Nevada Modified Business Tax Form 2016

What is the Nevada Modified Business Tax Form

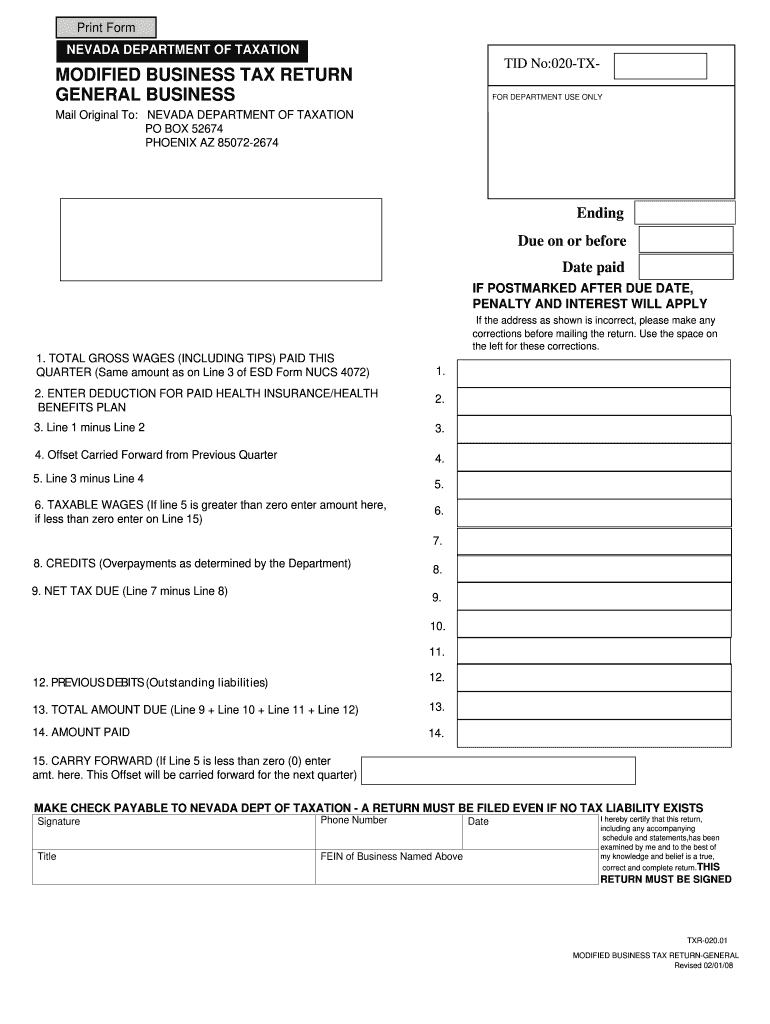

The Nevada Modified Business Tax Form is a tax document used by businesses operating in Nevada to report their modified business tax obligations. This form is essential for employers to calculate and remit the appropriate amount of tax based on their payroll. The tax is primarily levied on businesses with employees, and it helps fund various state services. Understanding this form is crucial for compliance with Nevada tax regulations.

How to use the Nevada Modified Business Tax Form

To effectively use the Nevada Modified Business Tax Form, businesses must first gather relevant payroll information, including total wages paid and the number of employees. The form guides users through calculating the tax owed based on these figures. It is important to follow the instructions carefully to ensure accurate reporting and payment. Utilizing digital tools can streamline this process, allowing for easier data entry and submission.

Steps to complete the Nevada Modified Business Tax Form

Completing the Nevada Modified Business Tax Form involves several key steps:

- Gather necessary payroll data, including total wages and employee counts.

- Fill out the required sections of the form, ensuring all information is accurate.

- Calculate the modified business tax based on the provided guidelines.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the Nevada Modified Business Tax Form

The legal use of the Nevada Modified Business Tax Form is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Electronic submissions are accepted and carry the same legal weight as paper submissions, provided they adhere to the requirements set forth by Nevada tax authorities. Compliance with these regulations is essential to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Nevada Modified Business Tax Form are crucial for compliance. Typically, businesses must submit the form quarterly, with specific due dates determined by the Nevada Department of Taxation. It is important to stay informed about these dates to ensure timely filing and avoid late fees. Keeping a calendar of these deadlines can help businesses manage their tax obligations effectively.

Form Submission Methods (Online / Mail / In-Person)

The Nevada Modified Business Tax Form can be submitted through various methods to accommodate different business needs. Options include:

- Online Submission: Businesses can file the form electronically through the Nevada Department of Taxation's online portal.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person: Some businesses may choose to deliver the form directly to their local tax office.

Quick guide on how to complete nevada modified business tax 2008 form

Effortlessly Prepare Nevada Modified Business Tax Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly and without obstacles. Handle Nevada Modified Business Tax Form on any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The simplest way to modify and eSign Nevada Modified Business Tax Form effortlessly

- Find Nevada Modified Business Tax Form and click on Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal standing as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign Nevada Modified Business Tax Form to ensure excellent communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nevada modified business tax 2008 form

Create this form in 5 minutes!

How to create an eSignature for the nevada modified business tax 2008 form

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Nevada Modified Business Tax Form?

The Nevada Modified Business Tax Form is a tax form that businesses in Nevada use to report their modified business tax obligations. This form helps calculate the tax owed based on the taxable wages and is crucial for maintaining compliance with state tax regulations.

-

How can airSlate SignNow assist with the Nevada Modified Business Tax Form?

airSlate SignNow offers an efficient platform for businesses to eSign and send the Nevada Modified Business Tax Form securely. Our solution streamlines the process, ensuring that you can quickly complete and submit this important tax document without hassles.

-

What are the costs associated with using airSlate SignNow for the Nevada Modified Business Tax Form?

airSlate SignNow provides affordable pricing plans tailored for businesses of all sizes. For a flat monthly fee, you gain access to all features necessary for completing, signing, and managing the Nevada Modified Business Tax Form, making it a cost-effective solution.

-

Is the airSlate SignNow platform easy to use for filing the Nevada Modified Business Tax Form?

Yes, airSlate SignNow is designed with user-friendliness in mind. You can easily navigate the platform to fill out, eSign, and submit the Nevada Modified Business Tax Form, even if you aren’t tech-savvy.

-

Does airSlate SignNow integrate with other business tools for tax submissions?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage the Nevada Modified Business Tax Form alongside your existing workflows. This enhances collaboration and simplifies document handling.

-

What are the key benefits of using airSlate SignNow for the Nevada Modified Business Tax Form?

Using airSlate SignNow for the Nevada Modified Business Tax Form streamlines your tax submission process, reduces paperwork, and ensures secure document handling. Additionally, it enables you to keep track of submissions and receive real-time updates, helping you stay organized.

-

Can I access the Nevada Modified Business Tax Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access the Nevada Modified Business Tax Form from your smartphone or tablet. This flexibility ensures that you can manage your tax documents on the go, making it easy to stay on top of your obligations.

Get more for Nevada Modified Business Tax Form

Find out other Nevada Modified Business Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors