Tax Alaska 2019-2026

What is the Tax Alaska

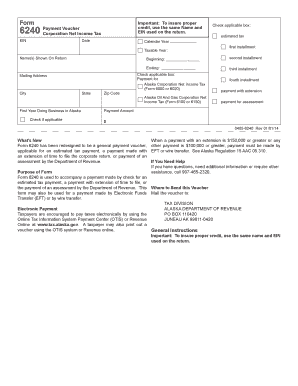

The Tax Alaska form is a crucial document for individuals and businesses operating in Alaska, designed to facilitate the reporting of tax information to the state government. This form captures various financial details necessary for determining tax obligations, ensuring compliance with state regulations. Understanding the purpose and requirements of the Tax Alaska form is essential for accurate filing and to avoid potential penalties.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, carefully fill out the form, paying close attention to each section to avoid errors. After completing the form, review it thoroughly for accuracy. Finally, submit the form by the specified deadline, either electronically or via mail, depending on your preference and the requirements set by the state.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws and regulations. This form must be completed truthfully and accurately to reflect an individual’s or business’s financial situation. Falsifying information on the form can lead to serious legal consequences, including fines and penalties. It is essential to adhere to all guidelines provided by the state to ensure that the form is legally binding and accepted by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical to avoid penalties and interest on unpaid taxes. Typically, the deadline aligns with the federal tax filing dates, but it is important to verify specific state deadlines each year. Mark your calendar with these dates to ensure timely submission. Additionally, be aware of any extensions that may be available if you require more time to complete your filing.

Required Documents

To successfully complete the Tax Alaska form, several documents are required. These typically include proof of income, such as W-2s or 1099s, records of deductions, and any relevant financial statements. Having these documents on hand will streamline the completion process and help ensure that all necessary information is accurately reported on the form.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with state tax laws. It is advisable to check their official website or contact them directly for the most current version of the form and any updates regarding filing procedures and requirements.

Examples of using the Tax Alaska

Examples of using the Tax Alaska form include individuals filing their annual income tax returns and businesses reporting their earnings for the year. For instance, a self-employed individual may use the form to report income from their business activities, while a corporation would use it to declare corporate earnings and pay applicable taxes. Each scenario requires careful attention to detail to ensure compliance with state tax laws.

Quick guide on how to complete tax alaska 6967200

Complete Tax Alaska effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the resources you need to generate, modify, and electronically sign your documents swiftly without delays. Manage Tax Alaska on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Efficiently edit and eSign Tax Alaska without hassle

- Obtain Tax Alaska and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize essential sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you prefer to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Alaska and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967200

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967200

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to Tax Alaska?

airSlate SignNow is an eSigning solution designed to streamline the document signing process for businesses in Alaska. It enhances efficiency and reduces paperwork, making it easier to manage Tax Alaska-related documents securely and quickly.

-

How does airSlate SignNow handle compliance with Tax Alaska regulations?

airSlate SignNow ensures that all electronic signatures comply with legal standards in Alaska, including IRS regulations related to Tax Alaska. This means you can confidently send and receive tax documents knowing they meet all necessary compliance requirements.

-

What features of airSlate SignNow are beneficial for managing Tax Alaska documents?

AirSlate SignNow offers robust features such as templates, customizable workflows, and secure storage to effectively manage Tax Alaska documents. These tools help streamline the signing process while ensuring that your sensitive information is well protected.

-

Is airSlate SignNow cost-effective for businesses dealing with Tax Alaska?

Yes, airSlate SignNow provides a cost-effective solution for managing Tax Alaska documentation. With flexible pricing plans, businesses can choose options that fit their needs without overspending, optimizing their operational costs related to document management.

-

Can I integrate airSlate SignNow with other tools for managing Tax Alaska?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications that are crucial for managing Tax Alaska processes. This connectivity enhances overall productivity by allowing you to manage all aspects of your tax documents within a single platform.

-

How does airSlate SignNow improve the security of Tax Alaska documents?

Security is paramount with airSlate SignNow as it employs top-notch encryption and secure cloud storage to protect Tax Alaska documents. These measures ensure that your sensitive tax information remains confidential and safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for Tax Alaska submissions?

Using airSlate SignNow for Tax Alaska submissions simplifies the process by reducing the time spent on paperwork. Additionally, it allows for tracking document statuses and providing notifications, which helps businesses remain organized and meet tax deadlines efficiently.

Get more for Tax Alaska

Find out other Tax Alaska

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online