New York State Instructions Form 2018

What is the New York State Instructions Form

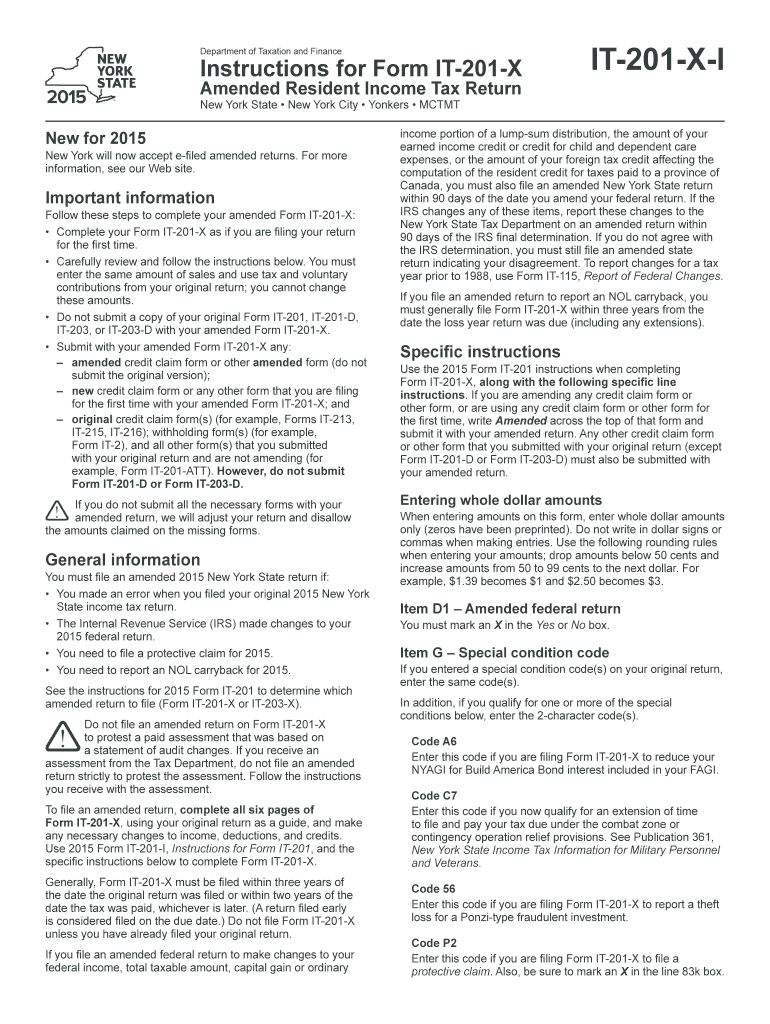

The New York State Instructions Form serves as a guideline for individuals and businesses in New York when completing various state tax forms. This form provides essential information regarding the requirements, processes, and regulations that must be followed to ensure compliance with state tax laws. It is crucial for accurate tax reporting and helps taxpayers understand their obligations and the necessary documentation required for submission.

How to use the New York State Instructions Form

Using the New York State Instructions Form involves several steps to ensure accurate completion. First, review the form thoroughly to understand the specific instructions related to your situation. Next, gather all necessary documents, such as previous tax returns and financial statements, to facilitate the completion process. Follow the guidelines outlined in the instructions carefully, ensuring that all required fields are filled out correctly. Finally, double-check your entries for accuracy before submitting the form.

Steps to complete the New York State Instructions Form

Completing the New York State Instructions Form requires a systematic approach. Begin by downloading the form from the official state website or obtaining a physical copy. Next, read through the instructions to familiarize yourself with the requirements. Gather all relevant documents, including income statements and deductions. Fill out the form step by step, ensuring that you provide accurate information in each section. After completing the form, review it for any errors or omissions, and then submit it according to the provided guidelines.

Legal use of the New York State Instructions Form

The legal use of the New York State Instructions Form is essential for ensuring that all submitted information is valid and compliant with state regulations. When completing this form, it is important to adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes providing accurate information and submitting the form by the designated deadlines. Failure to comply with these requirements may result in penalties or legal repercussions.

Form Submission Methods

The New York State Instructions Form can be submitted through various methods, providing flexibility for taxpayers. Individuals can choose to file the form online through the New York State Department of Taxation and Finance website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has specific guidelines and deadlines that must be followed to ensure timely processing.

Required Documents

When completing the New York State Instructions Form, certain documents are required to support the information provided. These may include proof of income, such as W-2 forms or 1099 statements, documentation of deductions or credits, and any previous tax returns. Having these documents readily available will facilitate the completion of the form and ensure that all necessary information is accurately reported.

Filing Deadlines / Important Dates

Filing deadlines for the New York State Instructions Form are critical for compliance. Typically, the deadline for individual tax returns is April fifteenth, though extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines or specific requirements for the current tax year. Marking these dates on a calendar can help ensure that all submissions are made in a timely manner, avoiding potential penalties.

Quick guide on how to complete 2015 new york state instructions form

Easy Preparation of New York State Instructions Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to quickly create, modify, and eSign your documents without delays. Manage New York State Instructions Form effortlessly on any device using the airSlate SignNow Android or iOS applications, and enhance your document-oriented processes today.

How to Alter and eSign New York State Instructions Form with Ease

- Obtain New York State Instructions Form and then select Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring the reprinting of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign New York State Instructions Form and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 new york state instructions form

Create this form in 5 minutes!

How to create an eSignature for the 2015 new york state instructions form

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the New York State Instructions Form and how can it benefit my business?

The New York State Instructions Form is a streamlined document that guides users through necessary processes in the state. By utilizing this form with airSlate SignNow, businesses can efficiently manage their documentation, ensuring compliance while saving time and resources. This efficiency can signNowly enhance productivity and focus on core business activities.

-

How does airSlate SignNow support the completion of the New York State Instructions Form?

airSlate SignNow offers intuitive tools that enable users to easily fill out and sign the New York State Instructions Form electronically. With features like real-time collaboration and automatic reminders, teams can work together seamlessly, reducing the chances of errors. This ensures that your documents are completed accurately and on time.

-

Is there a cost associated with using the New York State Instructions Form in airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, which includes access to various features that enhance the process of filling out the New York State Instructions Form. Pricing is flexible, catering to businesses of all sizes, and offers options including monthly subscriptions. This investment can lead to greater efficiency and reduced document turnaround times.

-

What features does airSlate SignNow provide for the New York State Instructions Form?

AirSlate SignNow provides several features for the New York State Instructions Form, including easy electronic signatures, document templates, and integration with other software. These features help streamline the signing process and enhance user experience. Additionally, robust security measures are in place to protect sensitive information.

-

Can I integrate airSlate SignNow with other applications when using the New York State Instructions Form?

Absolutely! airSlate SignNow offers integration with various applications like Google Drive, Salesforce, and Microsoft Office. This allows businesses to access and utilize the New York State Instructions Form within their existing workflows, making the process more efficient and cohesive. Enhanced integrations improve overall productivity and data management.

-

What are the benefits of using airSlate SignNow for the New York State Instructions Form?

Using airSlate SignNow for the New York State Instructions Form provides various benefits, including increased efficiency, reduced paper waste, and improved accuracy. The platform simplifies document management and allows users to track signers in real-time, which reduces delays and miscommunication. With user-friendly tools, it enhances the overall document workflow.

-

How secure is my data when using the New York State Instructions Form with airSlate SignNow?

AirSlate SignNow prioritizes the security of your data consistently when using the New York State Instructions Form. The platform complies with industry standards and employs advanced encryption methods to protect sensitive information. Regular security audits and user access controls further enhance data protection and privacy.

Get more for New York State Instructions Form

Find out other New York State Instructions Form

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple