Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form 2019

What is the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form

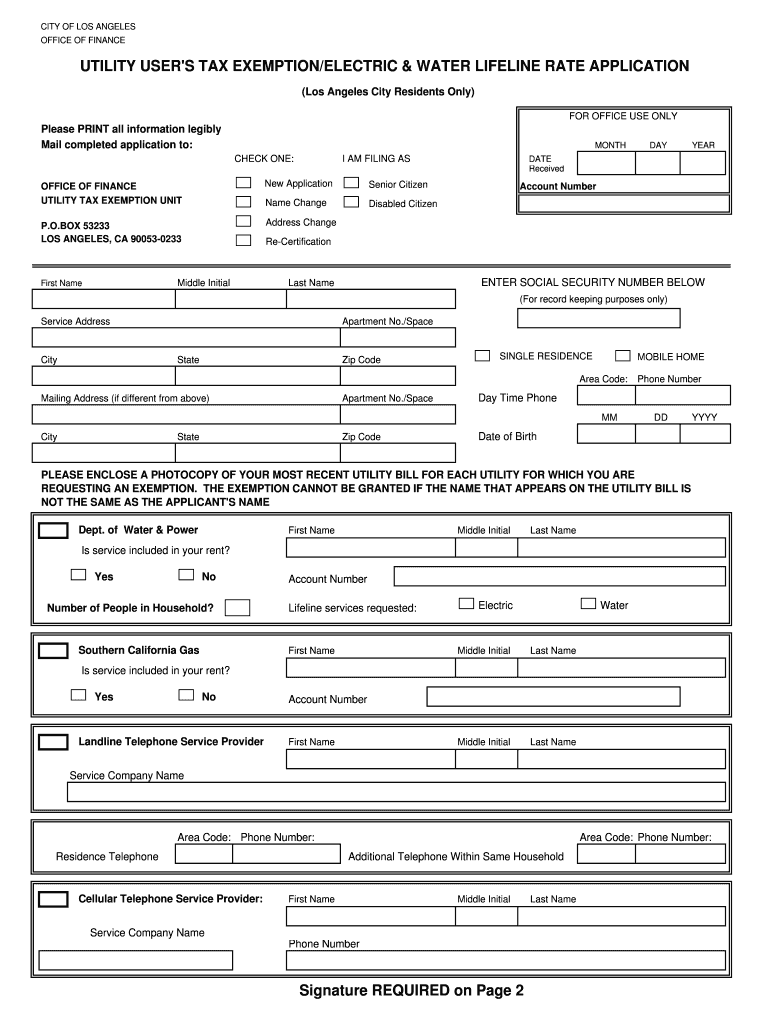

The Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form is a crucial document for residents seeking financial relief on their utility bills. This form allows eligible users to apply for exemptions or reduced rates on their electric and water services, helping to alleviate the financial burden of essential utilities. The program typically targets low-income households, seniors, or individuals with disabilities, ensuring that these vulnerable groups have access to necessary services at a more affordable rate.

How to use the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form

Using the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form involves several straightforward steps. First, ensure you meet the eligibility criteria, which may include income limits and residency requirements. Next, download or obtain the form from your local utility provider or relevant government agency. After filling out the form with accurate personal and financial information, submit it according to the instructions provided, either online, by mail, or in person. Keeping a copy of the completed application for your records is advisable.

Steps to complete the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form

Completing the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, such as proof of income, identification, and residency.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check your information for any errors or omissions.

- Sign and date the form where indicated.

- Submit the application according to the specified method, ensuring it is sent to the correct address or uploaded to the appropriate online portal.

Eligibility Criteria

Eligibility for the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form typically includes specific criteria that applicants must meet. Common requirements may include:

- Residency in the service area of the utility provider.

- Proof of income that falls below a certain threshold, often based on federal poverty guidelines.

- Age or disability status, which may provide additional considerations for qualification.

It is essential to review the specific eligibility criteria set by your local utility provider, as these can vary by location.

Form Submission Methods

The Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form can typically be submitted through various methods, depending on the utility provider's policies. Common submission options include:

- Online submission via the utility provider's website, often through a secure portal.

- Mailing the completed form to the designated address provided in the application instructions.

- In-person submission at designated utility offices or community service centers.

Choosing the most convenient method for your circumstances can help ensure timely processing of your application.

Key elements of the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form

Understanding the key elements of the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form is essential for successful completion. Important components typically include:

- Personal information, such as your name, address, and contact details.

- Income details, including sources and amounts to determine eligibility.

- Signature and date fields to affirm the accuracy of the information provided.

Completing these sections accurately is vital for the approval of your application.

Quick guide on how to complete utility users tax exemptionelectric amp water lifeline rate application 2013 form

Set up Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without any holdups. Manage Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form across any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form without hassle

- Find Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow has specifically designed for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click the Done button to keep your edits.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget the worries of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct utility users tax exemptionelectric amp water lifeline rate application 2013 form

Create this form in 5 minutes!

How to create an eSignature for the utility users tax exemptionelectric amp water lifeline rate application 2013 form

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form?

The Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form is a crucial document that allows eligible residents to apply for exemptions on their utility users tax for electric and water services. This form is designed to assist low-income households in reducing their utility expenses, making essential services more affordable.

-

How can I access the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form?

You can easily access the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form through the airSlate SignNow platform. Our user-friendly interface allows you to download, complete, and submit the application form online without any hassle.

-

What features does the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form include?

The Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form includes essential fields for personal information, utility account details, and income verification. By utilizing airSlate SignNow's features, users can electronically sign the form, ensuring a quick and secure processing experience.

-

Is there a cost associated with using the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form?

Using the airSlate SignNow platform to access and submit the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form is cost-effective. While the form itself is free to fill out, consider minimal charges for any additional services or features you may choose to utilize during the application process.

-

How long does it take to process the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form?

The processing time for the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form may vary based on the utility provider's requirements. Generally, after submitting the completed form through airSlate SignNow, you can expect a response within a few weeks, allowing you to plan accordingly.

-

Can I integrate the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form with other tools?

Yes, airSlate SignNow allows for integrations with various applications, enhancing the user experience when completing the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form. You can seamlessly connect with tools like CRMs, cloud storage services, and more to streamline your document management process.

-

What are the benefits of using airSlate SignNow for the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form?

Using airSlate SignNow for the Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form offers numerous benefits, including easy document eSigning, secure storage, and rapid submission. This ensures that eligible customers can quickly and efficiently apply for utility exemptions, promoting financial relief.

Get more for Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form

Find out other Utility Users Tax Exemptionelectric & Water Lifeline Rate Application Form

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form