How to File a Statement of Information Online 2023

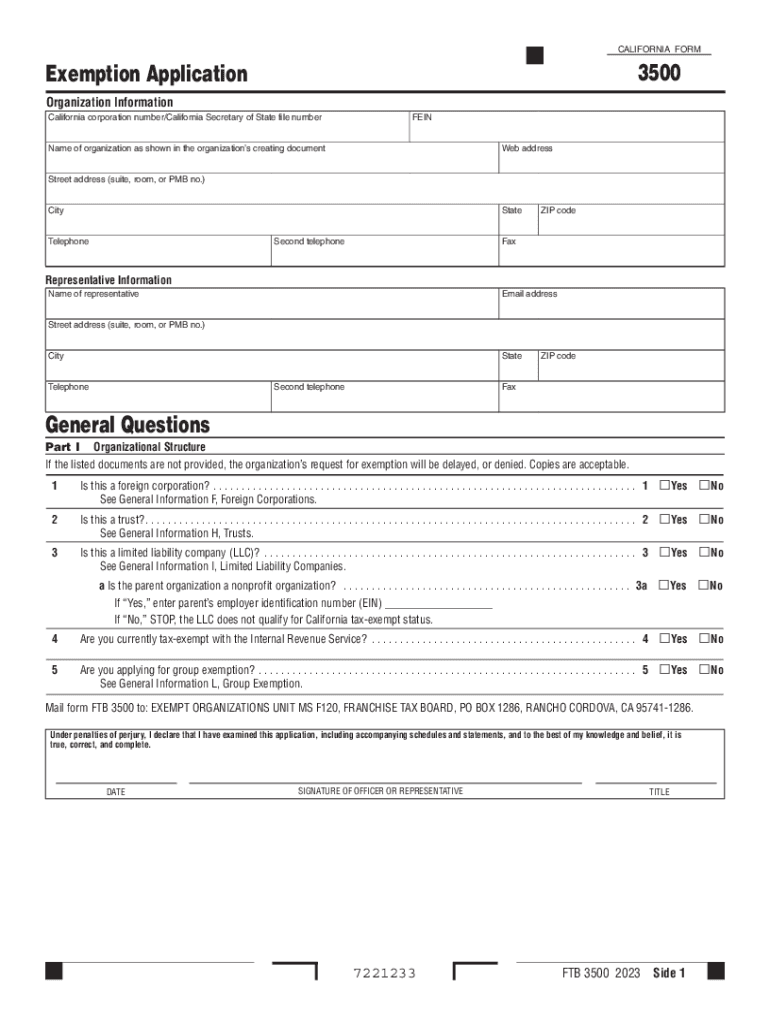

What is the form 3500 exemption application?

The form 3500 exemption application is a crucial document used in California for organizations seeking tax-exempt status. This form is primarily submitted to the California Franchise Tax Board (FTB) to determine eligibility for exemption from state income tax. Organizations such as charities, religious institutions, and educational entities often utilize this form to secure their tax-exempt status under California law.

Understanding the purpose of the form is essential for organizations aiming to operate without the burden of state taxes. The application process involves providing detailed information about the organization’s structure, purpose, and activities, ensuring compliance with state regulations.

Eligibility criteria for the form 3500 exemption application

To qualify for the form 3500 exemption application, organizations must meet specific eligibility criteria established by the California Franchise Tax Board. Generally, eligibility includes:

- Being organized and operated exclusively for charitable, religious, educational, or scientific purposes.

- Not engaging in activities that benefit private interests or individuals.

- Meeting the requirements set forth in Internal Revenue Code Section 501(c)(3) or other relevant sections for different types of organizations.

Organizations must thoroughly review these criteria to ensure they qualify before submitting their application. Failure to meet these requirements may result in denial of the exemption status.

Steps to complete the form 3500 exemption application

Completing the form 3500 exemption application involves several important steps. Organizations should follow this structured approach:

- Gather necessary documentation, including articles of incorporation, bylaws, and financial statements.

- Fill out the form accurately, providing detailed information about the organization’s mission and activities.

- Review the completed form to ensure all information is correct and complete.

- Submit the form to the California Franchise Tax Board, either online or via mail, along with any required fees.

Following these steps carefully can help streamline the application process and increase the likelihood of approval.

Required documents for the form 3500 exemption application

When submitting the form 3500 exemption application, organizations must include specific documents to support their request for tax-exempt status. Required documents typically include:

- Articles of incorporation or organization, demonstrating the entity's legal formation.

- Bylaws outlining the governing rules of the organization.

- Financial statements, including budgets and income statements, to illustrate financial health.

- A detailed description of the organization's activities and how they align with tax-exempt purposes.

Having these documents prepared and organized can facilitate a smoother application process and help prevent delays in approval.

Form submission methods for the form 3500 exemption application

Organizations can submit the form 3500 exemption application through various methods, allowing for flexibility based on preference and convenience. The primary submission methods include:

- Online submission through the California Franchise Tax Board’s website, which offers a streamlined process.

- Mailing a physical copy of the completed form and supporting documents to the appropriate FTB address.

- In-person submission at designated FTB offices, where staff can assist with any questions.

Choosing the right submission method can help ensure timely processing of the application.

Penalties for non-compliance with the form 3500 exemption application

Organizations that fail to comply with the requirements associated with the form 3500 exemption application may face significant penalties. Non-compliance can result in:

- Denial of tax-exempt status, leading to potential tax liabilities.

- Fines or penalties imposed by the California Franchise Tax Board.

- Loss of credibility and trust among donors and the community.

It is essential for organizations to adhere to all guidelines and requirements to maintain their tax-exempt status and avoid these repercussions.

Quick guide on how to complete how to file a statement of information online

Effortlessly prepare How To File A Statement Of Information Online on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the proper format and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage How To File A Statement Of Information Online on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and electronically sign How To File A Statement Of Information Online seamlessly

- Locate How To File A Statement Of Information Online and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your alterations.

- Choose how you prefer to send your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign How To File A Statement Of Information Online and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to file a statement of information online

Create this form in 5 minutes!

How to create an eSignature for the how to file a statement of information online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3500 exemption application?

The form 3500 exemption application is a document used by businesses to apply for an exemption from certain taxes in California. This application helps organizations streamline their tax compliance process. Understanding this form can signNowly benefit your business by potentially reducing tax liabilities.

-

How can airSlate SignNow assist with the form 3500 exemption application?

airSlate SignNow simplifies the process of preparing and submitting the form 3500 exemption application. Our platform offers easy-to-use eSignature capabilities, enabling you to complete your applications quickly and securely. This ensures that your submissions are efficiently managed and timely filed.

-

What features does airSlate SignNow provide for managing the form 3500 exemption application?

With airSlate SignNow, you get features like customizable templates, eSignature integration, and automated workflows that streamline the completion of the form 3500 exemption application. These features help reduce paperwork and enhance your application's accuracy. This means you can focus on your business rather than getting bogged down with administrative tasks.

-

Is there a cost associated with using airSlate SignNow for the form 3500 exemption application?

Yes, while airSlate SignNow offers a range of pricing plans, they are designed to be cost-effective for businesses of all sizes. Our plans allow you to select the features you need for the form 3500 exemption application. This flexibility means that you only pay for what you use, providing excellent value for your investment.

-

Can I integrate airSlate SignNow with other applications for the form 3500 exemption application?

Absolutely! airSlate SignNow supports various integrations with popular applications, making it easier for you to manage the form 3500 exemption application alongside your existing tools. This ensures a seamless workflow and enhances productivity, allowing you to stay organized while processing your applications.

-

What are the benefits of using airSlate SignNow for the form 3500 exemption application?

Using airSlate SignNow for the form 3500 exemption application provides a range of benefits, including time savings, enhanced security, and improved compliance. Our eSignature solution helps you avoid printing, scanning, and mailing documents, making the submission process quicker and more reliable. These advantages contribute to a more efficient business operation.

-

How secure is airSlate SignNow when submitting the form 3500 exemption application?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption and authentication measures to protect your data when submitting the form 3500 exemption application. You can confidently manage your sensitive documents, knowing that they are secure and compliant with industry standards.

Get more for How To File A Statement Of Information Online

Find out other How To File A Statement Of Information Online

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF