Form 3500 2016

What is the Form 3500

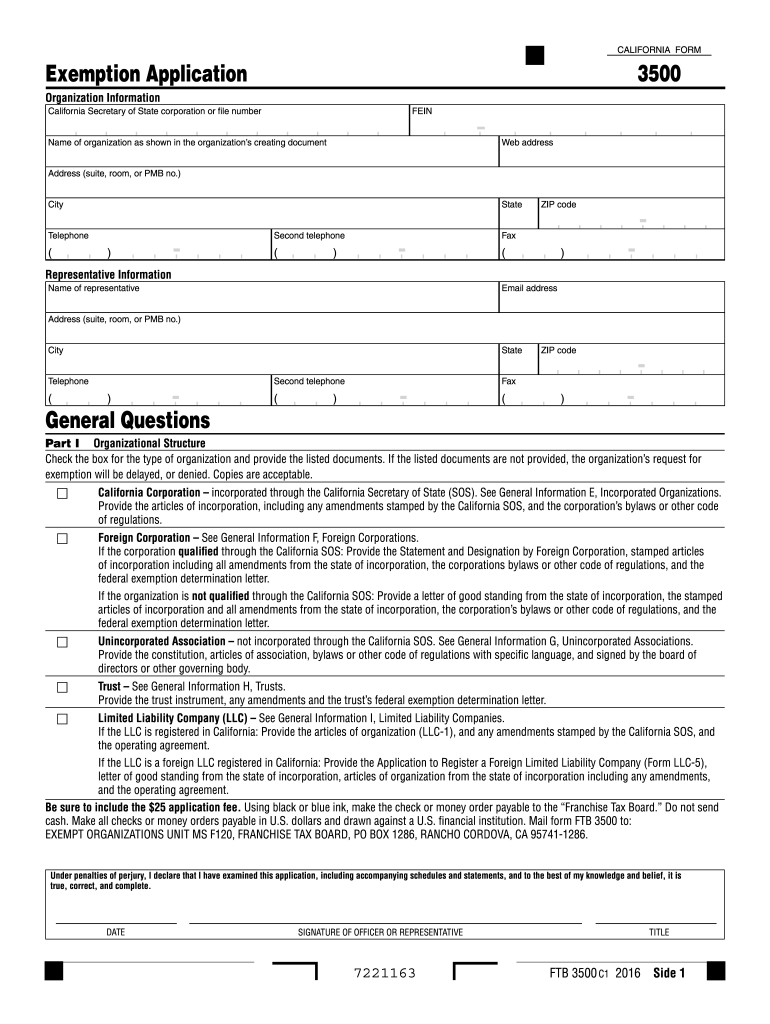

The Form 3500 is a crucial document used in the United States for specific tax-related purposes, primarily associated with business entities. This form is often required for entities seeking to establish their tax-exempt status under the Internal Revenue Code. Understanding the purpose and requirements of the Form 3500 is essential for organizations aiming to comply with federal regulations and benefit from tax exemptions.

How to use the Form 3500

Using the Form 3500 involves several key steps to ensure accurate completion and submission. First, gather all necessary information about your organization, including its legal name, address, and details about its structure and activities. Next, carefully fill out the form, ensuring that all sections are completed accurately. Finally, submit the form to the appropriate tax authority, either electronically or via mail, depending on the guidelines provided for your specific situation.

Steps to complete the Form 3500

Completing the Form 3500 requires a systematic approach. Start by downloading the latest version of the form from the official IRS website. Follow these steps:

- Read the instructions thoroughly to understand the requirements.

- Provide accurate information about your organization, including its mission and activities.

- Include any supporting documents required, such as articles of incorporation or bylaws.

- Review the completed form for accuracy before submission.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Form 3500

The legal use of the Form 3500 is governed by specific regulations under the Internal Revenue Code. To ensure that the form is legally binding, it must be completed accurately and submitted to the appropriate authorities. Compliance with all applicable laws and guidelines is essential for the form to be recognized as valid, especially when seeking tax-exempt status. Organizations should also maintain records of the submission for future reference.

Key elements of the Form 3500

Several key elements must be included in the Form 3500 to ensure its validity. These elements typically include:

- The legal name and address of the organization.

- A detailed description of the organization's activities.

- The names and addresses of the organization’s officers and directors.

- Supporting documentation that validates the organization's structure and purpose.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3500 can vary based on the type of organization and its specific circumstances. It is crucial to be aware of these deadlines to avoid penalties or delays in obtaining tax-exempt status. Generally, the form should be submitted within a specific time frame following the establishment of the organization. Keeping track of these important dates ensures compliance and smooth processing of the form.

Quick guide on how to complete form 3500 2016

Effortlessly Prepare Form 3500 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the correct form and securely store it digitally. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 3500 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to edit and eSign Form 3500 with ease

- Locate Form 3500 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as an ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 3500 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3500 2016

Create this form in 5 minutes!

How to create an eSignature for the form 3500 2016

How to create an eSignature for the Form 3500 2016 in the online mode

How to generate an electronic signature for the Form 3500 2016 in Chrome

How to generate an electronic signature for putting it on the Form 3500 2016 in Gmail

How to make an eSignature for the Form 3500 2016 right from your smartphone

How to make an eSignature for the Form 3500 2016 on iOS devices

How to generate an electronic signature for the Form 3500 2016 on Android OS

People also ask

-

What is Form 3500 and how is it used?

Form 3500 is a tax form utilized in various business contexts to report specific information or claims to tax authorities. Businesses often use Form 3500 to ensure compliance with state requirements, making it crucial in the documentation process. With airSlate SignNow, you can easily create, send, and eSign your Form 3500 for enhanced efficiency.

-

How can airSlate SignNow help streamline the submission of Form 3500?

airSlate SignNow provides a user-friendly platform that simplifies the creation, signing, and submission process for Form 3500. You can easily customize the form, gather electronic signatures, and track submissions in real-time. This not only saves time but also reduces the risk of errors associated with manual submissions.

-

Is there a pricing model for using airSlate SignNow for Form 3500?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Whether you are a small startup or a large enterprise, there are affordable options that allow you to efficiently handle your Form 3500 submissions. Sign up today to get a customized plan that fits your budget.

-

What features does airSlate SignNow offer for handling Form 3500?

airSlate SignNow includes features such as easy document editing, electronic signatures, and real-time collaboration to enhance your experience with Form 3500. You can also automate workflows and integrate with other applications to streamline your business processes. These features make it simple to manage your documentation needs.

-

Can I integrate airSlate SignNow with other software for Form 3500 processing?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, allowing you to manage your Form 3500 alongside your other business tools. Whether you use CRM systems, accounting software, or cloud storage, you can easily connect them to enhance your workflow.

-

What are the benefits of using airSlate SignNow for Form 3500?

Using airSlate SignNow for your Form 3500 submissions offers numerous benefits, including reduced processing time, improved accuracy, and enhanced security. You can complete the form electronically, ensuring that your documents are protected and compliance is maintained. Experience hassle-free management of your Form 3500 with this innovative solution.

-

Is airSlate SignNow compliant with legal standards for Form 3500?

Yes, airSlate SignNow is designed to comply with all legal standards, ensuring that your Form 3500 submissions are valid and secure. Electronic signatures obtained through our platform are legally binding and meet industry regulations. You can have peace of mind knowing your documentation is handled correctly.

Get more for Form 3500

Find out other Form 3500

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word