Tax Alaska 2013

What is the Tax Alaska

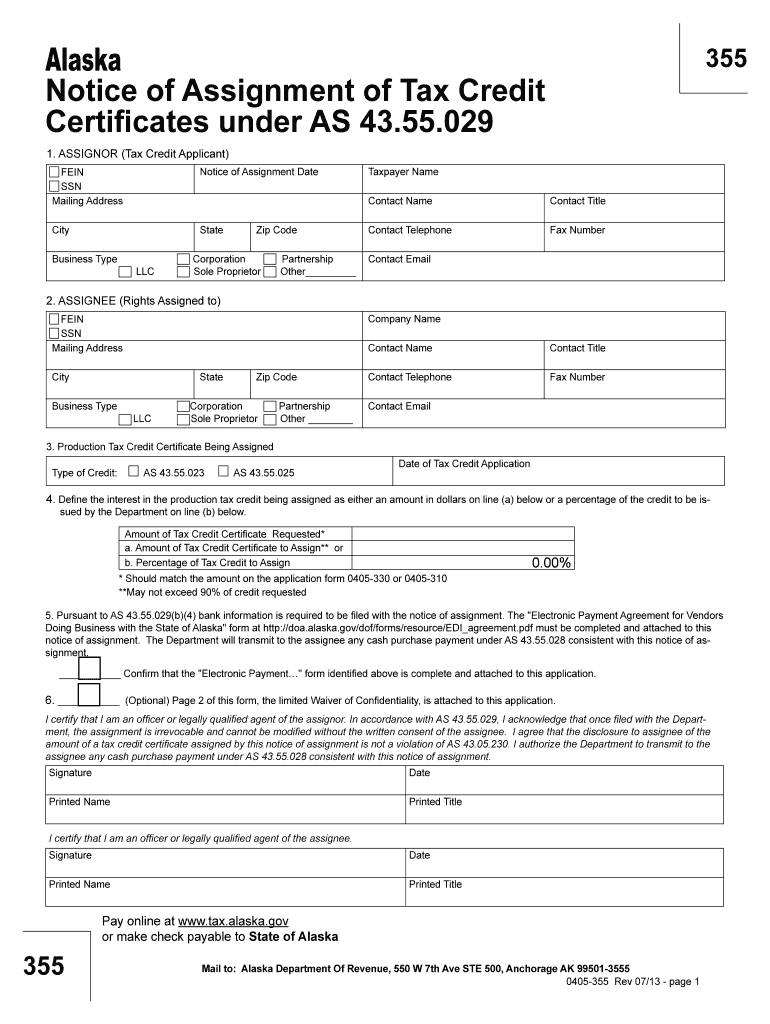

The Tax Alaska form is a specific document used by residents and businesses in Alaska to report their income and calculate their tax obligations. This form is essential for ensuring compliance with state tax laws and regulations. It captures various financial details, including income sources, deductions, and credits applicable to Alaskan taxpayers. Understanding the purpose and requirements of this form is crucial for accurate tax filing.

How to use the Tax Alaska

Using the Tax Alaska form involves several straightforward steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with accurate information regarding your income, deductions, and any applicable credits. It is important to follow the instructions provided with the form carefully to avoid errors. After completing the form, review it for accuracy before submission.

Steps to complete the Tax Alaska

Completing the Tax Alaska form can be done efficiently by following these steps:

- Collect all relevant financial documents, such as income statements and receipts for deductions.

- Download the Tax Alaska form from the official state website or obtain a physical copy.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check your entries for any mistakes or missing information.

- Sign and date the form where required.

- Submit the completed form by the specified deadline, either online or via mail.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws. To ensure that the form is legally binding, it must be filled out accurately and submitted by the designated deadline. Additionally, using electronic signatures via a reliable platform can enhance the legal validity of the document. Compliance with all relevant regulations is essential to avoid potential penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are crucial for compliance. Typically, the deadline for submitting the form aligns with federal tax deadlines, but it is essential to verify specific dates for Alaska. Taxpayers should mark their calendars for any important dates, including the start of the tax season, the final filing deadline, and any extensions that may apply. Staying informed about these dates helps avoid late penalties.

Required Documents

To complete the Tax Alaska form accurately, several documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Receipts for deductible expenses

- Records of any tax credits claimed

- Previous year’s tax return for reference

Having these documents ready will streamline the completion of the form and ensure all necessary information is included.

Form Submission Methods (Online / Mail / In-Person)

The Tax Alaska form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online using the state’s tax portal, which often provides a faster processing time. Alternatively, the form can be mailed directly to the appropriate tax office or submitted in person at designated locations. Each method has its own advantages, so selecting the one that best fits individual needs is important.

Quick guide on how to complete tax alaska 6967298

Easily prepare Tax Alaska on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Tax Alaska on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Tax Alaska effortlessly

- Locate Tax Alaska and then click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate creating new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tax Alaska and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967298

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967298

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What features does airSlate SignNow offer for handling Tax Alaska documents?

airSlate SignNow provides comprehensive features for managing Tax Alaska documents, including eSignature capabilities, document templates, and an intuitive interface. These tools help streamline your tax-related processes efficiently. You can also track document status and ensure compliance with necessary regulations.

-

How does airSlate SignNow ensure compliance with Tax Alaska regulations?

airSlate SignNow is designed to comply with various regulations, including those relevant to Tax Alaska. The platform incorporates security features and audit trails that help maintain compliance with state and federal laws, ensuring your documents are both secure and legally binding.

-

Is airSlate SignNow cost-effective for businesses managing Tax Alaska forms?

Yes, airSlate SignNow is a cost-effective solution for businesses handling Tax Alaska forms. With competitive pricing plans, it allows users to access advanced features without breaking the bank. This makes it an economical choice for businesses of all sizes looking to manage tax documentation efficiently.

-

Can airSlate SignNow integrate with other financial software for Tax Alaska?

airSlate SignNow offers seamless integrations with various financial software and applications, making it easy to manage Tax Alaska documents. By connecting with tools like accounting software, businesses can automatically sync their tax forms and data, simplifying the overall process.

-

What are the benefits of using airSlate SignNow for my Tax Alaska needs?

Using airSlate SignNow for your Tax Alaska needs can signNowly improve your document management process. The platform enhances efficiency through faster eSigning, reduces paper waste, and provides easy access to documents anytime, anywhere. This can lead to improved productivity and streamlined workflows.

-

How does the electronic signing process work with Tax Alaska documents in airSlate SignNow?

The electronic signing process for Tax Alaska documents in airSlate SignNow is straightforward. You upload your document, add recipient information, and request signatures. Signers receive an email notification to review and sign, and once completed, you'll get a fully executed copy in your account.

-

What level of security does airSlate SignNow provide for Tax Alaska documentation?

airSlate SignNow prioritizes the security of your Tax Alaska documentation through robust encryption and secure data storage. This ensures that all documents and personal information remain confidential and protected from unauthorized access. Regular security audits further enhance the platform’s reliability.

Get more for Tax Alaska

Find out other Tax Alaska

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors