Ftbcagov Form 3516 2015

What is the Ftbcagov Form 3516

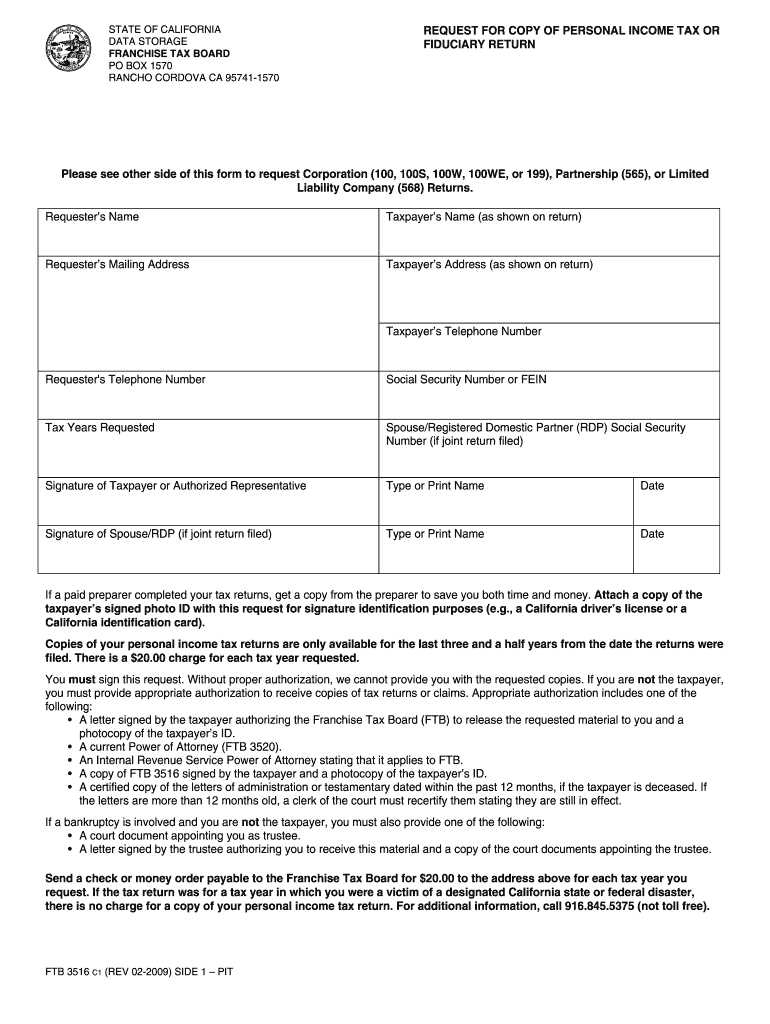

The Ftbcagov Form 3516 is an official document used primarily for federal tax purposes in the United States. This form is essential for individuals and businesses who need to report specific financial information to the government. Understanding its purpose is crucial for compliance with tax regulations, ensuring that all necessary data is accurately submitted to the appropriate authorities.

How to use the Ftbcagov Form 3516

Using the Ftbcagov Form 3516 involves several steps to ensure that all required information is accurately filled out. First, gather all necessary financial documents that will support the entries on the form. Next, carefully complete each section of the form, ensuring that all information is correct and up-to-date. After filling out the form, review it for any errors before submission. Proper use of this form helps maintain compliance with tax laws and regulations.

Steps to complete the Ftbcagov Form 3516

Completing the Ftbcagov Form 3516 requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant financial documents, including income statements and expense records.

- Begin filling out the form, starting with your personal or business information.

- Provide detailed financial information as required, ensuring that all figures are accurate.

- Review the completed form for any mistakes or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Ftbcagov Form 3516

The legal use of the Ftbcagov Form 3516 is governed by various tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated timeframes. Compliance with the Internal Revenue Service (IRS) guidelines is essential to avoid penalties. Additionally, understanding the legal implications of the information reported on the form can help prevent potential issues with tax authorities.

Key elements of the Ftbcagov Form 3516

Several key elements are critical to the Ftbcagov Form 3516. These include:

- Personal or business identification information.

- Financial data, including income and expenses.

- Signatures and dates, which confirm the accuracy of the information provided.

- Any supporting documentation that may be required to substantiate the claims made on the form.

Form Submission Methods

The Ftbcagov Form 3516 can be submitted through various methods, depending on the requirements set forth by the IRS. Common submission methods include:

- Online submission through the IRS e-file system.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Quick guide on how to complete ftbcagov form 3516 2009

Effortlessly Prepare Ftbcagov Form 3516 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Ftbcagov Form 3516 on any device using the airSlate SignNow applications for Android or iOS and simplify your document-driven tasks today.

How to Modify and Electronically Sign Ftbcagov Form 3516 with Ease

- Find Ftbcagov Form 3516 and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Ftbcagov Form 3516 and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftbcagov form 3516 2009

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is the Ftbcagov Form 3516 and how can airSlate SignNow help?

The Ftbcagov Form 3516 is a crucial document for certain government transactions. With airSlate SignNow, you can easily send, sign, and manage this form digitally, streamlining your workflow and ensuring compliance.

-

How much does it cost to use airSlate SignNow for Ftbcagov Form 3516?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By utilizing airSlate SignNow for documents like the Ftbcagov Form 3516, companies can save on administrative costs while ensuring efficient document management.

-

What features does airSlate SignNow include for managing the Ftbcagov Form 3516?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure storage, all of which streamline the management of the Ftbcagov Form 3516. These capabilities enhance productivity and ensure your documents are handled with care.

-

Is airSlate SignNow compliant with legal standards for the Ftbcagov Form 3516?

Yes, airSlate SignNow complies with all legal standards necessary for digital signatures and form submissions, including the Ftbcagov Form 3516. This compliance ensures that your documents hold legal validity and security.

-

Can I integrate airSlate SignNow with other applications when using the Ftbcagov Form 3516?

Absolutely! airSlate SignNow provides seamless integrations with various applications, enhancing your workflows related to the Ftbcagov Form 3516. This flexibility allows you to fit the solution into your existing systems for greater efficiency.

-

What are the benefits of using airSlate SignNow for the Ftbcagov Form 3516?

Using airSlate SignNow for the Ftbcagov Form 3516 provides numerous benefits, including reduced processing time, enhanced security, and improved document tracking. These features collectively help streamline your business processes and improve overall productivity.

-

How can I get started with airSlate SignNow for the Ftbcagov Form 3516?

Getting started with airSlate SignNow is easy! Simply visit the website, sign up for an account, and start creating your Ftbcagov Form 3516 documents. The user-friendly interface ensures that you can quickly begin leveraging the platform's capabilities.

Get more for Ftbcagov Form 3516

Find out other Ftbcagov Form 3516

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe