L 1040 Instructions Lansingmi Form

What is the L-1040 Instructions Lansing, MI?

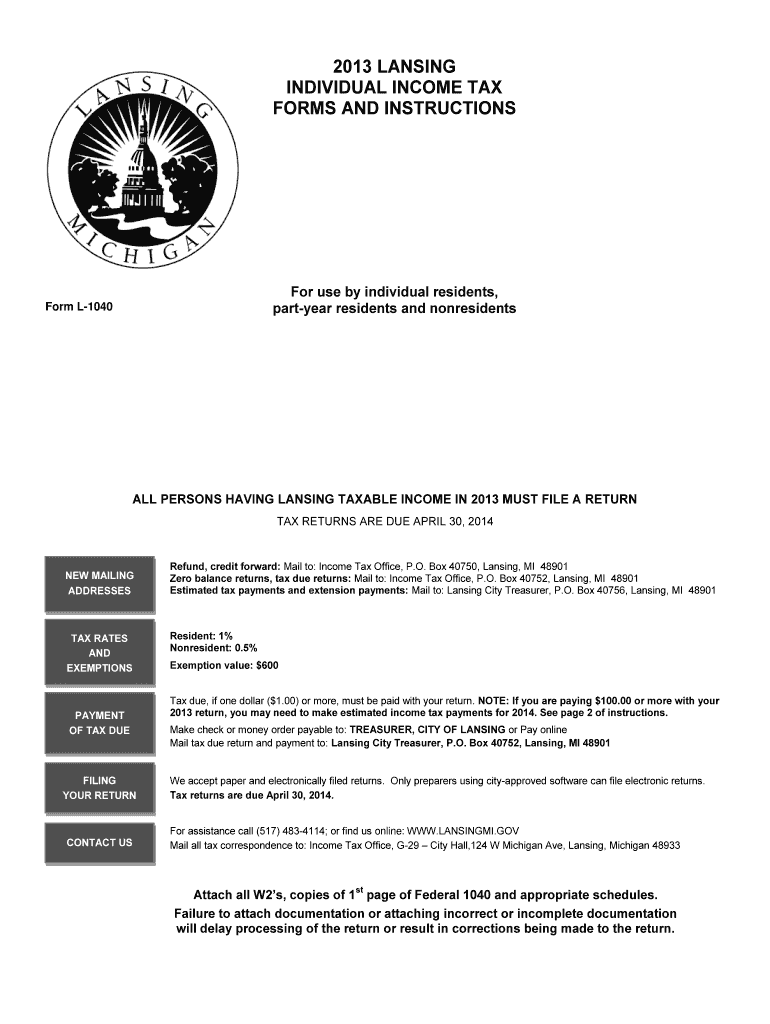

The L-1040 Instructions for Lansing, MI, provide essential guidelines for residents filing their local income tax returns. This document outlines the specific requirements and procedures necessary for accurately completing the city of Lansing tax forms. It includes information on taxable income, deductions, and credits applicable to Lansing residents, ensuring compliance with local tax regulations.

Steps to Complete the L-1040 Instructions Lansing, MI

Completing the L-1040 Instructions involves several key steps:

- Gather necessary documents, such as W-2 forms, 1099s, and any other income statements.

- Review the instructions carefully to understand the specific requirements for your situation.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Double-check your entries for accuracy before submission.

- Submit the completed form through your chosen method, whether online, by mail, or in person.

Required Documents for the L-1040 Instructions Lansing, MI

To complete the L-1040, certain documents are necessary:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Identification information, such as your Social Security number

Filing Deadlines / Important Dates for L-1040 Lansing, MI

It is crucial to be aware of the filing deadlines for the L-1040 form to avoid penalties. Typically, the local income tax return is due on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Always check for any updates regarding extensions or changes in filing dates.

Form Submission Methods for L-1040 Lansing, MI

Residents of Lansing have several options for submitting the L-1040 form:

- Online submission through the city’s official tax portal.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices during business hours.

Penalties for Non-Compliance with L-1040 Lansing, MI

Failure to comply with the filing requirements for the L-1040 can result in penalties. These may include fines for late submissions, interest on unpaid taxes, and potential legal action for continued non-compliance. It is advisable to file on time and ensure all information is accurate to avoid these consequences.

Quick guide on how to complete l 1040 instructions lansingmi

Effortlessly Complete L 1040 Instructions Lansingmi on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly replacement for traditional printed and signed paperwork, as you can easily access the proper format and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Handle L 1040 Instructions Lansingmi on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The Easiest Way to Edit and eSign L 1040 Instructions Lansingmi with Ease

- Find L 1040 Instructions Lansingmi and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent parts of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign L 1040 Instructions Lansingmi and guarantee excellent communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the l 1040 instructions lansingmi

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the CF 1040 Lansing form used for?

The CF 1040 Lansing form is utilized for filing individual income tax returns in the Lansing area. It helps individuals report their income and calculate their tax liabilities efficiently. By using the CF 1040 Lansing form, taxpayers can ensure compliance with state tax regulations.

-

How can airSlate SignNow help with CF 1040 Lansing submissions?

airSlate SignNow streamlines the process of completing and submitting CF 1040 Lansing forms by allowing users to eSign documents securely and efficiently. The platform provides templates that are specifically designed for tax forms, simplifying the entire filing process. With airSlate SignNow, ensure your CF 1040 Lansing submissions are accurate and timely.

-

What are the pricing options for airSlate SignNow when using CF 1040 Lansing?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses using the CF 1040 Lansing form. Pricing typically varies based on features selected and the number of users. Explore our website to find a plan that suits your requirements for completing your CF 1040 Lansing filings.

-

What features does airSlate SignNow provide for CF 1040 Lansing?

The key features of airSlate SignNow for CF 1040 Lansing include customizable templates, secure eSignatures, and document tracking. These features help users manage their tax documentation effectively while ensuring compliance with legal requirements. Additionally, our platform provides cloud storage for easy access to your CF 1040 Lansing forms when needed.

-

Is airSlate SignNow secure for CF 1040 Lansing document management?

Yes, airSlate SignNow is highly secure for managing CF 1040 Lansing documents. Our platform uses advanced encryption protocols to protect sensitive information during transmission and storage. With airSlate SignNow, you can confidently complete and submit your CF 1040 Lansing forms knowing your data is safe.

-

Can airSlate SignNow integrate with other software for CF 1040 Lansing processing?

Absolutely! airSlate SignNow allows seamless integration with various accounting and document management software to facilitate CF 1040 Lansing processing. This integration streamlines data transfer, reducing the need for manual entry, and ultimately saving time and reducing errors in tax filings.

-

What are the benefits of using airSlate SignNow for CF 1040 Lansing?

Using airSlate SignNow for CF 1040 Lansing offers numerous benefits, such as improved efficiency, reduced paperwork, and enhanced collaboration among teams. The ease of eSigning and managing documents digitally can signNowly speed up the filing process. Overall, airSlate SignNow makes handling your CF 1040 Lansing forms much simpler and more effective.

Get more for L 1040 Instructions Lansingmi

Find out other L 1040 Instructions Lansingmi

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation