NC DoR D 400 Form 2022

What is the NC DoR D 400 Form

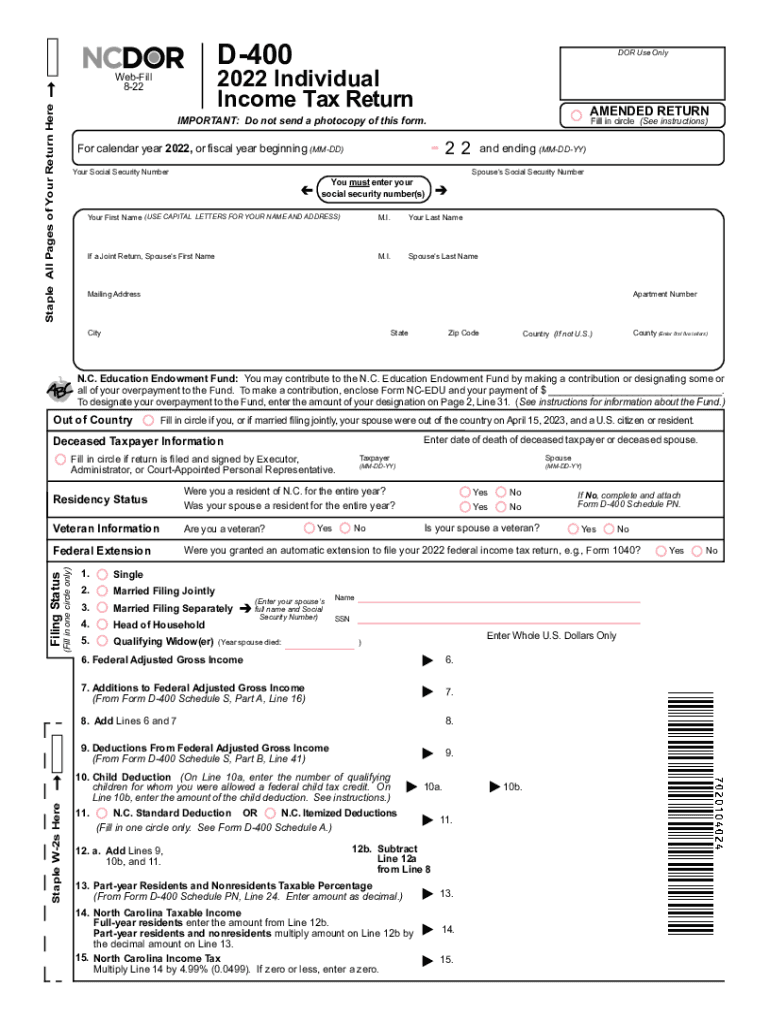

The NC DoR D 400 Form is the official North Carolina state income tax return form used by residents to report their income and calculate their tax liability. This form is essential for individuals who earn income within the state and need to comply with state tax regulations. The D 400 form captures various income sources, deductions, and credits to determine the final tax amount owed or the refund due. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with North Carolina tax laws.

Steps to complete the NC DoR D 400 Form

Completing the NC DoR D 400 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2s, 1099s, and any relevant receipts for deductions. Next, follow these steps:

- Begin by filling out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include wages, interest, and dividends.

- Claim any deductions and credits you are eligible for, which may include standard deductions or itemized deductions.

- Calculate your total tax liability based on the income reported and the deductions claimed.

- Sign and date the form to certify that all information is accurate and complete.

Once completed, the form can be submitted electronically or via mail, depending on your preference.

Legal use of the NC DoR D 400 Form

The NC DoR D 400 Form is legally binding when filled out and submitted according to North Carolina tax laws. To ensure its legal standing, it is essential to provide accurate information and adhere to all filing requirements. Electronic signatures, when used, must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. This legal framework supports the validity of e-signed documents, making them enforceable in court. Therefore, using a trusted eSignature solution can enhance the form's legal compliance.

Form Submission Methods

The NC DoR D 400 Form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file online through the North Carolina Department of Revenue's website, which offers a streamlined process. Alternatively, the form can be printed and mailed to the appropriate address, ensuring that it is postmarked by the filing deadline. In-person submissions may also be possible at designated tax offices, providing another avenue for taxpayers who prefer face-to-face assistance.

Filing Deadlines / Important Dates

Filing deadlines for the NC DoR D 400 Form are crucial for taxpayers to avoid penalties. Generally, the form must be filed by April 15 of the following year, aligning with federal tax deadlines. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates, as they can affect tax planning and compliance. Marking these deadlines on your calendar can help ensure timely submission.

Required Documents

To accurately complete the NC DoR D 400 Form, taxpayers need to gather several essential documents. These typically include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Receipts for deductible expenses, including medical costs and charitable contributions.

Having these documents readily available will facilitate a smoother and more accurate filing process.

Quick guide on how to complete nc dor d 400 form

Complete NC DoR D 400 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, amend, and electronically sign your documents swiftly without delays. Handle NC DoR D 400 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to amend and electronically sign NC DoR D 400 Form with ease

- Obtain NC DoR D 400 Form and select Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Amend and electronically sign NC DoR D 400 Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nc dor d 400 form

Create this form in 5 minutes!

How to create an eSignature for the nc dor d 400 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 form d 400?

The 2022 form d 400 is a tax form used to report certain financial activities and obligations. It is essential for individuals and businesses to accurately complete this form to avoid penalties. Understanding this form is crucial for compliance with tax regulations.

-

How can airSlate SignNow help with the 2022 form d 400?

airSlate SignNow simplifies the process of preparing and signing the 2022 form d 400 by allowing users to create, edit, and e-sign documents online. With its intuitive interface, you can ensure that all required fields are filled out correctly before submission. This saves time and reduces errors associated with traditional paperwork.

-

Is airSlate SignNow affordable for small businesses needing the 2022 form d 400?

Yes, airSlate SignNow offers a range of pricing plans that cater to the needs of small businesses. Our cost-effective solution provides access to essential features for completing the 2022 form d 400 without breaking the bank. You can choose a plan that suits your budget and requirements.

-

What features does airSlate SignNow provide for the 2022 form d 400?

With airSlate SignNow, you get features such as document templates, automated workflows, and real-time tracking for the 2022 form d 400. These tools streamline the signing process and ensure that your documents are securely stored. This enhances efficiency and helps you manage your paperwork effortlessly.

-

Can I integrate airSlate SignNow with other tools for the 2022 form d 400?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to connect your workflow tools. This means you can easily manage your 2022 form d 400 alongside your other business processes, enhancing collaboration and productivity.

-

What are the benefits of using airSlate SignNow for the 2022 form d 400?

Using airSlate SignNow for the 2022 form d 400 provides numerous benefits, including increased efficiency, reduced errors, and faster turnaround times. You can e-sign documents from anywhere, which means you’re not tied to your desk. Additionally, our platform ensures that your documents are secure and compliant with current regulations.

-

How does airSlate SignNow ensure security for the 2022 form d 400?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and security protocols to protect your data when handling the 2022 form d 400. This ensures that your sensitive information remains confidential and is only accessible to authorized users.

Get more for NC DoR D 400 Form

- Stanford application form pdf

- Ys 1 supplemental application form

- Atomic habits contract form

- Instrument check out form

- Argosy university transcripts form

- Printable blank printable spectrum noir color chart form

- Montessori assessment checklist form

- Objection to petition to relocate with minor children form

Find out other NC DoR D 400 Form

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online