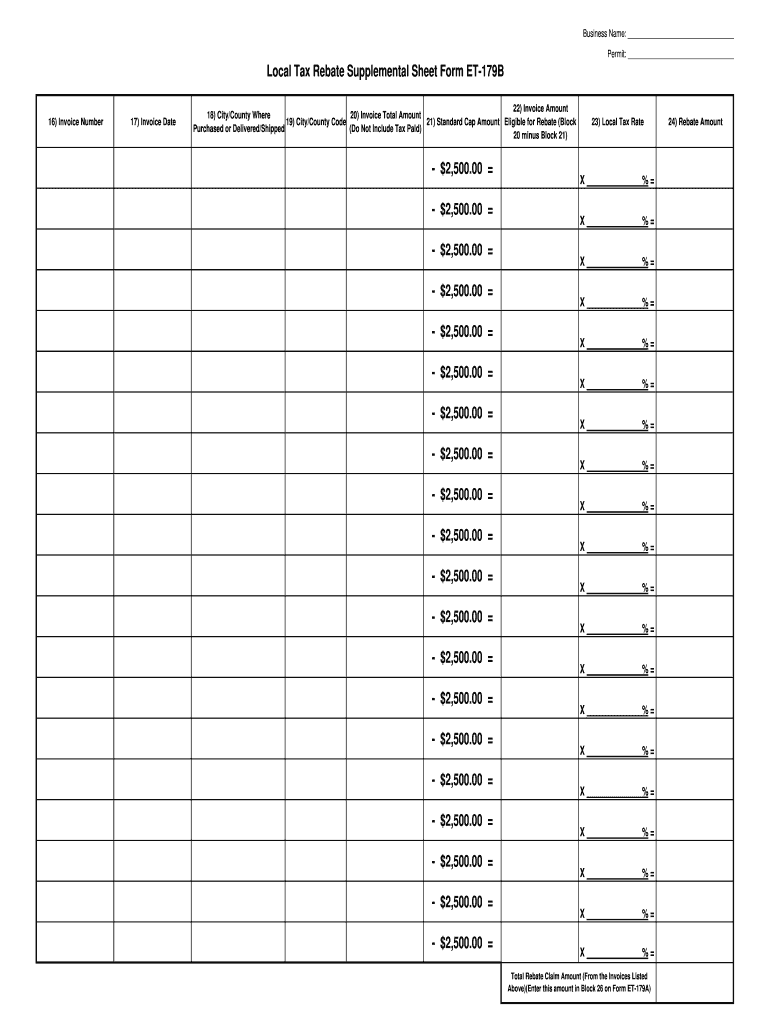

Et 179b Form

What is the ET-179B?

The ET-179B, also known as the Arkansas Tax Rebate Form, is a document used by residents of Arkansas to apply for tax rebates. This form is specifically designed to facilitate the process of claiming rebates based on the state’s tax laws. Understanding the purpose of this form is essential for taxpayers who wish to receive financial benefits from the state. The ET-179B helps ensure that residents can efficiently navigate the tax rebate process, making it easier to claim what they are entitled to under Arkansas tax regulations.

Steps to Complete the ET-179B

Completing the ET-179B requires careful attention to detail to ensure accuracy and compliance with state requirements. Here are the essential steps to follow:

- Gather necessary information, including your Social Security number, income details, and any relevant tax documents.

- Obtain the ET-179B form, which can be downloaded or printed from the Arkansas Department of Finance and Administration website.

- Fill out the form completely, ensuring all fields are accurately completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online, by mail, or in person, depending on your preference and the options available.

Legal Use of the ET-179B

The ET-179B is legally binding when completed and submitted according to Arkansas state laws. To ensure its legal validity, it must be signed by the taxpayer and submitted within the designated timeframe. Additionally, the form must be filled out truthfully, as providing false information can lead to penalties or disqualification from receiving the rebate. Understanding the legal implications of using the ET-179B is crucial for taxpayers to protect their rights and ensure compliance with state regulations.

Eligibility Criteria

To qualify for the Arkansas tax rebate using the ET-179B, certain eligibility criteria must be met. These criteria typically include:

- Residency in Arkansas for the tax year in question.

- Filing a state income tax return for the applicable year.

- Meeting income thresholds as defined by the Arkansas Department of Finance and Administration.

It is essential to review the specific eligibility requirements for the current tax year, as they may change annually. Ensuring that you meet these criteria will help streamline the rebate application process.

Form Submission Methods

Submitting the ET-179B can be done through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission through the Arkansas Department of Finance and Administration's official website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices or designated state facilities.

Choosing the right submission method can depend on personal preference and the urgency of the rebate claim.

Filing Deadlines / Important Dates

Filing deadlines for the ET-179B are critical to ensure that taxpayers do not miss out on their rebates. Typically, the form must be submitted by a specific date following the end of the tax year. It is advisable to check the Arkansas Department of Finance and Administration's announcements for the exact deadlines, as they can vary each year. Staying informed about these important dates helps taxpayers plan their submissions accordingly and avoid any potential penalties.

Quick guide on how to complete et 179b

Effortlessly Create Et 179b on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Et 179b on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Modify and eSign Et 179b with Ease

- Locate Et 179b and click Get Form to initiate the process.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or redact confidential information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, invite link, or download it to your PC.

Eliminate worries about lost or misplaced documents, annoying form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Et 179b, ensuring seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the et 179b

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the Arkansas tax rebate form and how does it work?

The Arkansas tax rebate form allows eligible residents to claim tax rebates based on specific criteria. This form is essential for ensuring you receive any available state tax benefits, and it must be filled out accurately to avoid delays in processing. By using the Arkansas tax rebate form, taxpayers can potentially receive money back, providing financial relief.

-

How do I obtain the Arkansas tax rebate form?

You can obtain the Arkansas tax rebate form from the Arkansas Department of Finance and Administration's official website. Additionally, many tax preparation software programs include the form for easy access. Simply download the form, fill it out, and follow the submission guidelines provided.

-

What information do I need to fill out the Arkansas tax rebate form?

To fill out the Arkansas tax rebate form, you'll need personal information such as your Social Security number, tax filing status, and your income information. Additionally, any relevant details about property taxes or other qualifying expenses may be required. Make sure to have your prior year’s tax return handy for reference.

-

Are there any fees associated with submitting the Arkansas tax rebate form?

There are typically no fees associated with submitting the Arkansas tax rebate form to the state, as it's a government-issued document. However, if you opt to use a tax preparation service or software, there may be costs involved. Review pricing details with the provider for any associated fees.

-

How long does it take to process the Arkansas tax rebate form?

Processing times for the Arkansas tax rebate form can vary, but typically, you should expect 4 to 6 weeks for your rebate to be processed. To ensure timely processing, it's crucial to complete the form accurately without errors. Tracking your rebate status through the Arkansas Department of Finance and Administration website can provide updates.

-

Can I e-sign the Arkansas tax rebate form?

Yes, airSlate SignNow provides a convenient solution to e-sign documents, including the Arkansas tax rebate form. By using an e-signature, you can ensure the form is signed securely and submitted quickly. This feature not only saves time but also enhances the security of your personal information.

-

What are the benefits of using airSlate SignNow for the Arkansas tax rebate form?

Using airSlate SignNow to manage your Arkansas tax rebate form offers several benefits, including ease of use and secure electronic signatures. The platform streamlines the document sending and signing process, allowing you to focus on other important tasks. Moreover, it is a cost-effective solution that simplifies the entire tax rebate process.

Get more for Et 179b

- Recommendation for award da form 638 apr

- If this message is not eventually replaced by foxit pdf sdk form

- Cui when filled in form

- Inspector general action request da form 1559 apr

- Fin 357 request to close provincial sales tax account form

- Declaration of eligibility for a registration conc form

- Corporate request form for certificates of good standing and

- Task analysissafe work method statement form

Find out other Et 179b

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free