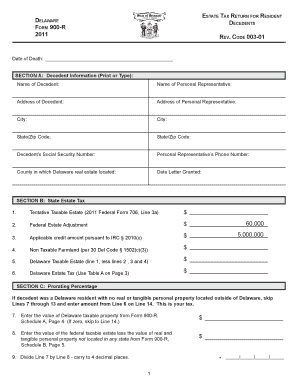

Delaware Form 900 R Instructions 2011

What is the Delaware Form 900 R Instructions

The Delaware Form 900 R Instructions provide guidance for individuals and businesses on how to complete the Delaware Corporate Income Tax Return. This form is essential for reporting income earned by corporations operating within the state. The instructions detail the necessary steps to ensure compliance with state tax laws, including the specific information required for accurate filing.

Steps to complete the Delaware Form 900 R Instructions

Completing the Delaware Form 900 R requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the identification section with the corporation's name, address, and federal Employer Identification Number (EIN).

- Report total income and allowable deductions accurately to determine taxable income.

- Calculate the tax owed based on the applicable tax rates for corporations in Delaware.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Delaware Form 900 R Instructions

The Delaware Form 900 R Instructions are legally binding and must be followed to ensure compliance with state tax regulations. Proper execution of the form is critical for avoiding penalties and ensuring that the corporation meets its tax obligations. The instructions outline the legal requirements for filing, including deadlines and necessary documentation, to maintain compliance with Delaware law.

Filing Deadlines / Important Dates

Timely filing of the Delaware Form 900 R is crucial to avoid penalties. The standard deadline for submitting the form is typically the first day of the fourth month following the end of the corporation's fiscal year. Corporations should be aware of any specific extensions or changes in deadlines that may apply, especially in light of any updates from the Delaware Division of Revenue.

Who Issues the Form

The Delaware Form 900 R is issued by the Delaware Division of Revenue. This state agency is responsible for the administration of tax laws and the collection of state revenue. Corporations must refer to the Division of Revenue for the most current version of the form and any updates to the filing process or requirements.

Required Documents

When completing the Delaware Form 900 R, certain documents are required to support the information reported. These may include:

- Financial statements, including balance sheets and income statements.

- Records of all deductions claimed, such as business expenses.

- Proof of any credits or incentives claimed under Delaware tax law.

Digital vs. Paper Version

The Delaware Form 900 R can be submitted in both digital and paper formats. The digital version allows for quicker processing and may offer benefits such as electronic confirmation of receipt. However, some corporations may prefer the traditional paper method for record-keeping purposes. It is essential to follow the submission guidelines provided by the Delaware Division of Revenue for either format.

Quick guide on how to complete delaware form 900 r instructions 5715196

Complete Delaware Form 900 R Instructions effortlessly on any device

Managing documents online has become increasingly popular with businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Delaware Form 900 R Instructions on any device using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and electronically sign Delaware Form 900 R Instructions with ease

- Locate Delaware Form 900 R Instructions and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your changes.

- Select how you wish to send your form, either by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Delaware Form 900 R Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware form 900 r instructions 5715196

Create this form in 5 minutes!

How to create an eSignature for the delaware form 900 r instructions 5715196

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What are the Delaware Form 900 R instructions?

The Delaware Form 900 R instructions provide guidance on how to accurately complete the form required for corporate franchise tax filing in Delaware. These instructions detail necessary information, payment guidelines, and deadlines to ensure compliance with state requirements.

-

How can airSlate SignNow help with Delaware Form 900 R instructions?

airSlate SignNow simplifies the process of completing the Delaware Form 900 R instructions by allowing users to fill out and eSign documents online. With its user-friendly interface, businesses can manage their tax filings efficiently while minimizing errors.

-

Is there a cost associated with using airSlate SignNow for Delaware Form 900 R instructions?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective. The pricing options vary based on features and usage, ensuring that businesses can select a plan that fits their needs while easily managing their Delaware Form 900 R instructions.

-

What features does airSlate SignNow offer for managing Delaware Form 900 R instructions?

airSlate SignNow offers a variety of features to streamline managing Delaware Form 900 R instructions, including document templates, cloud storage, and electronic signature capabilities. These features ensure that all necessary documents can be handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for Delaware Form 900 R instructions?

Absolutely! airSlate SignNow allows seamless integrations with various software solutions that businesses commonly use. This means you can coordinate the completion of Delaware Form 900 R instructions with your existing tools to enhance workflow and productivity.

-

What benefits does airSlate SignNow provide for handling Delaware Form 900 R instructions?

Using airSlate SignNow for Delaware Form 900 R instructions offers multiple benefits, including time savings, reduced paperwork, and enhanced accuracy. The platform's secure eSign capabilities help ensure that all documents are executed promptly, meeting statutory requirements efficiently.

-

Are there any tutorials available for Delaware Form 900 R instructions on airSlate SignNow?

Yes, airSlate SignNow provides various tutorials and resources to help users understand the Delaware Form 900 R instructions. These resources guide users through the necessary steps and features, making it easier for them to complete their forms correctly.

Get more for Delaware Form 900 R Instructions

Find out other Delaware Form 900 R Instructions

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure