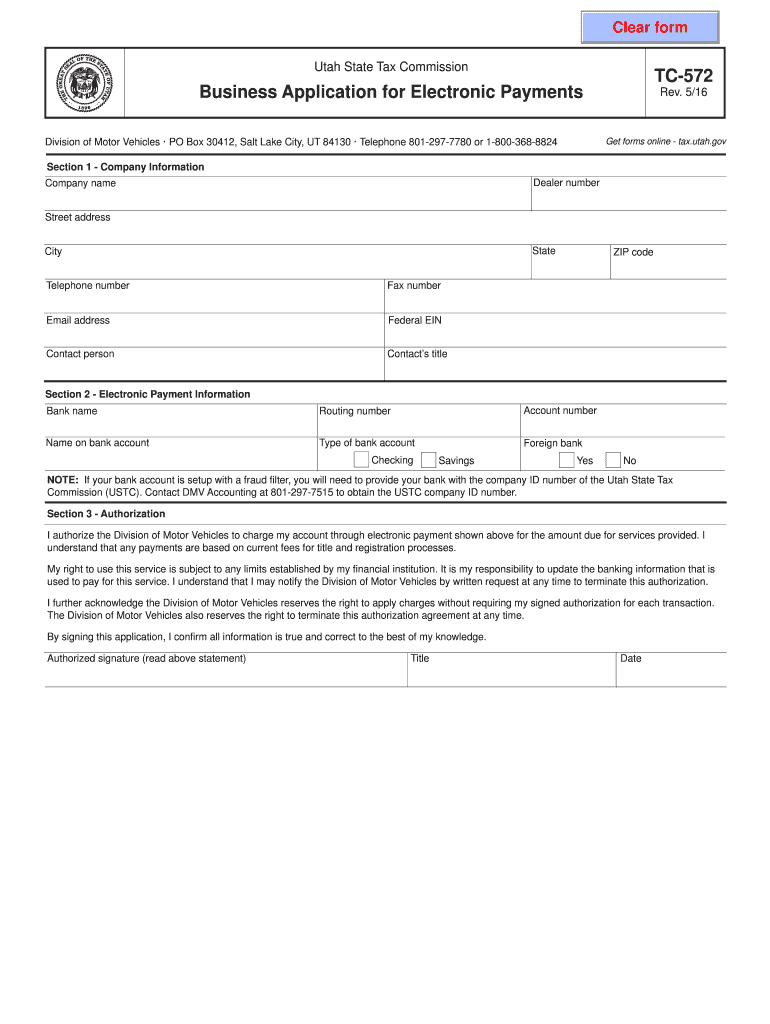

TC 572, Business Application for Electronic Payments Forms & Publications

What is the TC 572?

The TC 572 is a Business Application for Electronic Payments form used in the state of Utah. This form is essential for businesses that wish to make electronic payments to the Utah State Tax Commission. By completing the TC 572, businesses can streamline their payment processes, ensuring timely and efficient transactions. The form serves as a formal request to enroll in electronic payment systems, which can significantly reduce paperwork and enhance financial management.

How to Use the TC 572

Using the TC 572 involves several straightforward steps. First, ensure that you have all necessary information at hand, including your business details and tax identification numbers. Next, fill out the form accurately, providing all required information. Once completed, submit the TC 572 electronically or via mail, depending on your preference. After submission, monitor your application status to confirm enrollment in the electronic payment system.

Steps to Complete the TC 572

Completing the TC 572 requires careful attention to detail. Follow these steps for successful submission:

- Gather all necessary business information, including your legal business name, address, and tax identification number.

- Download the TC 572 form from the appropriate state resources.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the designated portal or mail it to the appropriate address.

Legal Use of the TC 572

The TC 572 is legally recognized as a formal application for businesses wishing to engage in electronic payments with the Utah State Tax Commission. By submitting this form, businesses comply with state regulations concerning electronic transactions. It is important to ensure that all information provided is accurate and truthful to avoid any legal repercussions or delays in processing.

Required Documents for the TC 572

When completing the TC 572, certain documents may be required to support your application. These typically include:

- Your business's tax identification number.

- Proof of business registration in Utah.

- Any previous tax returns or financial statements, if applicable.

Having these documents ready can facilitate a smoother application process.

Eligibility Criteria for the TC 572

To be eligible to submit the TC 572, your business must be registered with the Utah State Tax Commission and have a valid tax identification number. Additionally, businesses should be in good standing with all tax obligations to qualify for electronic payment options. It is advisable to check for any specific requirements that may apply to your business type.

Quick guide on how to complete tc 572 business application for electronic payments forms ampamp publications

Effortlessly Prepare TC 572, Business Application For Electronic Payments Forms & Publications on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without hassle. Manage TC 572, Business Application For Electronic Payments Forms & Publications on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign TC 572, Business Application For Electronic Payments Forms & Publications with Ease

- Locate TC 572, Business Application For Electronic Payments Forms & Publications and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which can be completed in seconds and is legally equivalent to a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and eSign TC 572, Business Application For Electronic Payments Forms & Publications to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 572 business application for electronic payments forms ampamp publications

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is tc 572 in airSlate SignNow?

TC 572 refers to a specific compliance standard that airSlate SignNow adheres to while providing electronic signature solutions. This ensures that all documents signed using our platform meet regulatory requirements and provide a secure and legal way to execute important agreements.

-

How does airSlate SignNow help with tc 572 compliance?

airSlate SignNow streamlines your document management processes to comply with tc 572 by implementing robust security measures and authentication methods. Our platform ensures that every eSignature is backed by encryption and audit trails that verify the legitimacy of the signed documents.

-

What features does airSlate SignNow offer to support tc 572 requirements?

AirSlate SignNow includes features like custom workflows, real-time document tracking, and multi-factor authentication, all of which support tc 572 standards. These features not only enhance security but also improve the efficiency of document signing processes for businesses.

-

Is airSlate SignNow cost-effective for businesses needing tc 572 compliance?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to meet tc 572 compliance. Our pricing plans are designed to fit various business sizes and needs, ensuring you get maximum value without compromising on compliance or security.

-

What are the benefits of using airSlate SignNow for tc 572 adherence?

Using airSlate SignNow for tc 572 adherence allows businesses to simplify their documentation processes while maintaining regulatory compliance. This leads to faster turnaround times for contracts and agreements, enhancing customer satisfaction and operational efficiency.

-

Can airSlate SignNow integrate with other tools for tc 572 compliance?

Absolutely! AirSlate SignNow supports seamless integrations with various software solutions, helping businesses achieve tc 572 compliance without disrupting their workflows. This interoperability enhances productivity by allowing users to manage documents from their existing systems.

-

What types of documents can I sign with airSlate SignNow to remain compliant with tc 572?

You can sign a wide variety of documents using airSlate SignNow and still remain compliant with tc 572, including contracts, NDAs, and forms. The platform ensures that all signed documents are legally binding and compliant with relevant regulations.

Get more for TC 572, Business Application For Electronic Payments Forms & Publications

Find out other TC 572, Business Application For Electronic Payments Forms & Publications

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document