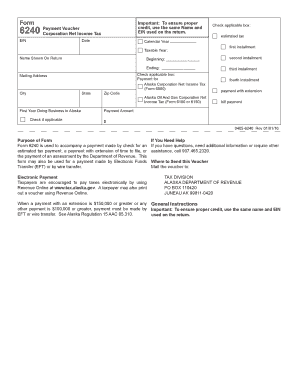

Tax Alaska 2016

What is the Tax Alaska

The Tax Alaska form is a specific document used for tax purposes within the state of Alaska. It serves various functions, including reporting income, calculating tax liabilities, and ensuring compliance with state tax regulations. Understanding this form is essential for residents and businesses operating in Alaska, as it outlines the necessary information required by the state tax authority.

How to use the Tax Alaska

Using the Tax Alaska form involves several steps that ensure accurate reporting and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring that all sections are completed accurately. After filling it out, review the information for any errors before submitting it to the appropriate state tax office. Utilizing digital tools can streamline this process, allowing for easy editing and eSigning.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant financial documents, including W-2s, 1099s, and other income statements.

- Download or access the Tax Alaska form from the state tax authority’s website.

- Fill out the form, providing accurate information in each section.

- Double-check all entries for accuracy, ensuring that calculations are correct.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form by the specified deadline, either online or by mail.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws and regulations. To be considered valid, the form must be filled out completely and accurately, with all required signatures. Compliance with state guidelines ensures that the form is accepted by tax authorities and that taxpayers meet their legal obligations. Digital signatures are recognized as legally binding, provided they adhere to the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are crucial for taxpayers to avoid penalties. Typically, the deadline aligns with the federal tax filing date, which is April fifteenth. However, taxpayers should verify specific dates for the current tax year, as extensions or changes may apply. Keeping track of these important dates helps ensure timely submissions and compliance with state tax regulations.

Required Documents

When completing the Tax Alaska form, several documents are required to provide accurate information. These include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents ready facilitates a smoother completion process and helps ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Tax Alaska form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the state tax authority's website, which often allows for quicker processing.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, which may be useful for those needing assistance.

Choosing the appropriate submission method can depend on personal preference and the urgency of processing.

Quick guide on how to complete tax alaska 6967199

Effortlessly Prepare Tax Alaska on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Tax Alaska on any device using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and electronically sign Tax Alaska with ease

- Locate Tax Alaska and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that task.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your delivery method for your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Tax Alaska and maintain exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967199

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967199

How to make an eSignature for the Tax Alaska 6967199 in the online mode

How to generate an eSignature for the Tax Alaska 6967199 in Chrome

How to make an electronic signature for putting it on the Tax Alaska 6967199 in Gmail

How to generate an electronic signature for the Tax Alaska 6967199 from your mobile device

How to generate an electronic signature for the Tax Alaska 6967199 on iOS devices

How to generate an eSignature for the Tax Alaska 6967199 on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Tax Alaska?

airSlate SignNow is a powerful tool that facilitates the electronic signing and sending of documents, specifically useful for managing Tax Alaska forms and submissions. By using this solution, businesses can streamline their tax processes in Alaska while ensuring compliance with local regulations.

-

How does airSlate SignNow simplify the process for Tax Alaska clients?

With airSlate SignNow, Tax Alaska clients can easily create, send, and eSign their tax documents online. The platform reduces paperwork, enhances efficiency, and helps ensure that all tax documents are securely stored and easily accessible, making tax filing less cumbersome.

-

What pricing plans does airSlate SignNow offer for handling Tax Alaska documents?

airSlate SignNow provides flexible pricing plans tailored to different business needs, including options for individuals working with Tax Alaska documentation. Pricing is transparent, and you can choose a plan based on the number of users and features necessary for effective document management related to taxes.

-

What key features does airSlate SignNow provide for Tax Alaska transactions?

airSlate SignNow boasts features such as customizable templates, automated workflows, and an intuitive eSigning process, all essential for managing Tax Alaska submissions efficiently. These features help businesses streamline their tax-related operations while ensuring compliance.

-

Is airSlate SignNow secure for handling sensitive Tax Alaska information?

Yes, airSlate SignNow employs industry-standard security measures to protect sensitive Tax Alaska information. The platform utilizes data encryption, secure storage, and compliance with legal regulations, ensuring that your tax documents remain safe and confidential.

-

How can airSlate SignNow integrate with other software for Tax Alaska purposes?

airSlate SignNow seamlessly integrates with various software solutions such as CRM systems and accounting tools, enhancing the management of Tax Alaska documentation. This allows users to sync their data effortlessly, improving overall workflow and efficiency.

-

What benefits can businesses expect from using airSlate SignNow for Tax Alaska?

By utilizing airSlate SignNow for Tax Alaska, businesses can expect increased productivity due to faster document turnaround times, reduced costs from less paperwork, and improved accuracy in tax submissions. These benefits help organizations focus on their core operations while efficiently managing tax obligations.

Get more for Tax Alaska

- Parenting plan montana form

- Telemarketing registration application montana department of doj mt form

- Menu template printable form

- Cfs 068 financial statement dphhs mt form

- Your inventory for keeping everyone safe department of public dphhs mt form

- Provideramp39s guide to the first health authorization process mar 04 dphhs mt form

- Nonprofit application for organization certificate of exemption ndbf ne form

- Notice of right to cure auto loan letter template form

Find out other Tax Alaska

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure