Form 568 2019

What is the Form 568

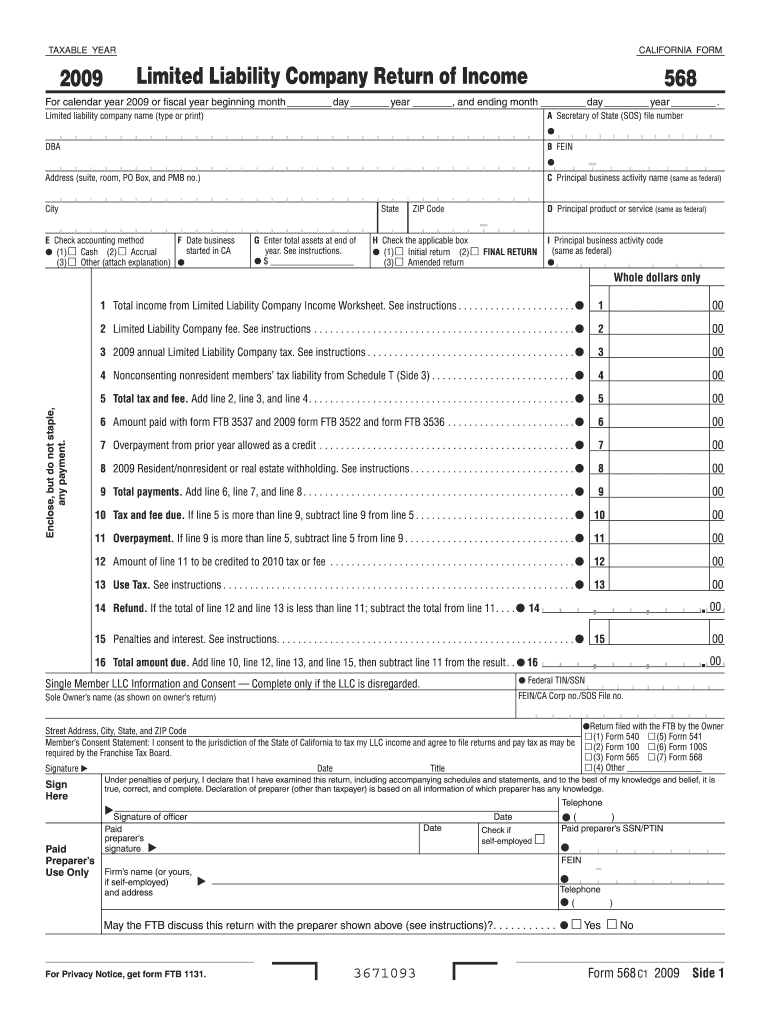

The Form 568 is a tax document used by limited liability companies (LLCs) in California to report their income, deductions, and credits to the state. This form is essential for LLCs that are classified as partnerships or disregarded entities for tax purposes. It helps the California Franchise Tax Board (FTB) assess the tax obligations of these entities. Completing the Form 568 accurately ensures compliance with state tax laws and helps avoid penalties.

How to use the Form 568

To use the Form 568, an LLC must first determine its classification for tax purposes. The form requires information about the LLC's income, expenses, and ownership structure. It is crucial to gather all necessary financial documents before starting the form. After filling out the required sections, the form must be submitted to the California FTB, either electronically or by mail. Ensure that all calculations are accurate to prevent delays in processing.

Steps to complete the Form 568

Completing the Form 568 involves several steps:

- Gather financial records, including income statements and expense reports.

- Identify the LLC's tax classification (e.g., partnership or disregarded entity).

- Fill out the form, providing details on income, deductions, and credits.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the completed form to the California FTB by the deadline.

Legal use of the Form 568

The legal use of the Form 568 is vital for compliance with California tax regulations. Submitting this form accurately and on time helps avoid penalties and interest charges. The information provided on the form is used by the California FTB to determine the LLC's tax liability. It is essential to maintain proper records and documentation to support the information reported on the form, as this may be required in case of an audit.

Filing Deadlines / Important Dates

The Form 568 must be filed annually, with specific deadlines that vary depending on the LLC's tax year. Generally, the form is due on the 15th day of the fourth month after the end of the LLC's tax year. For most LLCs operating on a calendar year basis, this means the form is typically due by April 15. It is important to keep track of these deadlines to ensure timely filing and avoid penalties.

Required Documents

When preparing to complete the Form 568, several documents are necessary:

- Income statements detailing all revenue generated by the LLC.

- Expense reports outlining all deductible costs incurred during the tax year.

- Ownership records, including member information and percentage of ownership.

- Any previous tax returns that may provide context for the current filing.

Form Submission Methods (Online / Mail / In-Person)

The Form 568 can be submitted through various methods, providing flexibility for LLCs. It can be filed electronically using the California FTB's e-file system, which is often the fastest option. Alternatively, the form can be mailed to the appropriate address listed on the FTB website. In-person submissions are also possible at designated FTB offices, though this method may require an appointment. Each method has its own processing times, so it is advisable to choose one that aligns with the filing deadline.

Quick guide on how to complete 2009 form 568

Get Form 568 ready effortlessly on any gadget

Digital document handling has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate template and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your files swiftly and without hassle. Manage Form 568 across any platform using airSlate SignNow's Android or iOS applications and enhance your document-focused tasks today.

The simplest method to alter and electronically sign Form 568 with ease

- Find Form 568 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Craft your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your changes.

- Select your preferred method to share your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Form 568 and guarantee exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 form 568

Create this form in 5 minutes!

How to create an eSignature for the 2009 form 568

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is Form 568 and who needs to file it?

Form 568 is a tax form required by the State of California for Limited Liability Companies (LLCs) to report income, deductions, and other financial information. If you operate an LLC in California, you need to file Form 568 with the California Franchise Tax Board to ensure compliance with state tax laws.

-

How can airSlate SignNow help with completing Form 568?

airSlate SignNow simplifies the process of completing Form 568 by allowing users to fill out and eSign the document electronically. The platform provides templates and an intuitive interface, ensuring that you can accurately complete this tax form without the hassle of printing or mailing.

-

Is there a cost associated with filing Form 568 using airSlate SignNow?

Using airSlate SignNow to prepare and eSign Form 568 comes with a subscription plan. Our cost-effective solutions are designed to fit your business needs, offering various pricing tiers based on features and usage, ensuring you can manage your tax documents efficiently.

-

What features does airSlate SignNow offer for managing Form 568?

airSlate SignNow includes features such as document templates, collaboration tools, and secure eSigning that make managing Form 568 easy. You can track progress, invite team members for review, and store documents securely, enhancing your overall tax management process.

-

Can I integrate airSlate SignNow with other software for filing Form 568?

Yes, airSlate SignNow includes integrations with several accounting and business management tools. This capability allows for seamless management of Form 568 alongside your existing systems, enhancing efficiency in your tax filing process.

-

What are the benefits of using airSlate SignNow for eSigning Form 568?

By using airSlate SignNow for eSigning Form 568, you benefit from increased security, reduced turnaround times, and improved compliance. The electronic signature process is legally binding, ensuring that your completed form is submitted accurately and on time.

-

How does airSlate SignNow ensure the security of my Form 568 data?

airSlate SignNow takes data security seriously and employs advanced encryption methods to protect your Form 568 and other sensitive documents. We are compliant with industry standards, ensuring that your information is safeguarded against unauthorized access.

Get more for Form 568

- Prescriptioins form

- Mschoa registration form

- Illinois consumer education proficiency test sample items form

- Core superior de california conrad de los ngelesj form

- Davie dog house form

- Helen holt mollohan scholarship application mollohanfoundation form

- Promontory community association the promontory form

- Sunday school registration form st george orthodox church stgeorgesf

Find out other Form 568

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later