ST 28B Ksrevenue 2014

What is the ST 28B Ksrevenue

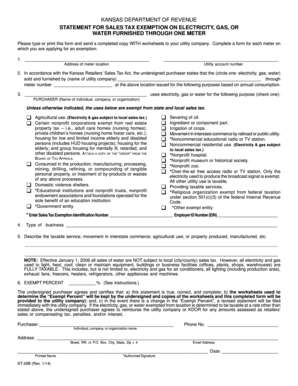

The ST 28B Ksrevenue form is a document used primarily for sales tax exemption purposes in the United States. This form allows eligible organizations, such as non-profits or government entities, to purchase goods and services without paying sales tax. By providing this form to vendors, the exempt organization can ensure compliance with state tax regulations while avoiding unnecessary expenses.

How to use the ST 28B Ksrevenue

To effectively use the ST 28B Ksrevenue form, follow these steps:

- Obtain the form from your state's revenue department website or office.

- Complete the required fields, including the name of the exempt organization, address, and tax identification number.

- Provide a detailed description of the items or services being purchased.

- Sign and date the form to validate its authenticity.

- Present the completed form to the vendor at the time of purchase.

Steps to complete the ST 28B Ksrevenue

Completing the ST 28B Ksrevenue form involves a few straightforward steps:

- Gather necessary information about your organization, including its legal name and tax ID.

- Fill out the form accurately, ensuring all details are correct to avoid delays.

- Review the form for completeness and accuracy.

- Sign the form, confirming that the information provided is truthful and that the organization qualifies for the exemption.

- Keep a copy of the completed form for your records.

Legal use of the ST 28B Ksrevenue

The legal use of the ST 28B Ksrevenue form is essential for maintaining compliance with state tax laws. When used correctly, this form protects organizations from sales tax liability on exempt purchases. It is crucial that the organization meets the eligibility criteria established by state law, as misuse of the form can lead to penalties or fines. Always ensure that the form is presented to vendors properly to validate the tax-exempt status.

Key elements of the ST 28B Ksrevenue

Key elements of the ST 28B Ksrevenue form include:

- Organization Information: Name, address, and tax identification number.

- Type of Exemption: A clear indication of the reason for tax exemption.

- Description of Purchases: Specific items or services being purchased tax-exempt.

- Signature: Authorized representative's signature to validate the form.

Who Issues the Form

The ST 28B Ksrevenue form is typically issued by the state's revenue department or tax authority. Each state may have its own version of the form, so it is important to obtain the correct document from the appropriate state agency. This ensures that the form complies with local regulations and is accepted by vendors within that jurisdiction.

Quick guide on how to complete st 28b ksrevenue

Complete ST 28B Ksrevenue effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without hold-ups. Manage ST 28B Ksrevenue on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and electronically sign ST 28B Ksrevenue with ease

- Find ST 28B Ksrevenue and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign ST 28B Ksrevenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 28b ksrevenue

Create this form in 5 minutes!

How to create an eSignature for the st 28b ksrevenue

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is the purpose of ST 28B Ksrevenue?

ST 28B Ksrevenue is designed to facilitate the electronic signature and transmission of documents. With airSlate SignNow, businesses can manage this process efficiently while ensuring compliance with state regulations.

-

How does airSlate SignNow help with ST 28B Ksrevenue documentation?

airSlate SignNow simplifies the completion of ST 28B Ksrevenue forms by providing a user-friendly interface for signing and sending documents. This helps businesses streamline their operations and reduce paper waste.

-

What are the pricing plans for airSlate SignNow concerning ST 28B Ksrevenue?

The pricing plans for airSlate SignNow are cost-effective, tailored to suit different business needs in managing ST 28B Ksrevenue documents. Plans range from basic options for small businesses to advanced features for larger enterprises, ensuring affordability for every organization.

-

Can I integrate airSlate SignNow with other software for ST 28B Ksrevenue management?

Yes, airSlate SignNow offers various integrations with popular software applications. This seamless connectivity enhances how businesses handle ST 28B Ksrevenue by allowing them to implement e-signature capabilities within their existing workflows.

-

What benefits does airSlate SignNow provide for handling ST 28B Ksrevenue?

Using airSlate SignNow for ST 28B Ksrevenue offers several benefits including increased efficiency, reduced turnaround times, and enhanced security. These advantages assist in ensuring timely compliance with state requirements.

-

Is airSlate SignNow suitable for all business sizes when dealing with ST 28B Ksrevenue?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, providing the necessary tools for managing ST 28B Ksrevenue documents effectively. Whether you’re a small startup or a large corporation, our solution is versatile enough to meet your needs.

-

How secure is airSlate SignNow for ST 28B Ksrevenue documentation?

airSlate SignNow prioritizes the security of your documents, utilizing advanced encryption and compliance with legal standards. This ensures that your ST 28B Ksrevenue forms remain secure, giving you peace of mind when handling sensitive information.

Get more for ST 28B Ksrevenue

Find out other ST 28B Ksrevenue

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself