D 400 Form 2019

What is the D 400 Form

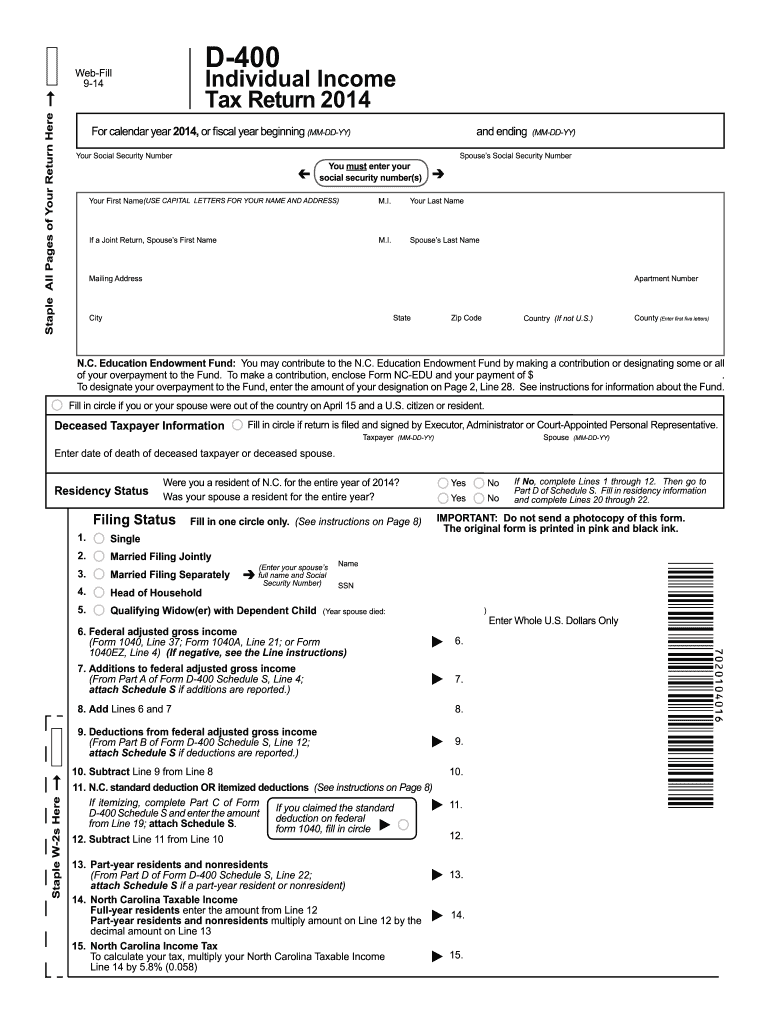

The D 400 Form is a crucial document used primarily for tax purposes in the United States. It is often associated with the filing of state income tax returns. This form allows taxpayers to report their income, claim deductions, and calculate their tax liability. Understanding the D 400 Form is essential for ensuring compliance with state tax laws and for maximizing potential refunds or minimizing liabilities.

How to use the D 400 Form

Using the D 400 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any receipts for deductible expenses. Next, carefully fill out the form, providing personal information, income details, and applicable deductions. It is important to follow the instructions provided with the form to avoid errors that could delay processing. Once completed, the form can be submitted electronically or via mail, depending on state guidelines.

Steps to complete the D 400 Form

Completing the D 400 Form requires attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, such as income statements and deduction receipts.

- Fill out personal information accurately, including name, address, and Social Security number.

- Report all sources of income, ensuring that all figures are correct and match your documentation.

- Claim any deductions or credits that apply to your situation, following the guidelines provided.

- Review the completed form for accuracy before submission.

Legal use of the D 400 Form

The D 400 Form is legally binding when completed and submitted according to state regulations. It is essential to provide truthful and accurate information, as any discrepancies can lead to penalties or audits. The form must be signed and dated, affirming that the information provided is correct to the best of the taxpayer's knowledge. Compliance with all legal requirements ensures that the form is accepted by state tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the D 400 Form vary by state but generally align with the federal tax filing deadline. Typically, taxpayers must submit their forms by April 15th of each year. However, some states may allow for extensions or have different due dates. It is important to check the specific deadlines for your state to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The D 400 Form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online: Many states offer electronic filing options, allowing taxpayers to submit their forms via secure online portals.

- Mail: Taxpayers can print the completed form and send it to the appropriate state tax office via postal service.

- In-Person: Some states allow for in-person submissions at designated tax offices, providing an opportunity for immediate assistance.

Quick guide on how to complete 2014 d 400 form

Effortlessly Prepare D 400 Form on Any Device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and without delays. Handle D 400 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign D 400 Form with Ease

- Locate D 400 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant sections of your documents or obscure sensitive details using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign D 400 Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 d 400 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 d 400 form

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the D 400 Form?

The D 400 Form is a crucial document used for tax purposes, specifically in the context of state income tax. It serves to report income details and calculate tax liabilities. Understanding how to properly fill out the D 400 Form can help ensure compliance and optimize your tax filings.

-

How can airSlate SignNow help with the D 400 Form?

airSlate SignNow allows users to effortlessly create, send, and eSign the D 400 Form online. With its intuitive interface, you can streamline the filing process, making it easier to manage and submit your tax documents securely. This saves time and reduces the risk of errors often associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for the D 400 Form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs, which include features for handling the D 400 Form. Pricing is designed to be affordable and provides excellent value for the functionality it offers. You can choose a plan that fits your specific requirements and budget.

-

What features does airSlate SignNow provide for managing the D 400 Form?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure eSignature capabilities specifically for the D 400 Form. Users can also track the status of their documents, ensuring that each form is processed efficiently. These features help simplify tax-related tasks and improve productivity.

-

Can I integrate airSlate SignNow with other tools to manage the D 400 Form?

Absolutely! airSlate SignNow easily integrates with various third-party applications, streamlining your workflow when managing the D 400 Form. Popular integrations include CRM systems, cloud storage services, and accounting software, enhancing your overall productivity and document management process.

-

What are the benefits of using airSlate SignNow for eSigning the D 400 Form?

Using airSlate SignNow for eSigning the D 400 Form offers several benefits, including enhanced efficiency and security. You can sign documents from any device, reducing the turnaround time for tax submissions. Additionally, built-in security features ensure that your sensitive information remains protected throughout the signing process.

-

Is it easy to get started with airSlate SignNow for the D 400 Form?

Yes, getting started with airSlate SignNow for the D 400 Form is a straightforward process. Once you create an account, you can access templates and begin customizing your forms immediately. The user-friendly platform provides guidance and support, making it accessible even for those without prior experience.

Get more for D 400 Form

- Multiplication x0x1x2x3and x4 paper to print form

- Workplace safety insurance board form 0793a

- National insurance satisfaction voucher 25989586 form

- Handrub form

- Form 720ext

- Construction bid proposal template pdf p1 docs engine com form

- Certified pod trainer reimbursement form omnipod

- Nysdhcr ra lr1 form

Find out other D 400 Form

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online