Nc Form Tax 2019

What is the Nc Form Tax

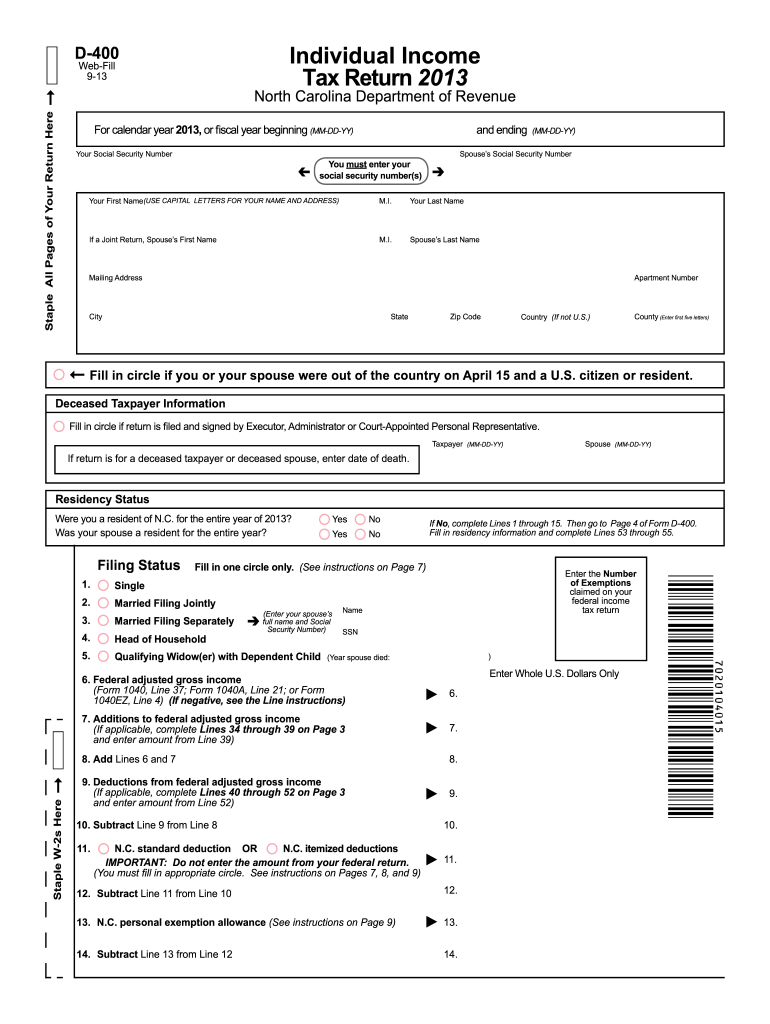

The Nc Form Tax is a crucial document used for reporting income and calculating tax liabilities in North Carolina. It is primarily utilized by individuals and businesses to ensure compliance with state tax regulations. This form collects essential information regarding income sources, deductions, and credits, allowing the North Carolina Department of Revenue to assess tax obligations accurately. Understanding the purpose and requirements of the Nc Form Tax is vital for all taxpayers in the state.

How to use the Nc Form Tax

Using the Nc Form Tax involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Next, fill out the form carefully, ensuring that all information is accurate and complete. Pay special attention to sections related to income, deductions, and credits. After completing the form, review it for any errors before submission. Finally, submit the form by the designated deadline, either electronically or by mail, to avoid any penalties.

Steps to complete the Nc Form Tax

Completing the Nc Form Tax requires a systematic approach to ensure all information is accurately reported. Here are the steps to follow:

- Gather all necessary documents, including income statements and receipts.

- Start filling out the form by entering personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and interest.

- Include any applicable deductions, such as mortgage interest, medical expenses, and charitable contributions.

- Calculate your total tax liability using the provided tax tables or software tools.

- Review the completed form for accuracy before submission.

Legal use of the Nc Form Tax

The Nc Form Tax is legally binding when completed and submitted correctly. To ensure its legal validity, taxpayers must adhere to state regulations regarding eSignature laws and document submission. Electronic submissions are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Using a reliable eSignature platform can enhance the legal standing of the form by providing a secure and verifiable signature.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is essential for avoiding penalties associated with the Nc Form Tax. Typically, the deadline for individual tax returns is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be aware of any extensions that may apply for filing or payment. Keeping track of these dates ensures that all tax obligations are met in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The Nc Form Tax can be submitted through various methods to accommodate different preferences. Taxpayers can file online using approved e-filing software, which often simplifies the process and reduces errors. Alternatively, the form can be mailed to the North Carolina Department of Revenue, ensuring that it is postmarked by the filing deadline. For those who prefer in-person submission, visits to local tax offices are also an option. Each method has its advantages, so choosing the one that best fits your needs is important.

Quick guide on how to complete 2013 nc form tax

Complete Nc Form Tax seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without complications. Manage Nc Form Tax on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Nc Form Tax effortlessly

- Locate Nc Form Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in a few clicks from your preferred device. Edit and eSign Nc Form Tax and assure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 nc form tax

Create this form in 5 minutes!

How to create an eSignature for the 2013 nc form tax

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the Nc Form Tax and why is it important?

The Nc Form Tax is a vital document for individuals and businesses in North Carolina that outlines tax obligations and information. Understanding its requirements is necessary to ensure compliance with state tax laws and to avoid potential penalties.

-

How does airSlate SignNow simplify the Nc Form Tax signing process?

airSlate SignNow simplifies the Nc Form Tax signing process by providing an intuitive platform for electronic signatures. Users can easily upload, edit, and eSign their tax forms, ensuring a fast and secure completion of their tax documents.

-

What are the pricing options for using airSlate SignNow for Nc Form Tax?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Our subscription options include access to features that enhance your ability to handle the Nc Form Tax, ensuring that you get value for your investment.

-

Can I integrate airSlate SignNow with other tax tools for managing the Nc Form Tax?

Yes, airSlate SignNow offers seamless integrations with various tax software and tools. This capability allows users to efficiently manage their Nc Form Tax along with other financial documents, streamlining their workflow.

-

Is it safe to use airSlate SignNow for Nc Form Tax documents?

Absolutely! airSlate SignNow employs robust security measures to protect your Nc Form Tax documents. With features like encryption and secure cloud storage, you can be confident that your information remains safe and confidential.

-

What features does airSlate SignNow offer for Nc Form Tax management?

AirSlate SignNow provides various features for effective Nc Form Tax management, including customizable templates, bulk sending options, and real-time tracking of document status. These tools help optimize the handling of your tax documents.

-

Can I use airSlate SignNow for business Nc Form Tax filings?

Yes, airSlate SignNow is fully equipped to assist businesses with their Nc Form Tax filings. The platform's capabilities allow for easy document management and eSigning, making it a convenient choice for corporate tax documentation.

Get more for Nc Form Tax

- Urs admission form

- Chuck schumer privacy release form

- Idaho release of interest 17682094 form

- Binary ionic and molecular compounds worksheet a side 1 form

- Sdpd ride along form

- Sbi home loan disbursement form pdf

- High school recommendation form lane college

- Failure by an owner to attach a copy of this rider to the tenants form

Find out other Nc Form Tax

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer