Business Entities Records Request California Secretary 2020

Understanding the form 3500

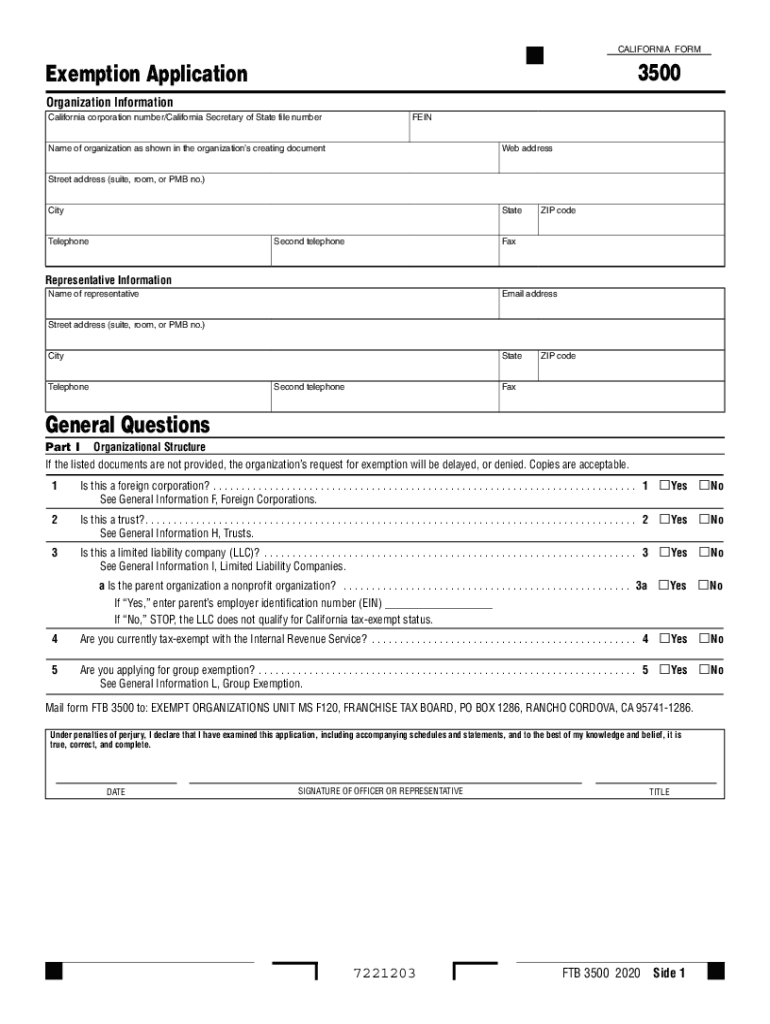

The form 3500, also known as the California exemption application, is essential for businesses seeking to obtain a tax exemption in California. This form is primarily used by organizations that qualify under specific categories, such as nonprofit organizations or certain types of businesses that meet the criteria for exemption from sales and use tax. Understanding the purpose and requirements of this form is crucial for ensuring compliance with California tax laws.

Eligibility criteria for the form 3500

To successfully complete the form 3500, applicants must meet specific eligibility criteria. Generally, the organization applying must be recognized as a nonprofit or a specific type of business that qualifies for tax exemption under California law. Key factors include:

- Type of organization (e.g., charitable, religious, educational)

- Compliance with state regulations

- Documentation proving the nature of the business

Ensuring that all criteria are met is vital for the approval of the exemption application.

Required documents for form 3500

When submitting the form 3500, applicants must provide several supporting documents to validate their eligibility. Commonly required documents include:

- Proof of the organization’s status (e.g., IRS determination letter)

- Bylaws or articles of incorporation

- Financial statements or budgets

Gathering these documents ahead of time can streamline the application process and enhance the likelihood of approval.

Steps to complete the form 3500

Completing the form 3500 involves several key steps that ensure accuracy and compliance. Here’s a simple guide to follow:

- Review the eligibility criteria to confirm that your organization qualifies for tax exemption.

- Gather all required documents and information needed for the application.

- Fill out the form 3500 completely, ensuring all sections are addressed.

- Submit the completed form along with the supporting documents to the California Franchise Tax Board.

Following these steps carefully can help avoid delays in processing the application.

Form submission methods for the form 3500

The form 3500 can be submitted through various methods, providing flexibility for applicants. The available submission methods include:

- Online submission via the California Franchise Tax Board's website

- Mailing the completed form and documents to the appropriate address

- In-person submission at designated tax offices

Choosing the right submission method can depend on the urgency and convenience for the applicant.

Penalties for non-compliance with form 3500

Failure to comply with the requirements associated with the form 3500 can lead to significant penalties. These may include:

- Denial of the tax exemption application

- Back taxes owed if the exemption is retroactively denied

- Potential fines or legal repercussions for non-compliance

Understanding these penalties underscores the importance of accurate and timely submission of the form 3500.

Quick guide on how to complete business entities records request california secretary

Complete Business Entities Records Request California Secretary effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Business Entities Records Request California Secretary on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign Business Entities Records Request California Secretary without any hassle

- Find Business Entities Records Request California Secretary and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or incorrectly filed documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign Business Entities Records Request California Secretary and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business entities records request california secretary

Create this form in 5 minutes!

How to create an eSignature for the business entities records request california secretary

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is form 3500 and why is it important?

Form 3500 is a crucial document used for various applications, such as seeking tax-exempt status in California. Understanding how to properly complete and submit form 3500 is essential for compliance and to ensure your organization can benefit from potential exemptions.

-

How can airSlate SignNow help with completing form 3500?

airSlate SignNow provides a user-friendly platform that allows you to easily fill out and send form 3500 electronically. With streamlined workflows and eSigning capabilities, you can ensure that your submissions are accurate and timely, eliminating the stress associated with paperwork.

-

What features does airSlate SignNow offer for managing form 3500?

airSlate SignNow offers features such as customizable templates, advanced signature options, and document tracking specifically designed for managing form 3500. These tools help users organize their documents efficiently and keep them secure during the signing process.

-

Is airSlate SignNow cost-effective for handling form 3500?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes for dealing with form 3500. Our pricing structure is designed to accommodate varying needs, ensuring that you can efficiently manage your forms without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for form 3500?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage form 3500 alongside your other business tools. This connectivity enhances your productivity and ensures that all relevant data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for form 3500 submissions?

Using airSlate SignNow for form 3500 submissions provides numerous benefits, including reduced processing time and elimination of paper clutter. You can enhance your workflow with automated reminders and notifications, ensuring that your submissions are completed promptly.

-

What types of businesses can benefit from using airSlate SignNow for form 3500?

Businesses of all types, including non-profits, startups, and established companies, can benefit from using airSlate SignNow for form 3500. Our platform is versatile and adaptable to different industry needs, making document management and eSigning a breeze.

Get more for Business Entities Records Request California Secretary

Find out other Business Entities Records Request California Secretary

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document