Franchise Tax Boardform3500 2020

What is the Franchise Tax Board Form 3500

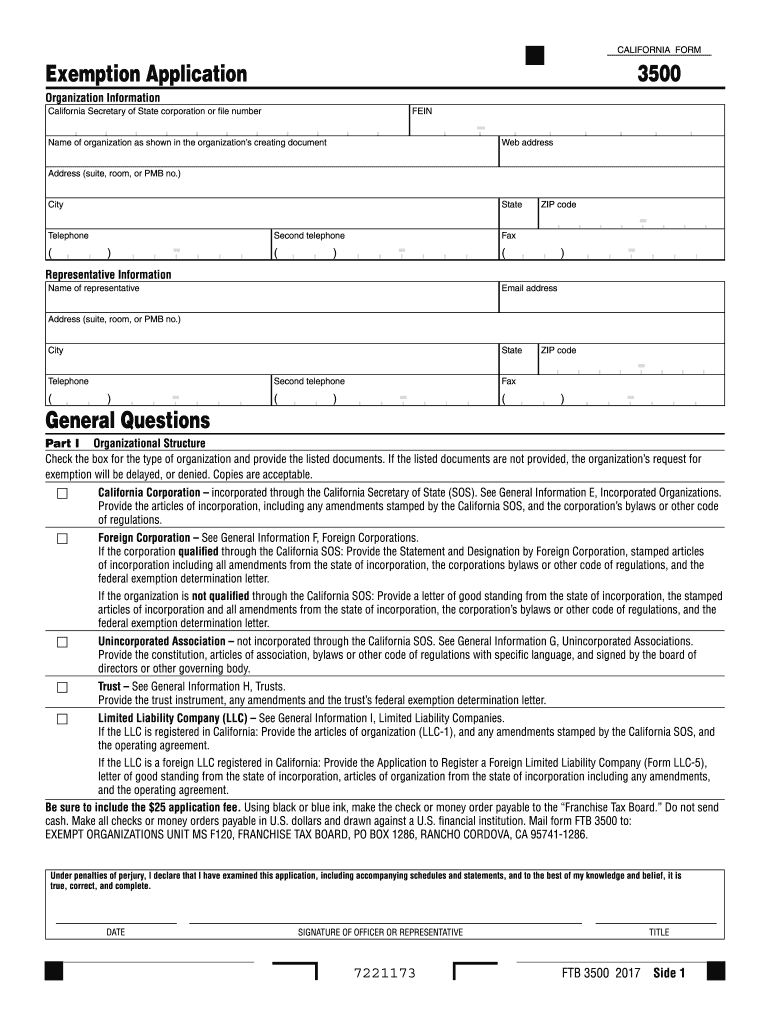

The Franchise Tax Board Form 3500 is a crucial document used by businesses in California to apply for tax-exempt status. This form is specifically designed for organizations seeking to obtain recognition as a nonprofit entity under California law. By completing and submitting Form 3500, applicants can ensure compliance with state regulations and benefit from various tax exemptions that support their charitable missions.

How to Use the Franchise Tax Board Form 3500

Using the Franchise Tax Board Form 3500 involves several key steps. First, ensure that your organization qualifies for tax-exempt status by reviewing the eligibility criteria set forth by the California Franchise Tax Board. Next, gather all required documentation, including your organization's articles of incorporation and bylaws. Fill out the form accurately, providing detailed information about your organization, its purpose, and its activities. Finally, submit the completed form along with any necessary attachments to the Franchise Tax Board for processing.

Steps to Complete the Franchise Tax Board Form 3500

Completing the Franchise Tax Board Form 3500 requires careful attention to detail. Follow these steps for a successful submission:

- Review the eligibility requirements for tax-exempt status.

- Gather necessary documents, including articles of incorporation and bylaws.

- Fill out the form, ensuring all sections are completed accurately.

- Attach any required documentation, such as financial statements or a statement of activities.

- Double-check your application for completeness and accuracy.

- Submit the form to the Franchise Tax Board by mail or electronically, depending on the available options.

Legal Use of the Franchise Tax Board Form 3500

The legal use of the Franchise Tax Board Form 3500 is essential for organizations seeking tax-exempt status under California law. By submitting this form, organizations affirm their commitment to comply with state regulations governing nonprofit entities. The form serves as a formal request for recognition of tax-exempt status, which, if granted, allows the organization to operate without certain tax liabilities, thereby enhancing its ability to fulfill its charitable objectives.

Required Documents for the Franchise Tax Board Form 3500

When submitting the Franchise Tax Board Form 3500, several documents are typically required to support your application. These may include:

- Articles of incorporation.

- Bylaws of the organization.

- A statement of activities outlining the organization’s purpose.

- Financial statements or budgets for the upcoming fiscal year.

- Any additional documentation that demonstrates the organization’s eligibility for tax-exempt status.

Form Submission Methods

The Franchise Tax Board Form 3500 can be submitted through various methods, ensuring flexibility for applicants. Organizations may choose to file the form electronically via the Franchise Tax Board's online portal or submit a paper version by mail. It is important to follow the specific submission guidelines provided by the Franchise Tax Board to ensure timely processing of your application.

Quick guide on how to complete franchise tax boardform3500 2011

Finish Franchise Tax Boardform3500 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and endorsed documents, as you can easily find the appropriate form and safely keep it online. airSlate SignNow provides you with all the resources you need to create, alter, and eSign your documents promptly without delays. Manage Franchise Tax Boardform3500 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to alter and eSign Franchise Tax Boardform3500 with ease

- Find Franchise Tax Boardform3500 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form: via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or mistakes that require printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Franchise Tax Boardform3500 and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct franchise tax boardform3500 2011

Create this form in 5 minutes!

How to create an eSignature for the franchise tax boardform3500 2011

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the Franchise Tax Boardform3500 used for?

The Franchise Tax Boardform3500 is used by businesses to apply for tax-exempt status in California. This form is essential for organizations seeking recognition by the Franchise Tax Board. Completing the Franchise Tax Boardform3500 accurately ensures compliance and potential tax benefits.

-

How can airSlate SignNow assist with the Franchise Tax Boardform3500?

airSlate SignNow simplifies the process of completing the Franchise Tax Boardform3500 by providing easy document creation and eSigning solutions. Our platform allows you to fill out and sign the form electronically, making it quick and efficient. With airSlate SignNow, you can track the progress of your submissions and ensure your documents are securely stored.

-

What are the pricing options for using airSlate SignNow to manage the Franchise Tax Boardform3500?

AirSlate SignNow offers various pricing plans tailored to fit the needs of different businesses managing the Franchise Tax Boardform3500. We provide flexible subscriptions, including basic and premium options, allowing you to choose what best suits your budget. Our cost-effective solutions ensure you can get your documents eSigned without breaking the bank.

-

Are there any features specifically designed for the Franchise Tax Boardform3500 in airSlate SignNow?

Yes, airSlate SignNow includes features that specifically enhance the process of handling the Franchise Tax Boardform3500. These features include reusable templates, automated workflows, and progress tracking. By utilizing these tools, you can streamline the preparation and submission of your form.

-

Is it secure to send the Franchise Tax Boardform3500 through airSlate SignNow?

Absolutely! Sending the Franchise Tax Boardform3500 through airSlate SignNow is secure and compliant with industry standards. Our platform employs advanced encryption and data protection measures to ensure your sensitive information remains confidential during the signing process.

-

Can I integrate airSlate SignNow with other tools for the Franchise Tax Boardform3500?

Yes, airSlate SignNow offers seamless integrations with a variety of applications to enhance the management of the Franchise Tax Boardform3500. You can connect with CRM systems, cloud storage services, and productivity tools to streamline your workflow. This makes it easier to manage documents and collaborate with your team.

-

What are the benefits of using airSlate SignNow for the Franchise Tax Boardform3500?

Using airSlate SignNow for the Franchise Tax Boardform3500 offers multiple benefits including enhanced efficiency, cost savings, and ease of use. Our platform helps you save time by reducing paperwork and eliminating errors with automated fillable fields. Additionally, the ability to eSign documents securely ensures you meet deadlines without unnecessary delays.

Get more for Franchise Tax Boardform3500

Find out other Franchise Tax Boardform3500

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later