Nc4 Form 2019

What is the Nc4 Form

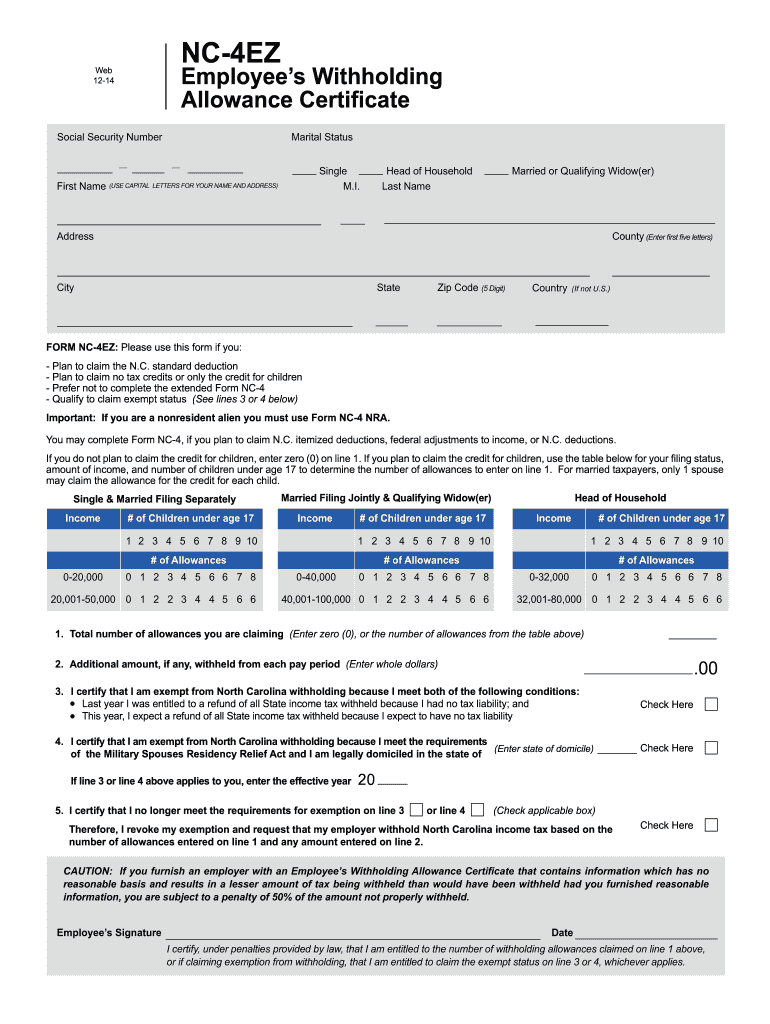

The Nc4 Form is a crucial tax document used in the United States, specifically designed for employees to provide their employers with information regarding their state tax withholding. This form is essential for ensuring that the correct amount of state income tax is withheld from an employee's paycheck. By accurately completing the Nc4 Form, employees can help avoid underpayment or overpayment of state taxes throughout the year.

How to use the Nc4 Form

Using the Nc4 Form involves several straightforward steps. First, employees need to obtain the form, which can typically be found on the official state revenue department website or provided by their employer. After acquiring the form, employees should fill in their personal information, including name, address, and Social Security number. Next, they must indicate their filing status and any allowances they wish to claim. Finally, employees should submit the completed form to their employer, who will use the information to adjust tax withholdings accordingly.

Steps to complete the Nc4 Form

Completing the Nc4 Form requires careful attention to detail. Here are the steps to follow:

- Download or request the Nc4 Form from your employer or state revenue department.

- Fill in your personal details, including your full name, address, and Social Security number.

- Select your filing status, which may include options such as single, married, or head of household.

- Claim any allowances you are eligible for, which can help reduce the amount of tax withheld.

- Review the completed form for accuracy before signing and dating it.

- Submit the form to your employer for processing.

Legal use of the Nc4 Form

The Nc4 Form serves as an official document that complies with state tax laws. When properly completed and submitted, it ensures that the correct amount of state income tax is withheld from an employee's wages. This legal framework helps prevent potential penalties for under-withholding or over-withholding taxes. Employers are required to keep the Nc4 Form on file for their records, ensuring compliance with state regulations.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Nc4 Form is essential for employees. Typically, employees should submit the form to their employer at the beginning of the tax year or whenever there is a change in their tax situation, such as a change in marital status or the number of dependents. Employers must ensure that the form is processed promptly to adjust withholdings accordingly. It is advisable to check with the state revenue department for any specific deadlines related to the Nc4 Form.

Examples of using the Nc4 Form

There are various scenarios in which an employee might need to use the Nc4 Form. For instance, a newly hired employee may complete the form to establish their state tax withholding preferences. Similarly, an employee who recently got married may need to update their filing status and allowances on the Nc4 Form. Additionally, individuals who experience significant life changes, such as having a child or purchasing a home, may also find it necessary to revise their withholding information using this form.

Quick guide on how to complete nc4 2014 form

Completing Nc4 Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to generate, adjust, and eSign your documents swiftly without delays. Manage Nc4 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Nc4 Form with ease

- Locate Nc4 Form and then click Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether it be via email, text message (SMS), an invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Edit and eSign Nc4 Form to ensure exceptional communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nc4 2014 form

Create this form in 5 minutes!

How to create an eSignature for the nc4 2014 form

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is an Nc4 Form, and why is it important?

The Nc4 Form is a crucial document used for withholding tax purposes in North Carolina. It provides essential information to determine how much tax should be withheld from your income. Properly completing the Nc4 Form can help ensure that you're compliant with state tax regulations.

-

How can airSlate SignNow help me complete the Nc4 Form?

airSlate SignNow offers an easy-to-use platform that allows you to digitally complete and eSign your Nc4 Form quickly and securely. With our intuitive features, you can fill out the form, save time, and eliminate errors that often accompany manual entries. Our solution streamlines the process, ensuring compliance with state guidelines.

-

Is there a cost associated with using airSlate SignNow for the Nc4 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs. We provide a cost-effective solution that allows you to manage your Nc4 Form and other documents efficiently. Explore our subscription options to find the best fit for your budget.

-

What features does airSlate SignNow provide for managing the Nc4 Form?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools enable you to customize your Nc4 Form, track status updates, and store your completed forms securely. Our user-friendly interface ensures a seamless experience from start to finish.

-

Can I integrate airSlate SignNow with other software for handling the Nc4 Form?

Absolutely! airSlate SignNow offers multiple integrations with popular software, making it easy to manage your Nc4 Form alongside your existing tools. Whether you use accounting software or CRM platforms, our integrations streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the Nc4 Form?

Using airSlate SignNow for your Nc4 Form provides numerous benefits, including time savings and increased accuracy. Our platform simplifies the document signing process and minimizes the chances of errors, helping you stay compliant with tax regulations. Additionally, you can access your documents anytime, anywhere.

-

How secure is airSlate SignNow for filing the Nc4 Form?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and stringent security measures to safeguard your Nc4 Form and personal information. You can confidently eSign and store your documents knowing they are protected from unauthorized access.

Get more for Nc4 Form

Find out other Nc4 Form

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast