CBT 100 New Jersey Corporation Business Tax Return NJ Gov 2018

What is the CBT 100 New Jersey Corporation Business Tax Return NJ gov

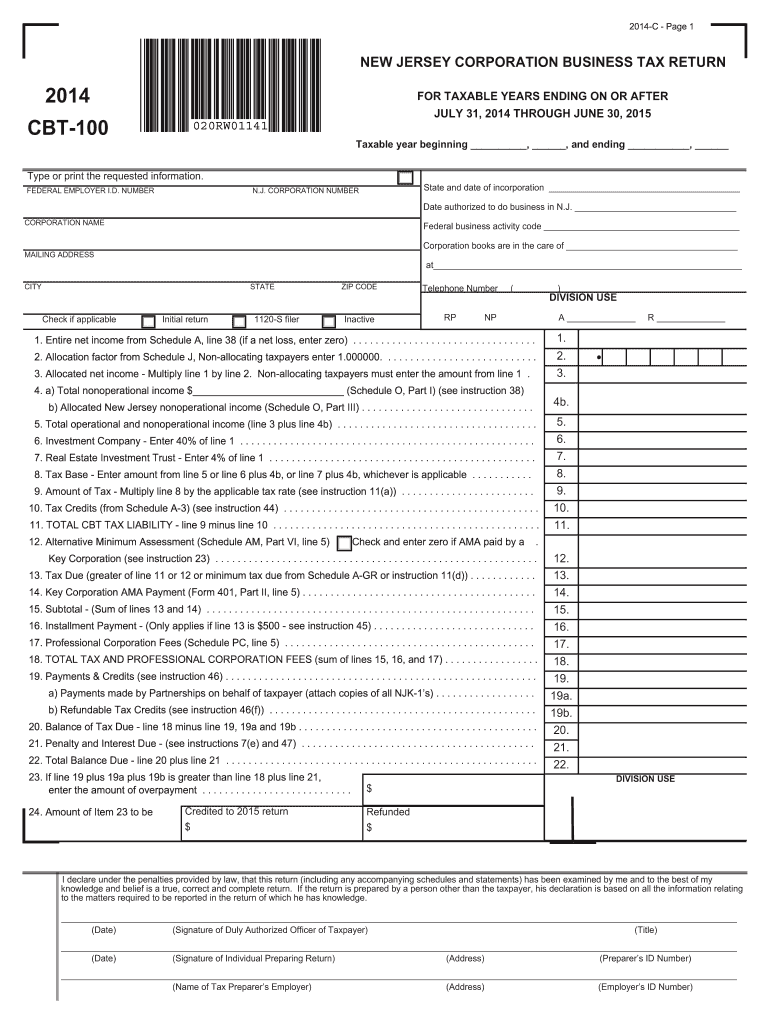

The CBT 100 New Jersey Corporation Business Tax Return is a crucial document for corporations operating in New Jersey. This form is used to report income, calculate tax liability, and ensure compliance with state tax regulations. Corporations must file this return annually to disclose their financial activities and pay the appropriate taxes owed to the state. The form captures essential information, including gross income, deductions, and credits, which are vital for determining the corporation's tax obligations.

Steps to complete the CBT 100 New Jersey Corporation Business Tax Return NJ gov

Completing the CBT 100 requires careful attention to detail. Here are the essential steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the required sections of the form, ensuring all income and deductions are accurately reported.

- Calculate the total tax liability based on the provided instructions.

- Review the form for accuracy and completeness before submission.

- Sign and date the form, ensuring compliance with signature requirements.

Legal use of the CBT 100 New Jersey Corporation Business Tax Return NJ gov

The CBT 100 form is legally binding when completed and submitted according to New Jersey's tax laws. To ensure its validity, corporations must adhere to specific guidelines regarding signatures and documentation. Electronic submissions are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. Proper execution of this form is essential for maintaining compliance and avoiding penalties.

Filing Deadlines / Important Dates

Corporations must be aware of key deadlines associated with the CBT 100 filing process. Typically, the return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April 15. It is crucial to file on time to avoid late fees and interest charges.

Required Documents

To complete the CBT 100, corporations need several supporting documents, including:

- Income statements detailing revenue and expenses.

- Balance sheets reflecting the corporation's financial position.

- Documentation for any deductions or credits claimed.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The CBT 100 can be submitted through multiple channels, providing flexibility for corporations. Options include:

- Online submission via the New Jersey Division of Taxation's website.

- Mailing a paper copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if necessary.

Penalties for Non-Compliance

Failure to file the CBT 100 on time or inaccuracies in the form can lead to significant penalties. These may include:

- Late filing fees that accumulate over time.

- Interest on unpaid taxes.

- Potential audits or further scrutiny from tax authorities.

Quick guide on how to complete cbt 100 new jersey corporation business tax return njgov

Complete CBT 100 New Jersey Corporation Business Tax Return NJ gov effortlessly on any device

Managing documents online has become increasingly popular among enterprises and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Oversee CBT 100 New Jersey Corporation Business Tax Return NJ gov on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to alter and eSign CBT 100 New Jersey Corporation Business Tax Return NJ gov seamlessly

- Find CBT 100 New Jersey Corporation Business Tax Return NJ gov and click on Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign CBT 100 New Jersey Corporation Business Tax Return NJ gov and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cbt 100 new jersey corporation business tax return njgov

Create this form in 5 minutes!

How to create an eSignature for the cbt 100 new jersey corporation business tax return njgov

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the CBT 100 New Jersey Corporation Business Tax Return NJ gov?

The CBT 100 New Jersey Corporation Business Tax Return NJ gov is a tax form required for corporations operating in New Jersey to report their income and calculate taxes owed. It is essential for compliance with state tax regulations and helps determine the corporation's taxable income.

-

How can airSlate SignNow assist with the CBT 100 New Jersey Corporation Business Tax Return NJ gov?

airSlate SignNow provides an efficient platform to prepare, sign, and submit your CBT 100 New Jersey Corporation Business Tax Return NJ gov. Our user-friendly interface streamlines the process, ensuring that all necessary documents are easily accessible for timely filing.

-

What are the pricing options for using airSlate SignNow for the CBT 100 New Jersey Corporation Business Tax Return NJ gov?

airSlate SignNow offers flexible pricing plans designed to fit various business needs. You can choose a subscription model that allows unlimited access to eSigning and document management tools, which is particularly beneficial for managing your CBT 100 New Jersey Corporation Business Tax Return NJ gov.

-

Are there any features specifically designed for the CBT 100 New Jersey Corporation Business Tax Return NJ gov?

Yes, airSlate SignNow includes features tailored for the CBT 100 New Jersey Corporation Business Tax Return NJ gov, such as customizable templates, automated reminders, and secure storage. These tools help ensure that your tax documents are completed accurately and submitted on time.

-

What are the benefits of using airSlate SignNow for tax document management?

By using airSlate SignNow for your tax document management, including the CBT 100 New Jersey Corporation Business Tax Return NJ gov, businesses can save time, reduce errors, and enhance collaboration. The electronic signing feature allows for quick approvals, making your tax processes more efficient.

-

Can airSlate SignNow integrate with accounting software when filing the CBT 100 New Jersey Corporation Business Tax Return NJ gov?

Yes, airSlate SignNow offers integrations with various accounting software solutions that can simplify the process of filing the CBT 100 New Jersey Corporation Business Tax Return NJ gov. This integration allows for seamless data transfer, ensuring your tax filings are accurate and comprehensive.

-

What security measures does airSlate SignNow implement for the CBT 100 New Jersey Corporation Business Tax Return NJ gov?

airSlate SignNow takes security seriously, employing encryption and secure data storage to protect your CBT 100 New Jersey Corporation Business Tax Return NJ gov documents. Our platform also includes audit trails and compliance features to ensure that your sensitive information remains secure.

Get more for CBT 100 New Jersey Corporation Business Tax Return NJ gov

Find out other CBT 100 New Jersey Corporation Business Tax Return NJ gov

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe