LLC University

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer