Sales and Use Tax Report Wisconsin Department of Revenue 2021-2026

Understanding the Wisconsin Business Tax Registration

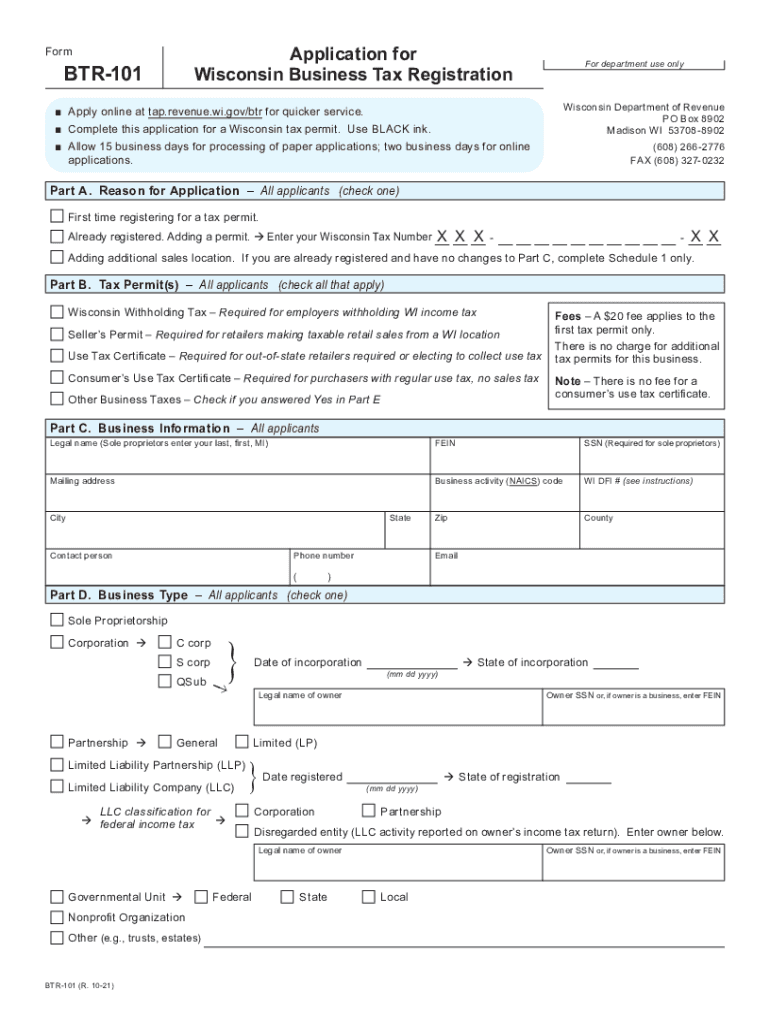

The Wisconsin business tax registration is a crucial step for businesses operating within the state. This registration is necessary for obtaining a Wisconsin business tax registration certificate, which allows businesses to collect and remit sales tax. The registration process ensures compliance with state tax laws and helps maintain accurate tax records.

Businesses must complete the application for Wisconsin business tax registration to receive their certificate. This document is essential for legal operations, as it verifies the business's authority to engage in taxable activities. The Wisconsin Department of Revenue oversees this registration process, providing guidance and resources to assist businesses.

Steps to Complete the Wisconsin Business Tax Registration

Completing the Wisconsin business tax registration involves several key steps:

- Gather necessary information, including your business name, address, and federal Employer Identification Number (EIN).

- Determine the type of business entity, such as LLC, corporation, or partnership, as this affects registration requirements.

- Visit the Wisconsin Department of Revenue website to access the application form, commonly referred to as BTR-101.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form online or by mail, following the specified submission methods outlined by the Department of Revenue.

After submission, businesses will receive confirmation of their registration status. It is important to keep a copy of the registration certificate for future reference.

Required Documents for Registration

When applying for the Wisconsin business tax registration, certain documents are required to ensure a smooth process. These include:

- Federal Employer Identification Number (EIN) or Social Security Number (SSN), depending on the business structure.

- Business formation documents, such as Articles of Incorporation or Organization for LLCs.

- Proof of business address, which may include utility bills or lease agreements.

- Any relevant licenses or permits required for specific business activities.

Having these documents ready can expedite the registration process and help avoid delays.

Form Submission Methods for Wisconsin Business Tax Registration

Businesses have multiple options for submitting the application for Wisconsin business tax registration:

- Online Submission: The most efficient method, allowing for immediate processing and confirmation.

- Mail Submission: Businesses can print the completed BTR-101 form and send it to the Wisconsin Department of Revenue via postal service.

- In-Person Submission: For those who prefer face-to-face interaction, visiting a local Department of Revenue office is an option.

Choosing the right submission method can depend on the business's specific circumstances and preferences.

Penalties for Non-Compliance with Tax Registration

Failing to register for Wisconsin business tax can lead to serious consequences. Businesses that do not comply may face penalties, including:

- Fines for late registration or failure to register.

- Interest on unpaid taxes, which can accumulate over time.

- Legal action from the Wisconsin Department of Revenue, which may include audits or additional scrutiny.

It is essential for businesses to stay informed about their registration status and ensure compliance to avoid these penalties.

Eligibility Criteria for Wisconsin Business Tax Registration

To qualify for Wisconsin business tax registration, certain eligibility criteria must be met. These include:

- The business must be engaged in taxable activities within Wisconsin.

- The applicant must provide accurate information regarding the business structure and ownership.

- Compliance with all state and federal laws governing business operations is required.

Meeting these criteria is critical for a successful registration process and for maintaining good standing with the Wisconsin Department of Revenue.

Quick guide on how to complete sales and use tax report wisconsin department of revenue

Accomplish Sales And Use Tax Report Wisconsin Department Of Revenue seamlessly on any gadget

Online document management has become a favored choice among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any holdups. Handle Sales And Use Tax Report Wisconsin Department Of Revenue on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Sales And Use Tax Report Wisconsin Department Of Revenue effortlessly

- Acquire Sales And Use Tax Report Wisconsin Department Of Revenue and click on Get Form to begin.

- Employ the tools that we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers precisely for that function.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your adjustments.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Sales And Use Tax Report Wisconsin Department Of Revenue to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales and use tax report wisconsin department of revenue

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax report wisconsin department of revenue

The way to create an e-signature for your PDF in the online mode

The way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What is Wisconsin business tax registration?

Wisconsin business tax registration is the process by which businesses operating in Wisconsin register for various state taxes. This typically includes sales tax, income tax withholding, and other applicable taxes. Proper registration ensures compliance with state regulations, helping businesses avoid fines and penalties.

-

How can airSlate SignNow assist with Wisconsin business tax registration?

airSlate SignNow offers an easy-to-use platform for businesses to manage their documents related to Wisconsin business tax registration. With electronic signatures and streamlined workflows, you can prepare and send tax registration forms efficiently. This reduces delays and ensures that your documents are submitted on time.

-

What are the costs associated with Wisconsin business tax registration?

The costs of Wisconsin business tax registration can vary depending on the type of business and the taxes applicable. However, utilizing airSlate SignNow can save you time and money by simplifying the registration process. Our cost-effective solutions ensure that your business meets all tax registration requirements without the burden of extensive paperwork.

-

What documents are needed for Wisconsin business tax registration?

To complete Wisconsin business tax registration, you typically need identification numbers, business formation documents, and relevant tax forms. airSlate SignNow makes it easy to gather and manage these documents digitally. Our platform ensures that all necessary documents are signed and submitted quickly, facilitating a smooth registration process.

-

Is airSlate SignNow compliant with Wisconsin business tax registration regulations?

Yes, airSlate SignNow is designed to comply with Wisconsin business tax registration regulations. We adhere to state laws related to eSigning and document management, providing a trustworthy solution for your tax registration needs. By using our platform, businesses can confidently manage their tax obligations in accordance with Wisconsin regulations.

-

Can I integrate airSlate SignNow with my current accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software tools to assist with Wisconsin business tax registration and other tax-related tasks. This integration allows for a smooth transition of data, making it easier to manage your tax filings alongside your business operations.

-

What features does airSlate SignNow offer to streamline Wisconsin business tax registration?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure cloud storage to streamline Wisconsin business tax registration. These tools help you stay organized and compliant without the complexities of traditional paperwork. By simplifying the process, we ensure your business can focus on growth.

Get more for Sales And Use Tax Report Wisconsin Department Of Revenue

- California completion form

- Quitclaim deed by two individuals to llc california form

- Grant deed 497298343 form

- Enhanced life estate or lady bird quitclaim deed from two individuals or husband and wife to two individuals or husband and form

- Life estate grant form

- Grantor grantees form

- Grant deed from three individuals to an individual california form

- California probate code form

Find out other Sales And Use Tax Report Wisconsin Department Of Revenue

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement