Nc 4 Form 2019

What is the Nc 4 Form

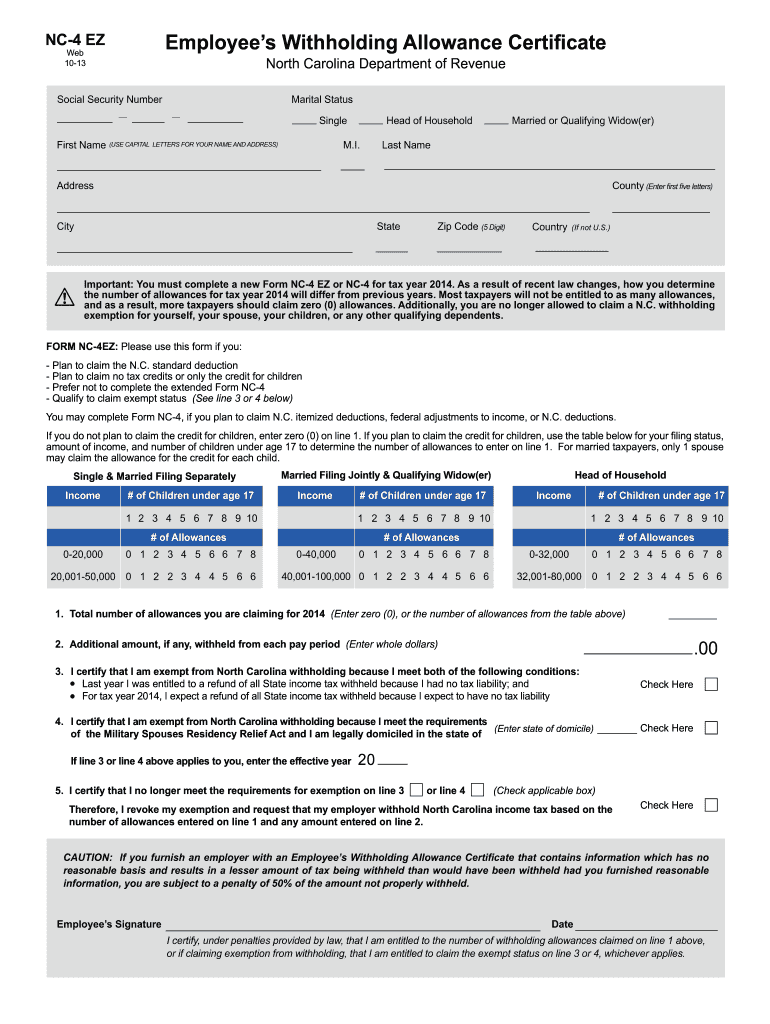

The Nc 4 Form is a North Carolina state tax form used by employees to determine the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of taxes is withheld based on an individual's specific tax situation, including their filing status, number of allowances, and additional withholding preferences. By accurately completing the Nc 4 Form, employees can help avoid under-withholding, which may lead to tax liabilities at the end of the year.

How to use the Nc 4 Form

Using the Nc 4 Form involves several straightforward steps. First, individuals must gather information regarding their personal tax situation, including their filing status and the number of allowances they wish to claim. Next, they should complete the form by filling in the required fields, ensuring all information is accurate. After completing the form, it should be submitted to the employer, who will use it to adjust the state income tax withholding accordingly. It is advisable to review the form periodically, especially after any significant life changes, to ensure the withholding remains appropriate.

Steps to complete the Nc 4 Form

Completing the Nc 4 Form requires careful attention to detail. Here are the steps to follow:

- Obtain a copy of the Nc 4 Form from the North Carolina Department of Revenue website or your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status by selecting the appropriate box (single, married, etc.).

- Determine the number of allowances you wish to claim based on your tax situation.

- If applicable, specify any additional amount you want withheld from each paycheck.

- Review the completed form for accuracy and sign it.

- Submit the form to your employer for processing.

Legal use of the Nc 4 Form

The Nc 4 Form is legally binding once it is completed and submitted to an employer. It serves as the official document that dictates how much state income tax will be withheld from an employee's paycheck. Employers are required to adhere to the information provided on the form to ensure compliance with North Carolina tax laws. It is important for employees to understand that submitting an incorrect form or failing to update it when necessary can lead to legal repercussions, including penalties for underpayment of taxes.

Key elements of the Nc 4 Form

Several key elements are essential for the proper completion of the Nc 4 Form:

- Personal Information: Name, address, and Social Security number are required to identify the taxpayer.

- Filing Status: This indicates whether the taxpayer is single, married, or head of household.

- Allowances: The number of allowances affects the amount withheld; more allowances typically result in less tax withheld.

- Additional Withholding: Taxpayers can specify an additional amount to be withheld if they expect to owe more taxes.

Form Submission Methods

The Nc 4 Form can be submitted in several ways, depending on the employer's preferences. Common methods include:

- In-Person: Employees may deliver the completed form directly to their employer's payroll department.

- Mail: Some employers may allow submission via postal service, though this is less common.

- Electronic Submission: Employers may offer a digital platform for submitting the Nc 4 Form, streamlining the process.

Quick guide on how to complete 2013 nc 4 form

Prepare Nc 4 Form effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers a viable eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely archive it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Nc 4 Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign Nc 4 Form without hassle

- Find Nc 4 Form and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Craft your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Nc 4 Form while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 nc 4 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 nc 4 form

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Nc 4 Form and why do I need it?

The Nc 4 Form is used by employees in North Carolina to claim withholding allowances for state income tax. It helps ensure that the correct amount of tax is deducted from your paycheck. Using the Nc 4 Form is important for accurate tax payments and can help you manage your state tax liability effectively.

-

How can airSlate SignNow help me with the Nc 4 Form?

airSlate SignNow simplifies the process of filling out and signing the Nc 4 Form electronically. Our platform allows you to complete the form easily, ensuring accuracy and professionalism. Additionally, our eSignature feature helps speed up the submission process.

-

What are the costs associated with using airSlate SignNow for the Nc 4 Form?

airSlate SignNow offers flexible pricing plans, starting from a basic package that is affordable for small businesses. Each plan includes features that assist with document management, including the Nc 4 Form. Check our website for specific pricing details tailored to your needs.

-

Are there any features unique to handling the Nc 4 Form on airSlate SignNow?

Yes, airSlate SignNow provides unique features specifically designed for handling the Nc 4 Form. You can fill, sign, and send the form securely, track its status, and store it in the cloud for easy access. This ensures compliance and organization for your tax documents.

-

Can I integrate airSlate SignNow with other applications to manage the Nc 4 Form?

Absolutely! airSlate SignNow offers seamless integrations with various popular applications like Google Workspace, Microsoft 365, and more. These integrations streamline your workflow for managing the Nc 4 Form, making it easier to collaborate and share documents with your team.

-

What are the benefits of eSigning the Nc 4 Form with airSlate SignNow?

eSigning the Nc 4 Form with airSlate SignNow enhances efficiency and security. It eliminates the need for printing and scanning, reducing delays in processing. Plus, our secure signing process ensures that your personal information remains confidential.

-

Is airSlate SignNow compliant with North Carolina tax regulations for the Nc 4 Form?

Yes, airSlate SignNow is fully compliant with North Carolina tax regulations pertaining to the Nc 4 Form. Our solution adheres to legal standards for electronic signatures, ensuring that your submissions are valid. You can trust us with your tax-related documents.

Get more for Nc 4 Form

Find out other Nc 4 Form

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later