Maryland Estimated Tax Form 502

What is the Maryland Estimated Tax Form 502

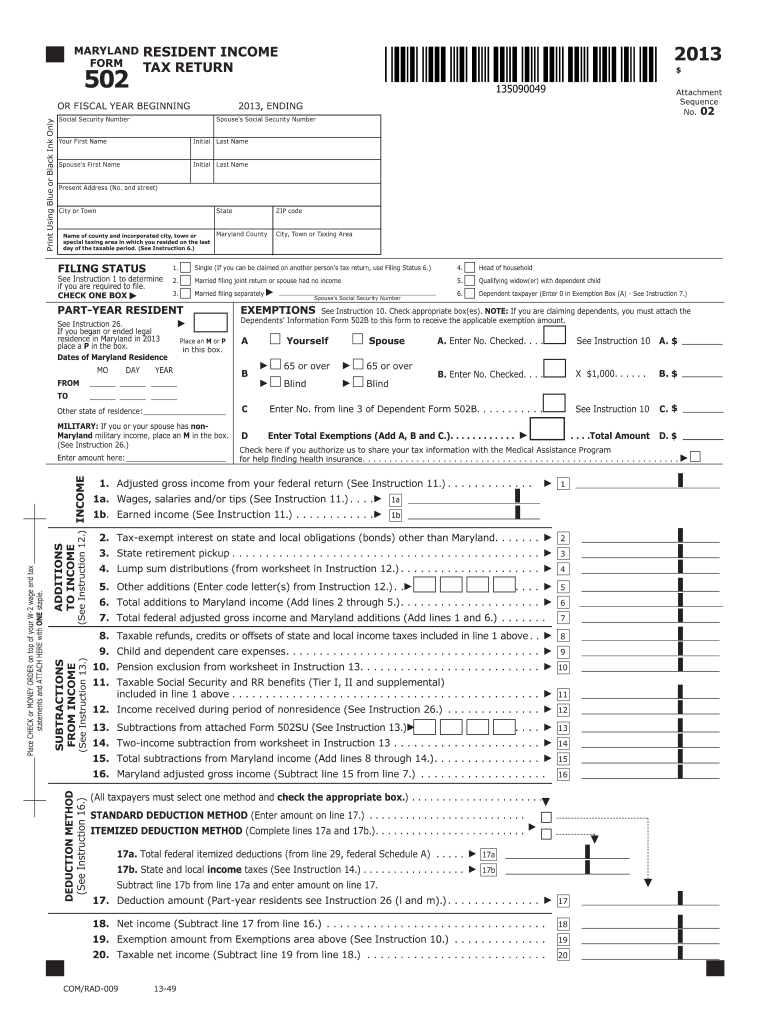

The Maryland Estimated Tax Form 502 is a document used by residents of Maryland to report their estimated income tax liability for the year. This form is essential for individuals who expect to owe tax of one thousand dollars or more when they file their tax return. By submitting this form, taxpayers can make quarterly estimated tax payments, thereby avoiding penalties for underpayment at the end of the tax year. The 2013 Maryland Form 502 is specifically designed for the tax year 2013, and it includes sections for reporting various types of income, deductions, and credits applicable to Maryland residents.

Steps to complete the Maryland Estimated Tax Form 502

Completing the 2013 Maryland Form 502 involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including W-2s, 1099s, and records of other income sources.

- Calculate your estimated income: Determine your expected total income for the year, including wages, self-employment income, and investment earnings.

- Determine deductions and credits: Identify any deductions or credits you qualify for, which can reduce your overall tax liability.

- Fill out the form: Input your calculated income, deductions, and credits into the appropriate sections of the form.

- Review your entries: Double-check all information for accuracy to avoid errors that could lead to penalties.

- Submit the form: Follow the submission guidelines for online filing or mail it to the appropriate address.

Legal use of the Maryland Estimated Tax Form 502

The 2013 Maryland Form 502 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be signed and dated by the taxpayer or an authorized representative. Electronic signatures are acceptable, provided they comply with the legal standards for eSignatures in Maryland. The form must also be submitted by the established deadlines to avoid penalties for late payments. Adhering to these requirements helps maintain the form's legal standing in case of audits or disputes with the state tax authority.

Filing Deadlines / Important Dates

For the 2013 Maryland Form 502, it is crucial to adhere to specific filing deadlines to avoid penalties. The estimated tax payments are typically due on the following dates:

- First Quarter: April 15, 2013

- Second Quarter: June 15, 2013

- Third Quarter: September 15, 2013

- Fourth Quarter: January 15, 2014

Taxpayers should ensure that their payments are postmarked by these dates to remain compliant with Maryland tax laws.

Form Submission Methods (Online / Mail / In-Person)

The 2013 Maryland Form 502 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission: Taxpayers can file electronically through the Maryland Comptroller's website, which offers a streamlined process for completing and submitting the form.

- Mail submission: The completed form can be printed and mailed to the designated address provided in the form instructions.

- In-person submission: Taxpayers may also choose to deliver the form in person at local tax offices, ensuring immediate receipt.

Key elements of the Maryland Estimated Tax Form 502

The 2013 Maryland Form 502 includes several key elements that taxpayers must complete:

- Personal information: This section requires the taxpayer's name, address, and Social Security number.

- Income details: Taxpayers must report all sources of income, including wages, business income, and investment earnings.

- Deductions and credits: This section allows taxpayers to claim any applicable deductions and credits that reduce their taxable income.

- Estimated tax calculation: Taxpayers must calculate their estimated tax liability based on their reported income and deductions.

Quick guide on how to complete maryland estimated tax form 502

Effortlessly Prepare Maryland Estimated Tax Form 502 on Any Device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Maryland Estimated Tax Form 502 across any platform with the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to Edit and eSign Maryland Estimated Tax Form 502 with Ease

- Find Maryland Estimated Tax Form 502 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searches, or mistakes that require you to print new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Maryland Estimated Tax Form 502 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland estimated tax form 502

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the 2013 Maryland Form 502 tax?

The 2013 Maryland Form 502 tax is the state's income tax return form used by residents to report their income and calculate their taxes owed. This form is essential for individuals and businesses to ensure compliance with state tax regulations. By accurately completing the 2013 Maryland Form 502 tax, you can avoid potential penalties.

-

How can airSlate SignNow help with the 2013 Maryland Form 502 tax?

airSlate SignNow streamlines the process of signing and sending the 2013 Maryland Form 502 tax by allowing users to eSign documents securely and efficiently. With its easy-to-use interface, you can prepare your tax forms and get necessary signatures faster, helping to meet state deadlines. This increases productivity and reduces the inconvenience of paper-based processes.

-

Is there a cost associated with using airSlate SignNow for the 2013 Maryland Form 502 tax?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses and individuals handling the 2013 Maryland Form 502 tax. Pricing plans are flexible and cater to various needs, ensuring that you get the best value for your eSignature solutions. This investment can save time and minimize errors in tax filing.

-

What features does airSlate SignNow offer for the 2013 Maryland Form 502 tax?

AirSlate SignNow offers a variety of features ideal for managing the 2013 Maryland Form 502 tax, including customizable templates, secure eSigning, and audit trails. These features make it easy to manage document workflows, ensuring compliance and reliability in your tax submission process. With its robust functionalities, you’ll have everything you need for effective document management.

-

Can I integrate airSlate SignNow with my existing accounting software for the 2013 Maryland Form 502 tax?

Absolutely! airSlate SignNow can seamlessly integrate with a variety of accounting software applications, enhancing the efficiency of completing the 2013 Maryland Form 502 tax. This integration helps streamline document flows, enabling you to access and sign forms directly within your existing systems without any hassle.

-

How does airSlate SignNow ensure the security of the 2013 Maryland Form 502 tax?

AirSlate SignNow takes security seriously, offering features like data encryption and secure cloud storage to protect your 2013 Maryland Form 502 tax. Additionally, it complies with industry standards and regulations, ensuring your sensitive information remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for filing the 2013 Maryland Form 502 tax?

Using airSlate SignNow for filing the 2013 Maryland Form 502 tax offers numerous benefits including time savings, improved accuracy, and enhanced collaboration between signers. The platform allows you to easily track document status and reminders, which is crucial for meeting tax deadlines. This not only reduces stress but also helps you file on time.

Get more for Maryland Estimated Tax Form 502

- Client bconsentb form caci caci international co

- Iuga bladder diary form

- Formato de solicitud de crdito comercial

- Notice of objection alberta form

- State of maryland form 4a

- Cardinal health hcg combo rapid test instructions form

- Www ccsdschools com form

- Itc 5 11 michigan state youth soccer association form

Find out other Maryland Estimated Tax Form 502

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure