Form it 203, Nonresident and Part Year Resident Income Tax Return 2017

What is the Form IT 203, Nonresident And Part Year Resident Income Tax Return

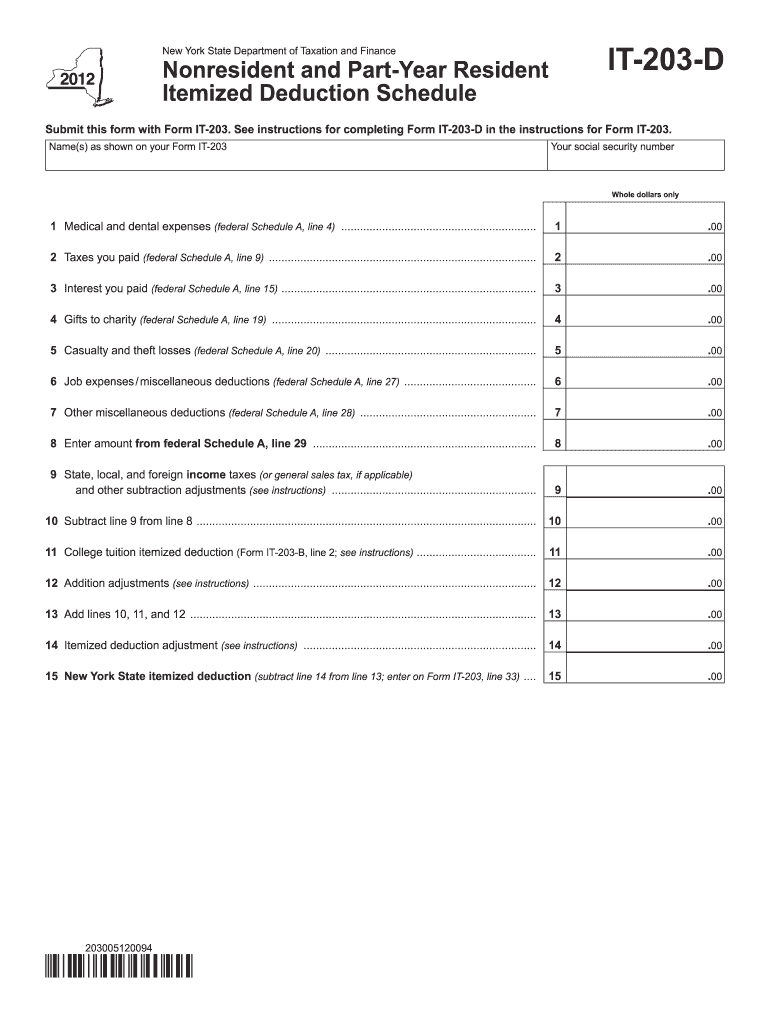

The Form IT 203 is a tax return specifically designed for nonresidents and part-year residents of New York State. This form allows individuals who do not reside in New York for the entire tax year to report their income earned within the state. It is essential for ensuring compliance with state tax laws and for calculating any tax owed or refund due. Understanding the purpose of this form is crucial for accurate tax reporting and fulfilling legal obligations.

Steps to complete the Form IT 203, Nonresident And Part Year Resident Income Tax Return

Completing the Form IT 203 involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Determine your residency status and the income earned while in New York.

- Fill out the form, ensuring all sections are completed accurately, including personal information and income details.

- Calculate your New York taxable income and any applicable credits or deductions.

- Review the completed form for accuracy before submission.

Legal use of the Form IT 203, Nonresident And Part Year Resident Income Tax Return

The legal use of the Form IT 203 is governed by New York State tax regulations. It is crucial that the form is filled out correctly to avoid issues with the state tax authority. E-signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that the form is legally binding when submitted electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 are typically aligned with the federal tax deadlines. Generally, the form must be filed by April fifteenth of the year following the tax year in question. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes in deadlines to ensure timely submission and avoid penalties.

Required Documents

To accurately complete the Form IT 203, you will need to gather various documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income earned while in New York.

- Documentation supporting deductions or credits claimed.

Who Issues the Form

The Form IT 203 is issued by the New York State Department of Taxation and Finance. This agency is responsible for the administration of state tax laws and ensures that taxpayers comply with their obligations. Accessing the form directly from the official state website is advisable to ensure you have the most current version.

Quick guide on how to complete form it 203 nonresident and part year resident income tax return

Prepare Form IT 203, Nonresident And Part Year Resident Income Tax Return effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the accurate form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents promptly without delays. Manage Form IT 203, Nonresident And Part Year Resident Income Tax Return on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form IT 203, Nonresident And Part Year Resident Income Tax Return with ease

- Find Form IT 203, Nonresident And Part Year Resident Income Tax Return and click Get Form to initiate.

- Make use of the tools available to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 203, Nonresident And Part Year Resident Income Tax Return to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 nonresident and part year resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the form it 203 nonresident and part year resident income tax return

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is Form IT 203, Nonresident And Part Year Resident Income Tax Return?

Form IT 203, Nonresident And Part Year Resident Income Tax Return, is a tax form used by nonresidents and part-year residents of New York to report and pay their income taxes. This form allows taxpayers to declare their income, claim deductions, and calculate their tax liability for the time they lived or worked in New York State.

-

How does airSlate SignNow help with Form IT 203, Nonresident And Part Year Resident Income Tax Return?

airSlate SignNow simplifies the process of completing and submitting Form IT 203, Nonresident And Part Year Resident Income Tax Return by allowing users to fill out and eSign the document electronically. This ensures that you can complete your tax return efficiently, securely, and from anywhere, reducing the chances of errors.

-

What features does airSlate SignNow offer for eSigning Form IT 203, Nonresident And Part Year Resident Income Tax Return?

airSlate SignNow offers various features for eSigning Form IT 203, Nonresident And Part Year Resident Income Tax Return, including customizable templates, secure cloud storage, and real-time collaboration. These features allow users to streamline their tax preparation processes and ensure that signatures are collected promptly.

-

Is there a cost associated with using airSlate SignNow for Form IT 203, Nonresident And Part Year Resident Income Tax Return?

Yes, there is a cost associated with using airSlate SignNow; however, it is designed to be a cost-effective solution for businesses and individuals. Pricing plans vary based on the specific features you need and the volume of documents you handle, making it accessible for different users preparing Form IT 203, Nonresident And Part Year Resident Income Tax Return.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely! airSlate SignNow can integrate with a variety of tax preparation software and accounting tools, making it easier to manage your Form IT 203, Nonresident And Part Year Resident Income Tax Return alongside your other financial documents. This integration ensures a seamless workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax forms like Form IT 203, Nonresident And Part Year Resident Income Tax Return?

Using airSlate SignNow for tax forms like Form IT 203, Nonresident And Part Year Resident Income Tax Return offers numerous benefits, including enhanced security, reduced paperwork, and faster turnaround times. The platform allows you to eSign documents quickly, ensuring compliance without the delays associated with traditional methods.

-

How secure is eSigning Form IT 203, Nonresident And Part Year Resident Income Tax Return with airSlate SignNow?

airSlate SignNow prioritizes security, employing end-to-end encryption and compliance with relevant security standards. This means that your information and eSigned Form IT 203, Nonresident And Part Year Resident Income Tax Return are protected from unauthorized access, giving you peace of mind.

Get more for Form IT 203, Nonresident And Part Year Resident Income Tax Return

Find out other Form IT 203, Nonresident And Part Year Resident Income Tax Return

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later