Dc Tax Certification Form

What is the DC Tax Certification?

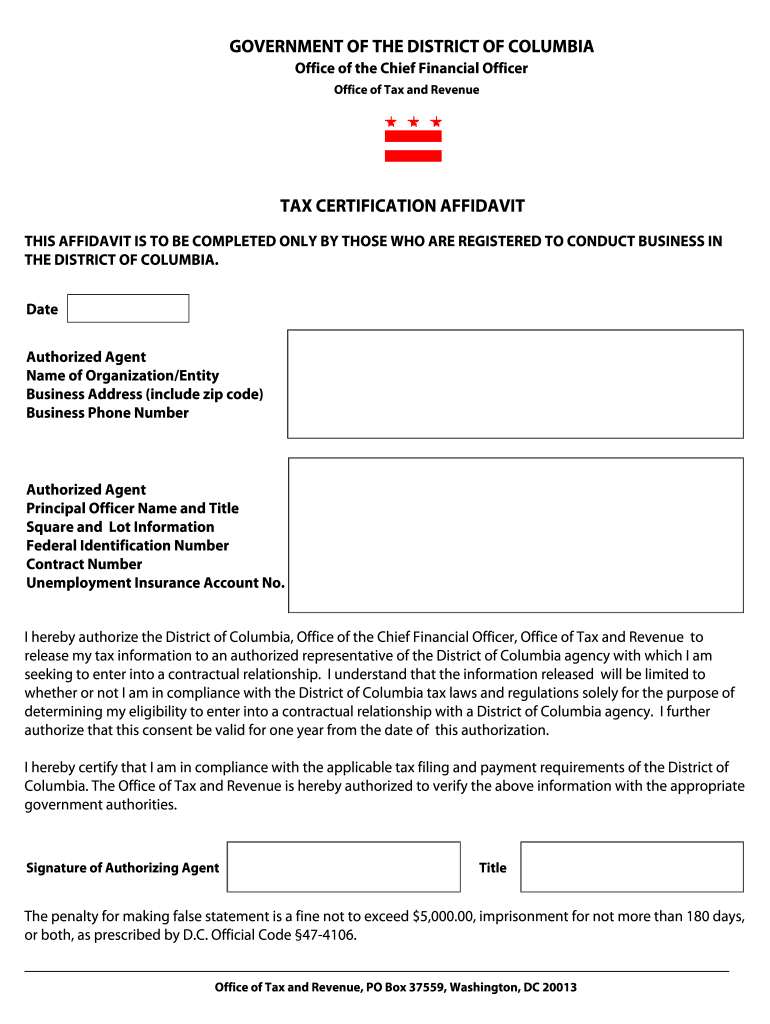

The DC Tax Certification Affidavit is an official document required by the District of Columbia to verify an individual's or business's tax compliance status. This affidavit serves as a declaration that all taxes owed to the District have been paid or are in good standing. It is often necessary for various legal and financial transactions, including obtaining licenses, permits, or contracts within the district. The certification ensures that the taxpayer is in compliance with local tax laws and regulations, thereby helping to maintain the integrity of the tax system.

How to Obtain the DC Tax Certification

To obtain the DC Tax Certification Affidavit, individuals or businesses must follow a specific process. First, ensure that all tax obligations to the District of Columbia are satisfied. This includes filing all required tax returns and paying any outstanding taxes. Next, complete the application form for the tax certification, which can typically be found on the official District of Columbia government website. Once the form is filled out, submit it along with any required documentation, such as proof of tax payments. The processing time may vary, so it's advisable to apply well in advance of any deadlines.

Steps to Complete the DC Tax Certification

Completing the DC Tax Certification Affidavit involves several key steps:

- Verify your tax status by checking your account with the Office of Tax and Revenue (OTR).

- Gather necessary documents, including tax returns, payment receipts, and identification.

- Fill out the DC Tax Certification Affidavit form accurately, ensuring all information is current.

- Submit the completed form and any supporting documents to the appropriate OTR office.

- Await confirmation of your certification status, which may be provided via email or postal mail.

Legal Use of the DC Tax Certification

The DC Tax Certification Affidavit holds legal significance as it serves as proof of tax compliance. It is often required for various legal processes, such as applying for business licenses, securing contracts, or participating in government procurement opportunities. The affidavit must be signed and dated by the applicant, affirming that the information provided is true and correct. Misrepresentation or failure to comply with tax obligations can lead to legal penalties, including fines or disqualification from obtaining necessary permits.

Required Documents for the DC Tax Certification

When applying for the DC Tax Certification Affidavit, certain documents are typically required to verify your tax compliance. These may include:

- Current tax returns for the past few years.

- Receipts or proof of payment for any outstanding taxes.

- Identification documents, such as a driver's license or passport.

- Any additional forms as specified by the Office of Tax and Revenue.

Penalties for Non-Compliance

Failure to obtain the DC Tax Certification Affidavit or to comply with tax obligations can result in serious penalties. These may include:

- Fines imposed by the District of Columbia for unpaid taxes.

- Inability to secure business licenses or permits.

- Legal action taken by the District to recover owed taxes.

- Negative impact on credit ratings and business reputation.

Quick guide on how to complete dc tax certification

Complete Dc Tax Certification seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed records, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Dc Tax Certification on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Dc Tax Certification effortlessly

- Obtain Dc Tax Certification and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Dc Tax Certification while ensuring exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dc tax certification

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is a DC tax certification affidavit?

A DC tax certification affidavit is a legal document that verifies an individual's or business's tax status in Washington, D.C. It is often required for various transactions, such as obtaining licenses or permits. Understanding the requirements for a DC tax certification affidavit can help streamline your business processes.

-

How can airSlate SignNow help with DC tax certification affidavits?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning DC tax certification affidavits. With its user-friendly interface, you can easily manage the entire affidavit process, from drafting to final signature. This cost-effective solution ensures compliance and saves you valuable time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to cater to different business needs, including an affordable option for those needing DC tax certification affidavits. Pricing typically varies based on features and the number of users. For a complete breakdown, you can visit the pricing section of our website.

-

Are there any specific features for handling DC tax certification affidavits?

Yes, airSlate SignNow includes specific features designed for handling DC tax certification affidavits, such as customizable templates and automated reminders. These features ensure that you can efficiently manage document workflows and stay compliant with local regulations. They also enhance overall productivity by minimizing manual processes.

-

How secure is the eSigning process for DC tax certification affidavits?

The eSigning process for DC tax certification affidavits on airSlate SignNow is highly secure, employing industry-standard encryption to protect your documents. Additionally, our platform complies with various security regulations, ensuring that your sensitive information remains confidential. You can sign with confidence knowing your data is protected.

-

Can I integrate airSlate SignNow with other tools for managing DC tax certification affidavits?

Absolutely! airSlate SignNow offers seamless integrations with many popular business tools, making it easy to manage DC tax certification affidavits alongside your existing workflows. Whether you use CRM software, project management tools, or accounting systems, integrations enhance efficiency and streamline document management.

-

What are the benefits of using airSlate SignNow for DC tax certification affidavits?

Using airSlate SignNow for DC tax certification affidavits offers multiple benefits, including faster processing times and reduced paperwork. Our intuitive platform simplifies the signing process, allowing you to focus on core business operations. Moreover, it helps maintain compliance with local regulations, ensuring you meet necessary requirements.

Get more for Dc Tax Certification

Find out other Dc Tax Certification

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online