Form 8606 2023

What is the Form 8606

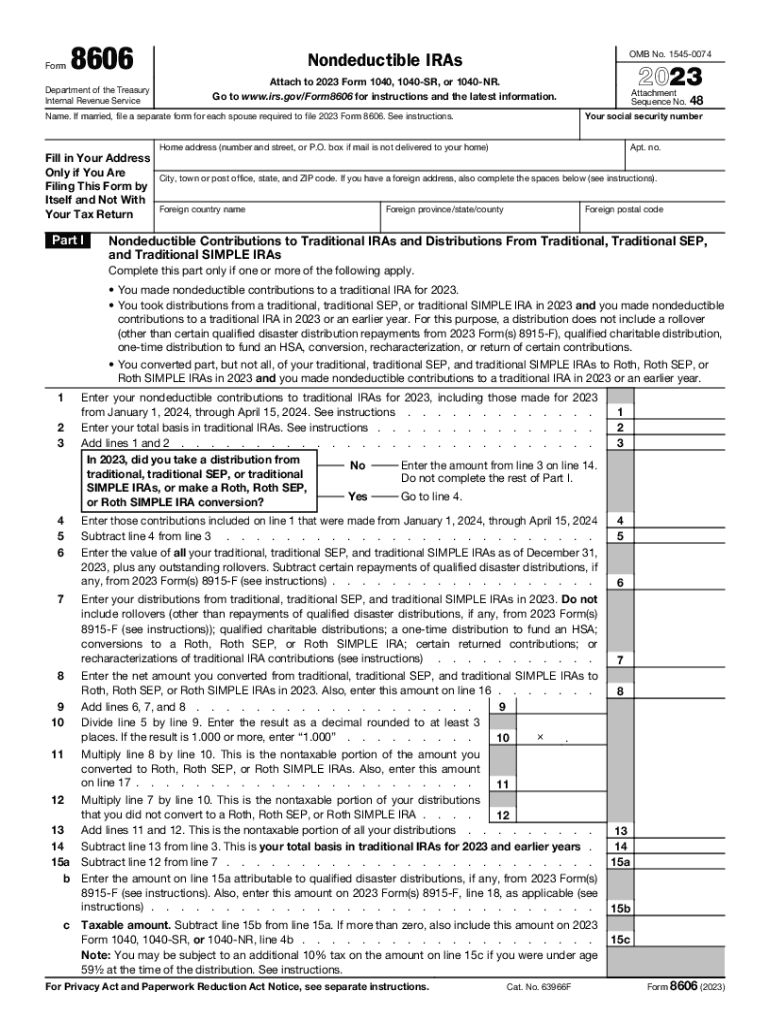

The Form 8606 is a tax document used by individuals in the United States to report non-deductible contributions to traditional Individual Retirement Accounts (IRAs) and to track distributions from Roth IRAs. This form is essential for taxpayers who have made non-deductible contributions or who have received distributions from Roth IRAs, as it helps ensure accurate reporting of taxable income and prevents double taxation on contributions. The IRS requires this form to be filed with your federal income tax return if you have made these types of contributions or distributions.

How to use the Form 8606

To use the Form 8606 effectively, begin by determining if you need to file it based on your IRA contributions and distributions. If you made non-deductible contributions to a traditional IRA or received distributions from a Roth IRA, you must complete this form. Fill out the form by providing your personal information, detailing your contributions, and indicating any distributions received. Be sure to follow the instructions carefully to ensure compliance with IRS regulations and to accurately report your tax obligations.

Steps to complete the Form 8606

Completing the Form 8606 involves several key steps:

- Gather necessary documents, including records of your IRA contributions and distributions.

- Enter your personal information at the top of the form, including your name and Social Security number.

- Detail your non-deductible contributions to traditional IRAs in Part I of the form.

- Complete Part II if you received distributions from Roth IRAs, indicating the amount and type of distribution.

- Review the form for accuracy and completeness before submitting it with your tax return.

Key elements of the Form 8606

The Form 8606 includes several important sections that taxpayers must complete:

- Personal Information: This section requires your name, Social Security number, and filing status.

- Non-Deductible Contributions: Report the total amount of non-deductible contributions made to traditional IRAs.

- Roth IRA Distributions: If applicable, provide details about any distributions received from Roth IRAs.

- Taxable Amount: Calculate any taxable amounts resulting from distributions, if necessary.

IRS Guidelines

The IRS provides specific guidelines for completing Form 8606, which include instructions on eligibility, reporting requirements, and deadlines. Taxpayers should refer to the most recent IRS publications for detailed information on how to fill out the form correctly. It is crucial to stay informed about any changes to tax laws that may affect how the form is completed and submitted.

Filing Deadlines / Important Dates

Form 8606 must be filed by the tax return deadline, which is typically April 15 of the following year. If you are unable to meet this deadline, you may file for an extension, but the form must still be submitted by the extended due date to avoid penalties. It is important to keep track of these dates to ensure compliance and avoid any potential issues with the IRS.

Quick guide on how to complete form 8606 702539239

Complete Form 8606 effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly and seamlessly. Manage Form 8606 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Form 8606 without any hassle

- Locate Form 8606 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive details with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign Form 8606 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8606 702539239

Create this form in 5 minutes!

How to create an eSignature for the form 8606 702539239

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8606 form 2022 printable and who needs it?

The 8606 form 2022 printable is a tax document used to report non-deductible contributions to traditional IRAs and to calculate the taxable portion of distributions. Individuals who contribute to IRAs or receive distributions from them may need to fill out this form to accurately report their taxes.

-

Where can I find the 8606 form 2022 printable?

You can easily access the 8606 form 2022 printable on the IRS website or through tax preparation software. Additionally, airSlate SignNow allows you to create and manage your tax documents, making it convenient to obtain and print the form directly from our platform.

-

How does airSlate SignNow simplify the process of using the 8606 form 2022 printable?

airSlate SignNow streamlines the process by providing an easy-to-use interface for filling out and signing the 8606 form 2022 printable online. Our solution enables you to send the completed form to tax professionals or save it for your records seamlessly, all in one place.

-

Are there any costs associated with obtaining the 8606 form 2022 printable through airSlate SignNow?

While the form itself is free to obtain, using airSlate SignNow may incur subscription fees depending on the features you need. Our pricing is competitive and designed to provide cost-effective solutions for managing your documents, including the 8606 form 2022 printable.

-

What features does airSlate SignNow offer for managing the 8606 form 2022 printable?

airSlate SignNow offers features like electronic signatures, document sharing, and real-time notifications, which enhance the handling of the 8606 form 2022 printable. With our platform, you can ensure your documents are signed quickly and securely, simplifying your tax preparation process.

-

Can I integrate airSlate SignNow with other software to manage the 8606 form 2022 printable?

Yes, airSlate SignNow offers integrations with popular accounting and tax software, making it easier to manage the 8606 form 2022 printable alongside your financial documents. This integration helps streamline your workflow and keeps everything organized.

-

What are the benefits of using airSlate SignNow for tax documents like the 8606 form 2022 printable?

By using airSlate SignNow for your tax documents, including the 8606 form 2022 printable, you benefit from a secure, user-friendly platform that enhances efficiency. Our solution allows for easy tracking of document status and reduces the time spent on manual tasks, making tax season less stressful.

Get more for Form 8606

- Partners research proposal coversheet partners research resadmin partners form

- Missouri report manual form

- Ma accident form 2012

- Pa form 600

- Sample accident report form american camp association acacamps

- Pdf filler incident report form

- Usaa accident report form

- How to get a copy of your high school diploma in south carolina form

Find out other Form 8606

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template