Instructions for Form 199 California Franchise Tax Board 2010

What is the Instructions For Form 199 California Franchise Tax Board

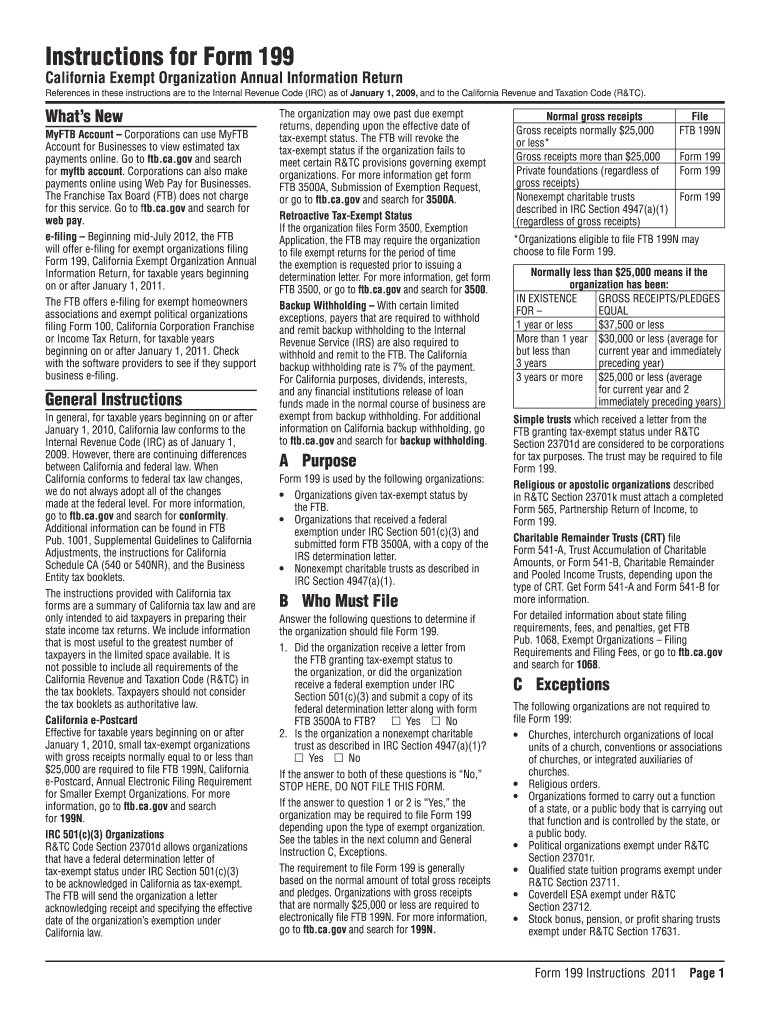

The Instructions For Form 199 are essential guidelines provided by the California Franchise Tax Board for organizations that need to file their California tax returns. This form is specifically designed for exempt organizations, including nonprofit entities, to report their income and expenses accurately. Understanding these instructions is crucial for ensuring compliance with state tax laws and maintaining tax-exempt status.

Steps to complete the Instructions For Form 199 California Franchise Tax Board

Completing the Instructions For Form 199 involves several key steps that organizations must follow to ensure accurate filing. First, gather all necessary financial documents, including income statements and expense reports. Next, carefully read through the instructions to understand the specific requirements for your organization type. Then, fill out the form by entering the required information, ensuring that all figures are accurate and properly documented. Finally, review the completed form for any errors before submission.

Filing Deadlines / Important Dates

Timely submission of the Instructions For Form 199 is critical to avoid penalties. The typical deadline for filing is the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if your fiscal year ends on December thirty-first, the form is due by May fifteenth of the following year. It is advisable to check the California Franchise Tax Board website for any updates or changes to these deadlines.

Legal use of the Instructions For Form 199 California Franchise Tax Board

Legal compliance when using the Instructions For Form 199 is essential for organizations to maintain their tax-exempt status. This includes adhering to the guidelines set forth by the California Franchise Tax Board regarding the accuracy of reported information and the proper use of eSignatures if filing electronically. Organizations must ensure that all submitted documents meet the legal standards established by state tax laws.

Required Documents

To complete the Instructions For Form 199, organizations need to prepare several documents. These typically include financial statements, detailed income and expense records, and any relevant supporting documentation that demonstrates compliance with tax regulations. Having these documents readily available can streamline the filing process and help ensure that all necessary information is included.

Form Submission Methods (Online / Mail / In-Person)

Organizations have multiple options for submitting the Instructions For Form 199. The form can be filed online through the California Franchise Tax Board's e-file system, which is often the most efficient method. Alternatively, organizations may choose to submit the form by mail, ensuring it is sent to the correct address based on their specific circumstances. In-person submissions may also be possible at designated tax offices, though this option is less common.

Quick guide on how to complete instructions for form 199 california franchise tax board

Effortlessly Prepare Instructions For Form 199 California Franchise Tax Board on Any Device

The management of documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage Instructions For Form 199 California Franchise Tax Board on any device through airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Instructions For Form 199 California Franchise Tax Board with Ease

- Obtain Instructions For Form 199 California Franchise Tax Board and select Get Form to begin.

- Leverage the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and hit the Done button to save your changes.

- Decide how you wish to share your form—by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to misplaced or lost files, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and electronically sign Instructions For Form 199 California Franchise Tax Board to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 199 california franchise tax board

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 199 california franchise tax board

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What are the Instructions For Form 199 California Franchise Tax Board?

The Instructions For Form 199 California Franchise Tax Board provide detailed guidelines for California non-profits to report their annual income and maintain compliance. This form is essential for organizations looking to fulfill state tax obligations while ensuring transparency. Being well-versed in these instructions can help avoid common mistakes during the filing process.

-

Where can I find the latest Instructions For Form 199 California Franchise Tax Board?

The latest Instructions For Form 199 California Franchise Tax Board can be found directly on the California Franchise Tax Board's official website. They provide the most current guidelines, downloadable forms, and additional support resources. Always ensure you refer to the most recent version to guarantee compliance.

-

How does airSlate SignNow facilitate the completion of Instructions For Form 199 California Franchise Tax Board?

airSlate SignNow streamlines the process of completing the Instructions For Form 199 California Franchise Tax Board through its user-friendly electronic signature solutions. With templates available for various formats, you can easily populate and send the form for signatures, accelerating the submission process. This makes it easier for organizations to comply with filing timelines.

-

Is there a cost associated with using airSlate SignNow to manage Instructions For Form 199 California Franchise Tax Board?

airSlate SignNow offers several pricing plans to fit different business sizes and needs, making it a cost-effective solution for managing Instructions For Form 199 California Franchise Tax Board. Plans typically include various features such as unlimited templates, cloud storage, and eSigning capabilities. Evaluate the plans to find the one that best suits your organization.

-

What features does airSlate SignNow offer that assist with Instructions For Form 199 California Franchise Tax Board?

airSlate SignNow offers features that greatly assist in managing Instructions For Form 199 California Franchise Tax Board, including customizable templates, powerful electronic signature capabilities, and secure document storage. These tools allow users to complete and send forms swiftly and securely while maintaining compliance with state requirements. It's designed for easy access and streamlining workflows.

-

Can airSlate SignNow integrate with other platforms I use for handling Instructions For Form 199 California Franchise Tax Board?

Yes, airSlate SignNow seamlessly integrates with a variety of platforms, enhancing your ability to manage Instructions For Form 199 California Franchise Tax Board. Integrations with CRM systems, cloud storage solutions, and other productivity tools facilitate a more efficient workflow. This interoperability helps reduce manual entry and minimizes errors in document handling.

-

What are the benefits of using airSlate SignNow for Instructions For Form 199 California Franchise Tax Board?

The benefits of using airSlate SignNow for Instructions For Form 199 California Franchise Tax Board include increased efficiency, reduced administrative workload, and enhanced document security. By enabling electronic signatures and improved document tracking, businesses can expedite their filing processes while ensuring compliance. This consolidated approach also streamlines collaboration among team members.

Get more for Instructions For Form 199 California Franchise Tax Board

- Bank statement document form

- Commsec executor authority form

- Austria visa application form pdf fill in online

- Bowflex 6 week challenge pdf form

- Blanco overname pidpa form

- Certificado de admissibilidade form

- Property tax deduction claim by veteran or surviving spousecivil union or domestic partner of veteran or serviceperson form

- Supplemental local sales and use tax schedule dfa arkansas form

Find out other Instructions For Form 199 California Franchise Tax Board

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy