Vt Use Form

What is the Vt Use?

The Vt Use refers to the Vermont Use Tax, which is a tax imposed on the use of tangible personal property or certain services in Vermont when sales tax has not been paid. This tax applies to items purchased outside Vermont but used within the state, ensuring that local businesses are not disadvantaged by out-of-state purchases. Understanding the Vt Use is essential for residents and businesses to comply with state tax laws and avoid penalties.

Steps to complete the Vt Use

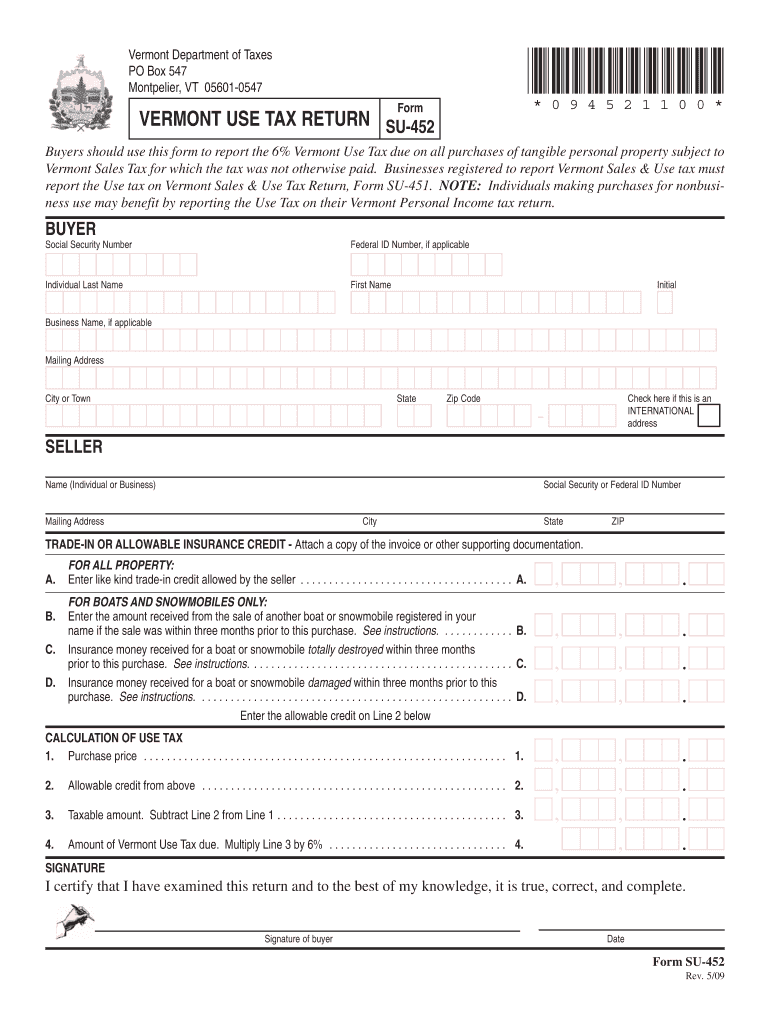

Completing the Vt Use involves several key steps to ensure accurate filing. First, gather all relevant purchase receipts for items bought outside Vermont. Next, determine the total value of these purchases. After that, calculate the use tax owed based on the current Vermont use tax rate. Finally, fill out the appropriate form, typically the Form SU-452, and submit it either online or via mail. Keeping detailed records of all transactions will facilitate the process and ensure compliance.

Legal use of the Vt Use

The legal use of the Vt Use tax is governed by state laws that require residents and businesses to report and pay taxes on items purchased without sales tax. This includes items bought from out-of-state retailers or online. Compliance with these laws is crucial, as failure to report use tax can lead to penalties and interest charges. The Vermont Department of Taxes provides guidelines to help taxpayers understand their obligations under the law.

Filing Deadlines / Important Dates

Filing deadlines for the Vt Use tax are typically aligned with annual tax filing dates. For most taxpayers, the deadline to file the Form SU-452 is April 15 of each year. However, businesses may have different deadlines based on their fiscal year. It is important to stay updated on any changes to these deadlines to avoid late fees and penalties. Keeping a calendar of important tax dates can help ensure compliance.

Required Documents

To complete the Vt Use tax filing, certain documents are required. Taxpayers should have receipts or invoices for all purchases made outside Vermont that are subject to use tax. Additionally, previous tax returns may be helpful for reference. If applicable, documentation proving the tax rate applied to the purchases should also be included. Collecting these documents in advance can streamline the filing process.

Who Issues the Form

The Form SU-452, which is used for reporting and paying the Vermont Use tax, is issued by the Vermont Department of Taxes. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and support for individuals and businesses to help them understand their tax obligations and complete the necessary forms accurately.

Quick guide on how to complete vt use

Complete Vt Use seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Vt Use on any gadget using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign Vt Use with ease

- Locate Vt Use and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Vt Use and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vt use

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to vt su?

airSlate SignNow is an efficient platform designed for businesses to send and eSign documents quickly and securely. With a focus on vt su, it streamlines the document workflow, making it easier for users to manage their signing tasks.

-

How much does airSlate SignNow cost for vt su users?

The pricing for airSlate SignNow varies depending on the plan you choose, with options designed to cater to different business sizes and needs. For vt su users, cost-effective subscriptions are available that provide comprehensive features without breaking the budget.

-

What features does airSlate SignNow offer for vt su?

airSlate SignNow offers a variety of features tailored for vt su, including customizable templates, real-time tracking of document status, and integration with popular applications. These features help streamline the document management process, enhancing productivity.

-

Can I integrate other tools with airSlate SignNow for vt su?

Yes, airSlate SignNow supports integration with numerous third-party applications, streamlining workflows for vt su users. This compatibility allows businesses to connect their existing tools and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for vt su?

Utilizing airSlate SignNow for vt su provides multiple benefits, including increased efficiency, reduced turnaround time, and improved document security. This empowers businesses to manage their electronic signatures effectively and maintain compliance.

-

Is airSlate SignNow secure for processing vt su documents?

Absolutely. airSlate SignNow implements advanced security measures to protect your vt su documents, including encryption and secure access protocols. This ensures that your sensitive information remains safe throughout the signing process.

-

How does airSlate SignNow enhance collaboration for vt su teams?

airSlate SignNow enhances collaboration for vt su teams by allowing multiple users to review and sign documents simultaneously. This feature facilitates team efficiency and speeds up the overall document approval process.

Get more for Vt Use

Find out other Vt Use

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template