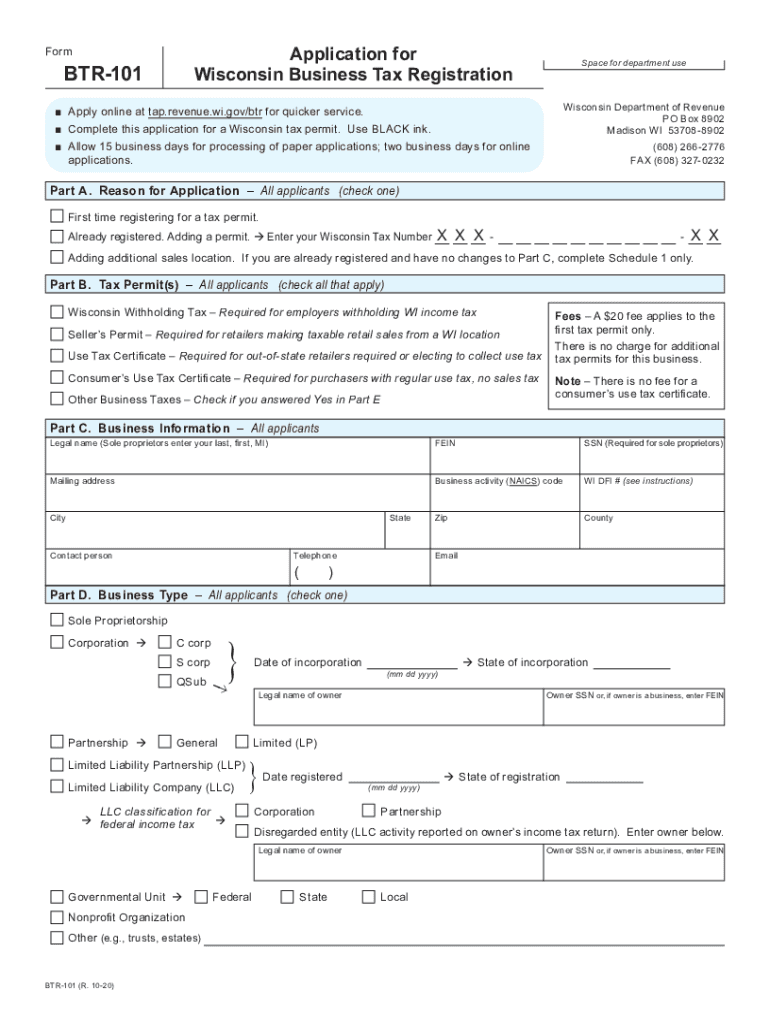

Business Tax Registration Wisconsin Department of Revenue 2020

What is the Business Tax Registration Wisconsin Department Of Revenue

The Business Tax Registration with the Wisconsin Department of Revenue (DOR) is a formal process that businesses must complete to operate legally within the state. This registration is essential for any entity engaging in business activities, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). By registering, businesses obtain a unique identification number that is necessary for tax purposes, allowing them to report and pay state taxes accurately.

Steps to complete the Business Tax Registration Wisconsin Department Of Revenue

Completing the Business Tax Registration involves several key steps:

- Gather necessary information, including your business name, address, and type of entity.

- Determine the specific taxes your business will be subject to, such as sales tax, income tax, or employer withholding tax.

- Access the online registration portal on the Wisconsin DOR website or obtain a paper application form.

- Complete the registration form with accurate details and submit it electronically or by mail.

- Receive confirmation of your registration, along with your business identification number.

Key elements of the Business Tax Registration Wisconsin Department Of Revenue

Several key elements are crucial for the Business Tax Registration:

- Business Identification Number: A unique number assigned to your business for tax purposes.

- Tax Types: Identification of the specific taxes applicable to your business, such as sales tax or income tax.

- Business Structure: Information on the legal structure of your business, whether it is a sole proprietorship, partnership, LLC, or corporation.

- Owner Information: Details about the business owner(s), including names and contact information.

Legal use of the Business Tax Registration Wisconsin Department Of Revenue

The legal use of the Business Tax Registration is vital for compliance with state tax laws. Registered businesses are required to file tax returns and remit taxes owed based on their business activities. Failure to register can lead to penalties, including fines and back taxes. Additionally, having a valid registration helps establish credibility with customers and vendors, as it demonstrates that the business operates within the legal framework set by the state.

Required Documents

To complete the Business Tax Registration, certain documents are typically required:

- Proof of business identity, such as a business license or articles of incorporation.

- Identification for the business owner, such as a driver's license or social security number.

- Any necessary permits or licenses relevant to your specific business type.

Application Process & Approval Time

The application process for the Business Tax Registration is generally straightforward. Once all required information and documents are submitted, the Wisconsin DOR typically processes applications within a few business days. However, processing times may vary based on the volume of applications received. It is advisable to plan ahead and submit your application early to ensure timely registration, especially if you have specific business activities planned.

Quick guide on how to complete business tax registration wisconsin department of revenue

Effortlessly Prepare Business Tax Registration Wisconsin Department Of Revenue on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any hold-ups. Manage Business Tax Registration Wisconsin Department Of Revenue seamlessly on any device using the airSlate SignNow apps for Android or iOS and enhance your document-focused tasks today.

Steps to Edit and eSign Business Tax Registration Wisconsin Department Of Revenue with Ease

- Obtain Business Tax Registration Wisconsin Department Of Revenue and select Get Form to begin.

- Utilize the features we offer to complete your document submission.

- Emphasize important sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details carefully and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and errors that necessitate printing fresh copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Business Tax Registration Wisconsin Department Of Revenue while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business tax registration wisconsin department of revenue

Create this form in 5 minutes!

How to create an eSignature for the business tax registration wisconsin department of revenue

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the form application wi offered by airSlate SignNow?

The form application wi by airSlate SignNow is a user-friendly tool that allows businesses to create, send, and eSign documents electronically. This application streamlines the document management process and enhances productivity by enabling seamless electronic signatures and form submissions.

-

How does pricing work for the form application wi?

airSlate SignNow offers flexible pricing plans for the form application wi, catering to businesses of all sizes. You can choose between monthly or annual subscriptions, and the pricing is competitive, ensuring you get great value for a cost-effective document management solution.

-

What features are included with the form application wi?

The form application wi includes various features such as customizable templates, advanced eSignature options, and real-time notifications. These features allow users to effectively manage their documents, track progress, and ensure secure and compliant transactions.

-

Can the form application wi be integrated with other tools?

Yes, the form application wi can easily integrate with popular third-party applications like Google Drive, Dropbox, and CRM systems. These integrations enhance workflow efficiency and allow users to manage documents from a single interface, making the process more cohesive.

-

What are the benefits of using the form application wi over traditional methods?

Using the form application wi signNowly reduces the time and costs associated with paper-based processes. It increases accuracy and security while providing a more eco-friendly solution by eliminating the need for printing and physical storage of documents.

-

Is the form application wi compliant with legal standards?

Absolutely! The form application wi complies with various electronic signature laws, ensuring that all signed documents are legally binding. This compliance not only protects your business but also instills confidence in your clients when they use electronic signatures.

-

How user-friendly is the form application wi for new users?

The form application wi is designed with an intuitive interface that makes it accessible for users of all skill levels. Comprehensive tutorials and customer support are also available to assist new users in getting started quickly and efficiently.

Get more for Business Tax Registration Wisconsin Department Of Revenue

- Wa llc form

- Wa company 497429244 form

- Wa pllc form

- Renunciation and disclaimer of property received by intestate succession washington form

- Washington notice owner form

- Quitclaim deed from individual to husband and wife washington form

- Warranty deed from individual to husband and wife washington form

- Transfer on death quitclaim deed from individual to individual with alternate beneficiary washington form

Find out other Business Tax Registration Wisconsin Department Of Revenue

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free