E 595e Form 2019

What is the E 595e Form

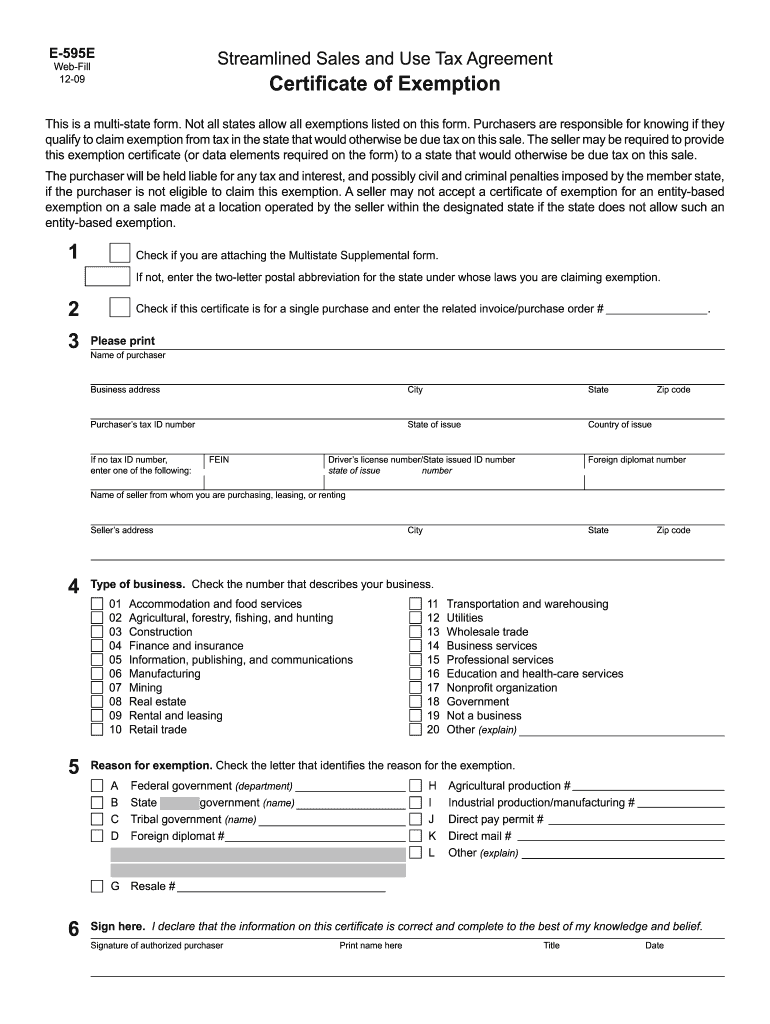

The E 595e Form is a crucial document used in the United States for sales and use tax exemption purposes. Specifically, it allows certain organizations, such as nonprofits and government entities, to purchase goods and services without incurring sales tax. This form is essential for qualifying entities to assert their tax-exempt status when making purchases, ensuring compliance with state tax regulations.

How to use the E 595e Form

Using the E 595e Form involves several straightforward steps. First, the purchasing entity must complete the form by providing necessary details such as the name, address, and type of organization. Next, the form must be presented to the seller at the time of purchase. It is important for the seller to retain a copy of this form for their records, as it serves as proof of the tax-exempt status of the buyer.

Steps to complete the E 595e Form

Completing the E 595e Form requires attention to detail. Follow these steps:

- Provide the full name and address of the purchaser.

- Indicate the type of organization (e.g., nonprofit, government).

- Include the reason for the exemption.

- Sign and date the form to certify the information is accurate.

Once filled out, ensure that the form is presented to the seller during the transaction.

Legal use of the E 595e Form

The E 595e Form is legally binding when completed accurately and used appropriately. It is essential for organizations to ensure they qualify for tax exemption under state law. Misuse of the form can lead to penalties, including back taxes and fines. Therefore, understanding the legal implications of using this form is crucial for maintaining compliance with tax regulations.

Who Issues the Form

The E 595e Form is typically issued by state tax authorities. Each state may have its own version of the form, tailored to its specific tax laws and regulations. It is important for organizations to obtain the correct version from their respective state’s tax department to ensure validity.

Form Submission Methods

The E 595e Form can be submitted in various ways, depending on the seller's policies and state regulations. Common submission methods include:

- Presenting a physical copy of the completed form at the point of sale.

- Submitting the form electronically, if the seller accepts digital documentation.

- Mailing the form to the seller for record-keeping purposes.

Always check with the seller regarding their preferred submission method to ensure compliance.

Quick guide on how to complete e 595e 2009 form

Effortlessly Prepare E 595e Form on Any Device

Digital document management has gained immense popularity among businesses and individuals. It serves as a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and efficiently. Manage E 595e Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Method to Edit and eSign E 595e Form with Ease

- Locate E 595e Form and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details, then click the Done button to preserve your changes.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you select. Modify and eSign E 595e Form to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct e 595e 2009 form

Create this form in 5 minutes!

How to create an eSignature for the e 595e 2009 form

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the E 595e Form and why is it important?

The E 595e Form is a crucial document for businesses that want to claim tax exemptions on certain purchases in the state of New York. By completing the E 595e Form, organizations can ensure they comply with state regulations and maintain their financial integrity. It's essential for businesses looking to manage their expenses effectively.

-

How can airSlate SignNow help me with the E 595e Form?

airSlate SignNow simplifies the process of completing and eSigning the E 595e Form by providing an intuitive platform for document management. With our tool, you can easily upload, fill out, and send the E 595e Form electronically without the hassle of dealing with paper. This enhances efficiency and reduces turnaround time.

-

Is airSlate SignNow a cost-effective solution for managing the E 595e Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, making it a cost-effective solution for managing the E 595e Form. With our plans, you can access features designed to streamline document signing processes while saving both time and money. Investing in our solution can lead to long-term savings for your business.

-

What features of airSlate SignNow are beneficial for working with the E 595e Form?

airSlate SignNow comes with features that include eSignature capabilities, document templates, and real-time tracking, which are particularly beneficial when dealing with the E 595e Form. These features ensure your document is not only signed quickly but also managed efficiently, reducing errors and enhancing compliance. You'll maintain control throughout the signing process.

-

Can I integrate airSlate SignNow with other applications while handling the E 595e Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing for a smooth workflow when managing the E 595e Form. You can connect it with platforms such as Google Drive, Dropbox, and more, making it easy to store and share your documents securely. This integration streamlines the process and enhances collaboration.

-

What are the benefits of using airSlate SignNow for the E 595e Form?

Using airSlate SignNow for the E 595e Form offers several benefits including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning, ensuring that all necessary parties can sign the document from anywhere, at any time. Our solution helps you stay organized and compliant, making documentation hassle-free.

-

Is airSlate SignNow user-friendly for new users managing the E 595e Form?

Yes, airSlate SignNow is designed to be user-friendly, even for those unfamiliar with handling documents like the E 595e Form. Our platform includes step-by-step guidance, making it easy for anyone to navigate and complete the form electronically. You'll find that our interface helps streamline your workflow without steep learning curves.

Get more for E 595e Form

Find out other E 595e Form

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed