1040x Me Amended Form 2012

What is the 1040x Me Amended Form

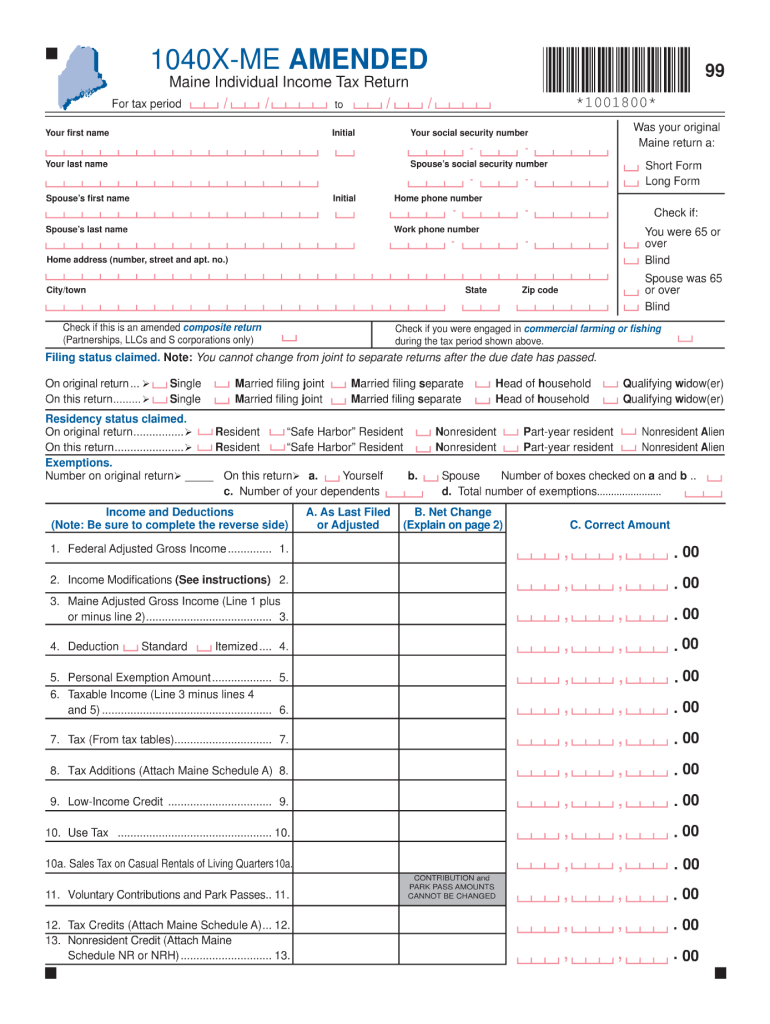

The 1040x Me Amended Form is a tax form used by individuals in the United States to amend their previously filed federal income tax returns. This form allows taxpayers to correct errors or make changes to their original 1040 forms. Common reasons for filing the 1040x include correcting filing status, income discrepancies, or claiming additional deductions or credits that were missed initially. Understanding the purpose of this form is essential for ensuring accurate tax reporting and compliance with IRS regulations.

How to use the 1040x Me Amended Form

Using the 1040x Me Amended Form involves several key steps. First, you should gather all relevant documents, including your original tax return and any supporting documentation for the changes you wish to make. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Clearly indicate the changes being made in the appropriate sections of the form. Finally, review the completed form for accuracy before submitting it to the IRS. Remember to keep copies of all documents for your records.

Steps to complete the 1040x Me Amended Form

Completing the 1040x Me Amended Form requires careful attention to detail. Follow these steps:

- Obtain the 1040x form from the IRS website or through tax software.

- Fill in your personal information at the top of the form.

- In Part I, explain the reasons for your amendments.

- In Part II, detail the changes in income, deductions, and credits.

- Calculate the new tax liability, if applicable, and determine if you owe additional taxes or are due a refund.

- Sign and date the form before submission.

Legal use of the 1040x Me Amended Form

The 1040x Me Amended Form is legally recognized by the IRS as a valid method for correcting tax returns. To ensure its legal use, it is important to adhere to IRS guidelines regarding the filing of amendments. This includes submitting the form within the designated time frame, typically within three years of the original filing date or within two years of paying any tax owed. Additionally, any changes made must be substantiated with appropriate documentation to support the claims made on the amended return.

Filing Deadlines / Important Dates

Filing deadlines for the 1040x Me Amended Form are crucial to avoid penalties. Generally, you must file the amended return within three years from the original filing date or within two years from the date you paid the tax, whichever is later. It is important to keep track of these deadlines to ensure compliance and to maximize any potential refunds. The IRS also provides specific dates for tax year amendments, which can vary, so checking the IRS website for updates is advisable.

Form Submission Methods (Online / Mail / In-Person)

The 1040x Me Amended Form can be submitted through various methods. Currently, the IRS allows electronic filing of the amended return through approved tax software. Alternatively, you can print the completed form and mail it to the appropriate IRS address based on your state of residence. In-person submission is not typically available for amended returns, as the IRS does not accept walk-in amendments at local offices. Always verify the submission method that best suits your needs and ensure that you follow the instructions provided by the IRS.

Quick guide on how to complete 1040x me amended 2010 form

Complete 1040x Me Amended Form effortlessly on any device

Managing documents online has gained considerable popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly without hindrances. Manage 1040x Me Amended Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign 1040x Me Amended Form with ease

- Locate 1040x Me Amended Form and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow has specifically designed for that task.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 1040x Me Amended Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040x me amended 2010 form

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is the 1040x Me Amended Form?

The 1040x Me Amended Form is a form that allows taxpayers to amend their previously filed IRS tax returns. It is crucial for correcting errors, claiming additional deductions, or changing filing statuses. With airSlate SignNow, completing and eSigning your 1040x Me Amended Form becomes a seamless process.

-

How can I access the 1040x Me Amended Form using airSlate SignNow?

You can easily access the 1040x Me Amended Form by signing up for airSlate SignNow. Our platform provides templates that allow you to fill out and customize your forms efficiently. Once completed, you can send them for eSignature without any hassle.

-

What features does airSlate SignNow offer for the 1040x Me Amended Form?

airSlate SignNow offers features like template management, electronic signatures, and document tracking for the 1040x Me Amended Form. These tools enable you to streamline your tax amendment process, ensuring quick submissions. Additionally, our user-friendly interface makes document handling straightforward.

-

Is there a cost associated with using airSlate SignNow for the 1040x Me Amended Form?

Yes, there is a cost associated with using airSlate SignNow, but we provide various pricing plans to fit different needs and budgets. Our plans are designed to be cost-effective, particularly for businesses that need to manage multiple documents, including the 1040x Me Amended Form.

-

Can I integrate airSlate SignNow with other software for filing the 1040x Me Amended Form?

Absolutely! airSlate SignNow supports integrations with various accounting and tax software, which can simplify how you manage your 1040x Me Amended Form. By connecting to your existing systems, you can ensure a smoother workflow and better document organization.

-

What are the benefits of using airSlate SignNow for my 1040x Me Amended Form?

Using airSlate SignNow for your 1040x Me Amended Form offers several benefits, including time-saving electronic signatures and improved accuracy through our templates. You can manage every aspect of your amendment process digitally, reducing the risk of errors and ensuring timely submissions to the IRS.

-

Is it safe to use airSlate SignNow for my 1040x Me Amended Form?

Yes, airSlate SignNow ensures the safety and confidentiality of your documents when working on your 1040x Me Amended Form. We implement advanced security measures, including encryption and secure servers, to protect your sensitive information throughout the signing and filing process.

Get more for 1040x Me Amended Form

- Family profiling form

- Affidavit information 92816848

- Trip cost report form

- Blank welding certificate form

- Great treasure hunt iowa form

- Laser hair removal facility certificate of registration application instructions form

- Add a category or sub category uk part 66 aircraft form

- Proof of degree form do not send us your original

Find out other 1040x Me Amended Form

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement