DOR Business Tax Registration Wisconsin Department of Revenue 2020

What is the DOR Business Tax Registration Wisconsin Department Of Revenue

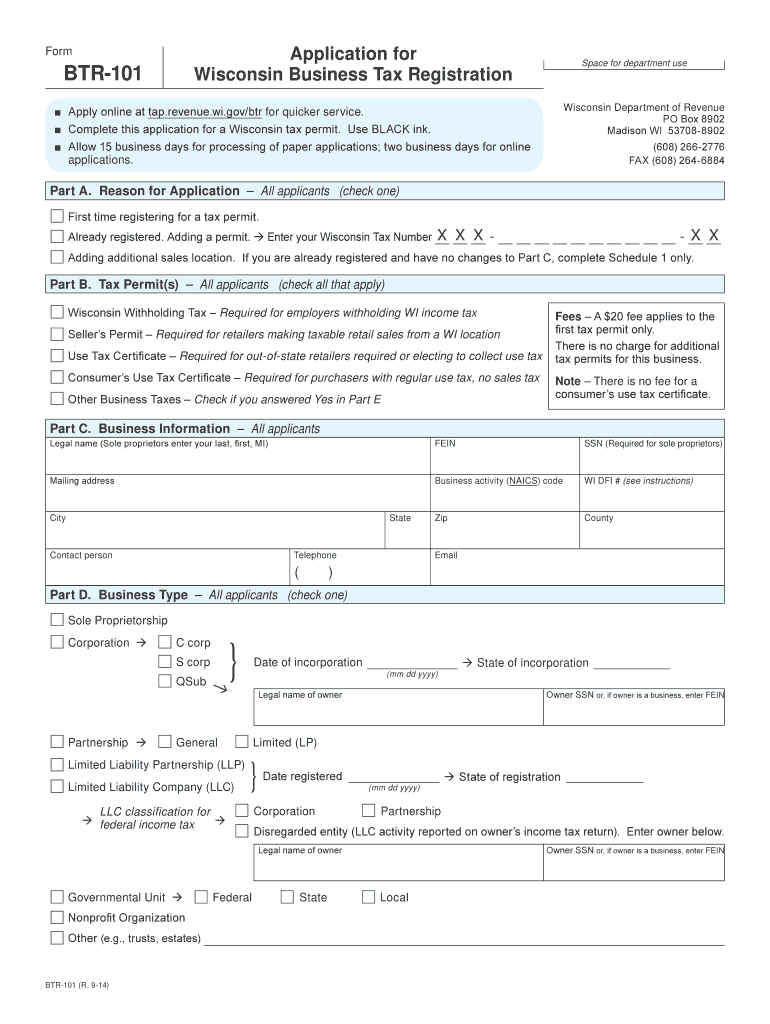

The DOR Business Tax Registration form is a crucial document required by the Wisconsin Department of Revenue for businesses operating within the state. This registration is necessary for obtaining various tax identification numbers, which are essential for compliance with state tax laws. The form collects vital information about the business, including its legal structure, ownership details, and the types of taxes the business will be liable for, such as sales tax or income tax. Proper completion and submission of this form ensure that businesses can operate legally and fulfill their tax obligations in Wisconsin.

Steps to complete the DOR Business Tax Registration Wisconsin Department Of Revenue

Completing the DOR Business Tax Registration involves several important steps. First, gather all necessary information about your business, including its legal name, address, and ownership structure. Next, determine the types of taxes your business will be responsible for, such as sales tax or employer withholding tax. After preparing this information, you can access the form online or request a paper version. Fill out the form accurately, ensuring all required fields are completed. Once finished, submit the form either electronically through the Wisconsin Department of Revenue's online portal or by mailing it to the appropriate address. Keep a copy for your records to ensure compliance and for future reference.

How to use the DOR Business Tax Registration Wisconsin Department Of Revenue

The DOR Business Tax Registration is used to officially register your business with the Wisconsin Department of Revenue. This registration enables your business to obtain necessary tax identification numbers, which are essential for tax reporting and compliance. After completing the registration, you will receive a confirmation from the department, which may include your tax ID numbers. These numbers are crucial for filing taxes, collecting sales tax from customers, and fulfilling other tax obligations. It is important to keep this information secure and accessible for future tax filings and audits.

Required Documents for the DOR Business Tax Registration Wisconsin Department Of Revenue

When preparing to complete the DOR Business Tax Registration, certain documents are necessary to support your application. These may include your business formation documents, such as Articles of Incorporation or Organization, proof of your business address, and identification for the business owners or partners. If applicable, you may also need to provide a federal Employer Identification Number (EIN) issued by the IRS. Having these documents ready will facilitate a smoother registration process and help ensure that your application is processed without delays.

Form Submission Methods for the DOR Business Tax Registration Wisconsin Department Of Revenue

The DOR Business Tax Registration can be submitted through various methods, providing flexibility for business owners. The primary method is online submission through the Wisconsin Department of Revenue's official website, which allows for immediate processing. Alternatively, businesses can choose to print the completed form and mail it to the designated address provided by the department. In some cases, in-person submissions may also be possible at local Department of Revenue offices. Each method has its own processing times, so it is advisable to choose the one that best fits your needs and timeline.

Penalties for Non-Compliance with the DOR Business Tax Registration Wisconsin Department Of Revenue

Failure to complete the DOR Business Tax Registration can result in significant penalties for businesses operating in Wisconsin. Non-compliance may lead to fines, interest on unpaid taxes, and potential legal action from the state. Additionally, businesses may be unable to obtain necessary permits or licenses, which can hinder operations. It is essential for business owners to prioritize timely registration and compliance to avoid these consequences and ensure smooth business operations within the state.

Quick guide on how to complete dor business tax registration wisconsin department of revenue

Complete DOR Business Tax Registration Wisconsin Department Of Revenue effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage DOR Business Tax Registration Wisconsin Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest method to alter and eSign DOR Business Tax Registration Wisconsin Department Of Revenue without any hassle

- Locate DOR Business Tax Registration Wisconsin Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether through email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign DOR Business Tax Registration Wisconsin Department Of Revenue and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor business tax registration wisconsin department of revenue

Create this form in 5 minutes!

How to create an eSignature for the dor business tax registration wisconsin department of revenue

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is DOR Business Tax Registration with the Wisconsin Department of Revenue?

DOR Business Tax Registration with the Wisconsin Department of Revenue is a mandatory process for businesses operating in Wisconsin, ensuring compliance with state tax regulations. It involves registering for various taxes such as sales tax, income tax, and employer withholding tax. This registration is crucial for legal operation and can be completed online through the state website.

-

How do I complete the DOR Business Tax Registration with the Wisconsin Department of Revenue?

To complete the DOR Business Tax Registration with the Wisconsin Department of Revenue, visit the Wisconsin Department of Revenue's official website. You can fill out the registration application online. Make sure to have all necessary information about your business, including legal structure and federal Employer Identification Number (EIN) at hand.

-

What are the costs associated with DOR Business Tax Registration in Wisconsin?

The DOR Business Tax Registration with the Wisconsin Department of Revenue typically does not have a direct registration fee. However, be aware that certain business taxes, such as sales tax, may require regular payments. It's essential to stay informed about any related tax obligations to avoid potential penalties.

-

What documents are needed for DOR Business Tax Registration with the Wisconsin Department of Revenue?

For DOR Business Tax Registration with the Wisconsin Department of Revenue, you’ll generally need identification documents, your business's legal formation papers, and your federal Employer Identification Number (EIN). Depending on your business type, additional documents may be required, so check the specific requirements on the Wisconsin Department of Revenue website.

-

How long does the DOR Business Tax Registration process take?

The DOR Business Tax Registration with the Wisconsin Department of Revenue can often be completed within a few business days if all necessary documentation is provided. There may be slight delays depending on the volume of applications. It’s advisable to submit your registration as early as possible to ensure compliance.

-

Can I amend my DOR Business Tax Registration with the Wisconsin Department of Revenue?

Yes, businesses can amend their DOR Business Tax Registration with the Wisconsin Department of Revenue. This allows you to update vital information such as address changes or changes in ownership. Ensure that any amendments are submitted promptly to maintain accurate records and avoid potential issues.

-

What are the penalties for not registering for DOR Business Tax in Wisconsin?

Failing to complete the DOR Business Tax Registration with the Wisconsin Department of Revenue can lead to signNow penalties, including fines and back taxes owed. Operating without proper registration can also jeopardize your business license and ability to conduct legal operations in Wisconsin. It's crucial to register on time to avoid these issues.

Get more for DOR Business Tax Registration Wisconsin Department Of Revenue

Find out other DOR Business Tax Registration Wisconsin Department Of Revenue

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free