WithholdingForms & InstructionsDepartment of Revenue Taxation 2020-2026

Understanding Colorado Withholding Tax Income

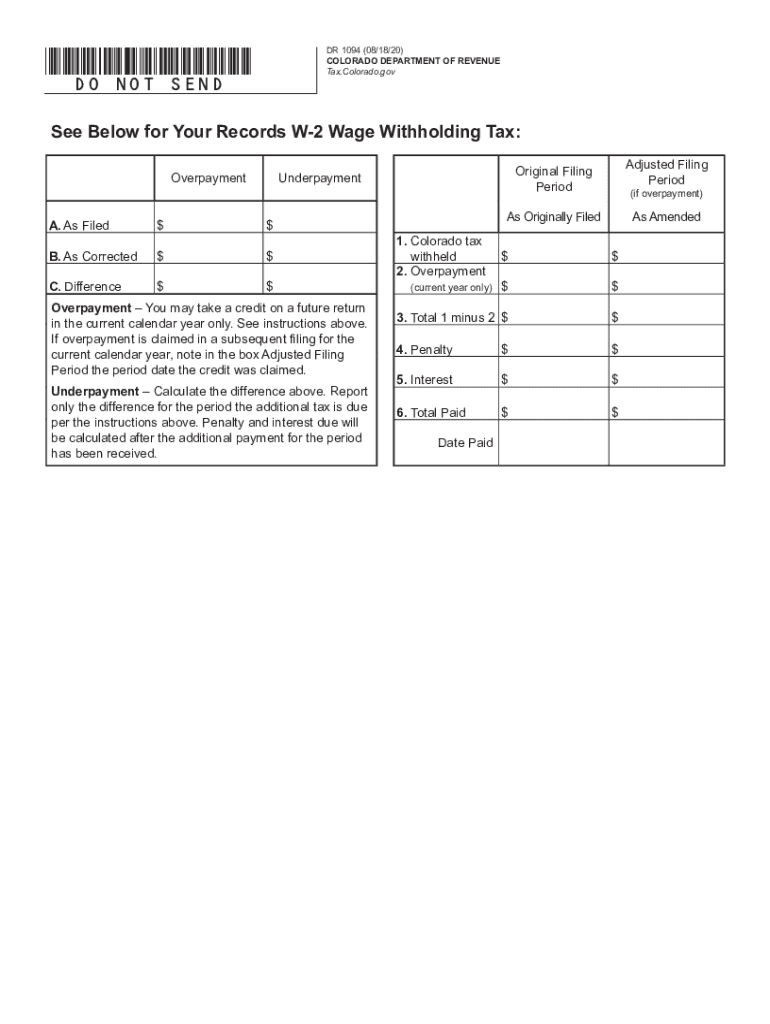

The Colorado withholding tax income refers to the amount of money that employers are required to withhold from employees' wages for state income tax purposes. This withholding is essential for ensuring that employees meet their tax obligations throughout the year. Employers must accurately calculate the withholding amount based on the employee's earnings and the information provided on their Colorado tax withholding form, such as the DR 1094. Understanding this process helps both employers and employees manage their tax responsibilities effectively.

Steps to Complete the Colorado Withholding Tax Form

Completing the Colorado withholding tax form involves several key steps:

- Gather necessary information, including employee details and income data.

- Obtain the correct version of the Colorado withholding tax form, typically the DR 1094.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form to the Colorado Department of Revenue by the specified deadline.

Following these steps can help prevent issues with tax compliance and ensure that the correct amount is withheld from employee wages.

Key Elements of the Colorado Withholding Tax Form

The Colorado withholding tax form contains several important elements that must be understood:

- Employee Information: This includes the employee's name, Social Security number, and address.

- Withholding Allowances: Employees can claim allowances based on their personal circumstances, which affects the withholding amount.

- Signature: The form must be signed by the employee to validate the information provided.

- Employer Details: Employers must provide their information, including their Colorado account number.

Each of these elements plays a crucial role in ensuring accurate tax withholding and compliance with state regulations.

Legal Use of the Colorado Withholding Tax Form

The legal use of the Colorado withholding tax form is governed by state tax laws. Employers are required to use the form to determine the correct amount of state income tax to withhold from employees' wages. This form serves as a legal document that outlines the employee's tax withholding preferences and must be kept on file by the employer. Compliance with these legal requirements helps avoid potential penalties and ensures that both employers and employees fulfill their tax obligations.

Filing Deadlines for Colorado Withholding Tax Forms

Filing deadlines for the Colorado withholding tax forms are crucial for compliance. Employers must submit the DR 1094 form by the end of each tax year, typically by January 31 of the following year. Additionally, employers are required to remit the withheld taxes to the Colorado Department of Revenue on a regular basis, which can be monthly, quarterly, or annually, depending on the amount of tax withheld. Staying informed about these deadlines helps prevent penalties and ensures timely compliance with state tax laws.

Penalties for Non-Compliance with Colorado Withholding Tax Regulations

Failure to comply with Colorado withholding tax regulations can result in significant penalties for employers. These may include fines for late submission of forms, failure to withhold the correct amount, or not filing the required forms altogether. Additionally, employees may face tax liabilities if their employers do not withhold the appropriate amounts. Understanding these penalties emphasizes the importance of accurate and timely compliance with Colorado tax laws.

Quick guide on how to complete withholdingforms ampamp instructionsdepartment of revenue taxation

Complete WithholdingForms & InstructionsDepartment Of Revenue Taxation effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers a perfect eco-conscious substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage WithholdingForms & InstructionsDepartment Of Revenue Taxation on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign WithholdingForms & InstructionsDepartment Of Revenue Taxation effortlessly

- Find WithholdingForms & InstructionsDepartment Of Revenue Taxation and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to secure your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign WithholdingForms & InstructionsDepartment Of Revenue Taxation and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholdingforms ampamp instructionsdepartment of revenue taxation

Create this form in 5 minutes!

How to create an eSignature for the withholdingforms ampamp instructionsdepartment of revenue taxation

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the Colorado withholding tax income?

Colorado withholding tax income refers to the state income tax deducted from employees' wages in Colorado. This amount is withheld by employers and submitted to the state, helping individuals manage their tax liabilities effectively. Understanding this tax is essential for businesses operating in Colorado to ensure compliance.

-

How can airSlate SignNow help with managing Colorado withholding tax income?

airSlate SignNow can streamline the documentation process related to Colorado withholding tax income by allowing businesses to send and eSign tax-related forms securely. This not only saves time but also ensures that all documents are managed efficiently and in compliance with state regulations. Convenience and efficiency are key benefits of using our platform.

-

What are the pricing options for airSlate SignNow related to Colorado withholding tax income filings?

airSlate SignNow offers various pricing plans designed to accommodate businesses of all sizes. Each plan includes features that facilitate easy management of documents related to Colorado withholding tax income, including eSigning capabilities and secure storage. You can choose a plan that best fits your needs and budget.

-

Does airSlate SignNow offer integrations for handling Colorado withholding tax income?

Yes, airSlate SignNow integrates with various accounting and payroll systems to help businesses manage Colorado withholding tax income more efficiently. These integrations ensure that your data flows seamlessly between systems, making it easier to track and report tax withholdings. Streamlining these processes saves time and reduces the risk of errors.

-

What features does airSlate SignNow provide to support Colorado businesses with tax documents?

airSlate SignNow provides features like eSigning, document templates, and secure cloud storage that are invaluable for Colorado businesses managing withholding tax income. These tools ensure that tax documents are completed quickly and accurately while maintaining compliance with state laws. Accessing documents remotely also allows for greater flexibility.

-

How does airSlate SignNow ensure compliance with Colorado tax regulations?

airSlate SignNow is designed to help businesses comply with Colorado tax regulations by providing legally binding eSignatures and a secure document management system. With our platform, you can easily audit your tax-related documents to ensure you meet all requirements, effectively managing your Colorado withholding tax income obligations.

-

Is airSlate SignNow suitable for small businesses dealing with Colorado withholding tax income?

Absolutely! airSlate SignNow is tailored to meet the needs of small businesses, offering a cost-effective solution for managing Colorado withholding tax income documentation. Our user-friendly interface and templates make it easy for smaller enterprises to navigate tax obligations without requiring extensive resources or expertise.

Get more for WithholdingForms & InstructionsDepartment Of Revenue Taxation

- Pmfby self declaration form pdf download

- Behavior rating scale template 51006025 form

- Market leader business english lsungen form

- Husband application form

- To kill a mockingbird character chart form

- Re exit entry visa pdf download form

- Gun permit tn form

- New jersey ltc prior authorization fax request form

Find out other WithholdingForms & InstructionsDepartment Of Revenue Taxation

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament