KANSAS DEPARTMENT of REVENUE 465818 STATEMENT for SALES TAX 2021-2026

Understanding the Kansas Tax Exemption Form

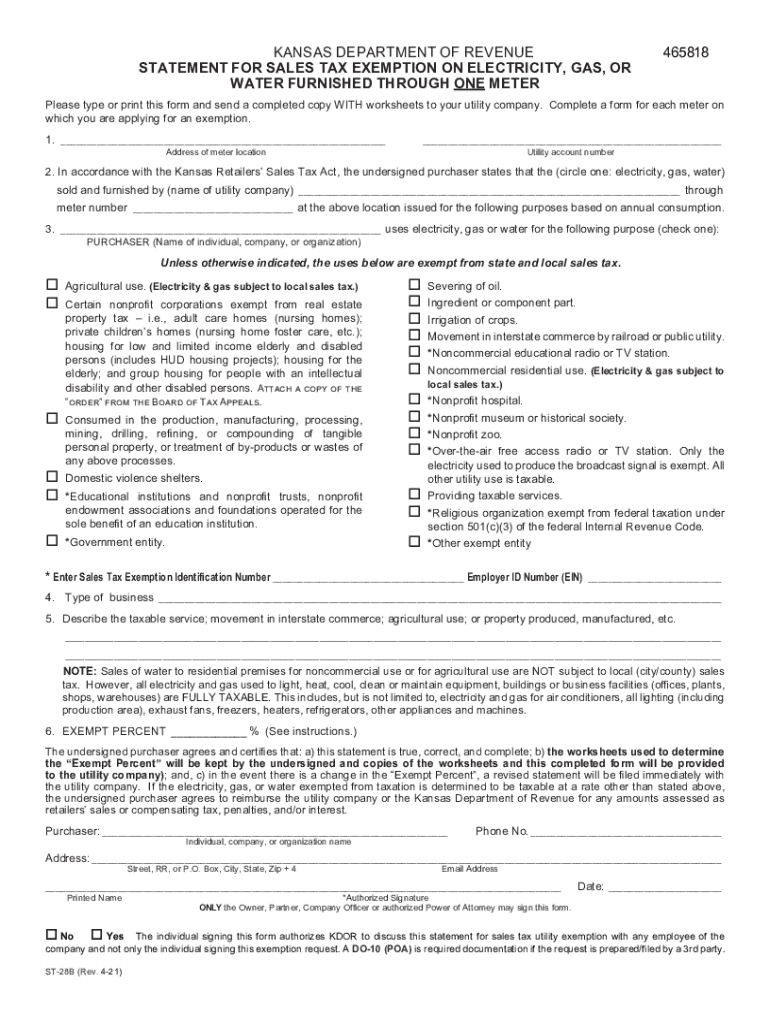

The Kansas tax exemption form, often referred to as the Kansas Department of Revenue 465818 Statement for Sales Tax, is a crucial document used by businesses and individuals to claim sales tax exemptions in the state of Kansas. This form allows eligible entities to purchase goods and services without incurring sales tax, provided they meet specific criteria outlined by the Kansas Department of Revenue. Understanding the purpose and use of this form is essential for ensuring compliance with state tax regulations.

Steps to Complete the Kansas Tax Exemption Form

Completing the Kansas tax exemption form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your business name, address, and tax identification number.

- Identify the specific exemption category that applies to your situation, such as non-profit status or specific business activities.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate vendor or supplier to claim your exemption.

Eligibility Criteria for the Kansas Tax Exemption Form

To qualify for a sales tax exemption in Kansas, applicants must meet certain eligibility criteria. Generally, the following categories may qualify:

- Non-profit organizations, including charities and educational institutions.

- Government entities, such as state and local agencies.

- Businesses engaged in manufacturing or certain agricultural activities.

It is important to review the specific requirements for each category to ensure compliance and successful exemption claims.

Legal Use of the Kansas Tax Exemption Form

The Kansas tax exemption form must be used in accordance with state laws and regulations. Misuse of the form, such as claiming exemptions for ineligible purchases, can lead to penalties and fines. It is essential to understand the legal implications of using this form, including maintaining accurate records of exempt purchases and ensuring that the form is only provided to vendors for eligible transactions.

Form Submission Methods

The Kansas tax exemption form can be submitted through various methods, depending on the vendor's preferences:

- Online Submission: Some vendors may allow electronic submission of the form via email or through their online platforms.

- Mail: The completed form can be printed and mailed directly to the vendor.

- In-Person: Presenting the form in person at the time of purchase is also an option, depending on the vendor's policy.

Key Elements of the Kansas Tax Exemption Form

Several key elements must be included in the Kansas tax exemption form to ensure its validity:

- Business Information: Name, address, and tax identification number of the purchaser.

- Exemption Reason: A clear statement of the reason for the exemption, including applicable statutes.

- Signature: The form must be signed by an authorized representative of the purchasing entity.

Ensuring that all key elements are present will help facilitate the acceptance of the form by vendors.

Quick guide on how to complete kansas department of revenue 465818 statement for sales tax

Prepare KANSAS DEPARTMENT OF REVENUE 465818 STATEMENT FOR SALES TAX effortlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, enabling you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage KANSAS DEPARTMENT OF REVENUE 465818 STATEMENT FOR SALES TAX on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to modify and electronically sign KANSAS DEPARTMENT OF REVENUE 465818 STATEMENT FOR SALES TAX with ease

- Locate KANSAS DEPARTMENT OF REVENUE 465818 STATEMENT FOR SALES TAX and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Verify the information and click on the Done button to save your alterations.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign KANSAS DEPARTMENT OF REVENUE 465818 STATEMENT FOR SALES TAX and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas department of revenue 465818 statement for sales tax

Create this form in 5 minutes!

How to create an eSignature for the kansas department of revenue 465818 statement for sales tax

The best way to generate an e-signature for your PDF file in the online mode

The best way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is the 28b tax form and why do I need it?

The 28b tax form is a crucial document used for reporting specific tax-related information. Understanding its purpose is essential for compliance and ensures your business meets necessary regulatory requirements. With airSlate SignNow, you can easily send and eSign this form digitally, streamlining your administrative tasks.

-

How can airSlate SignNow help me with the 28b tax form?

AirSlate SignNow provides a user-friendly platform that simplifies the process of managing the 28b tax form. You can easily prepare, eSign, and send the document efficiently, making tax season less stressful. Our features help ensure that your forms are completed accurately and delivered on time.

-

Is there a cost associated with using airSlate SignNow for the 28b tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. While there may be a fee, the cost is offset by the time saved and improved accuracy in handling documents like the 28b tax form. We provide a variety of pricing options to ensure you find one that fits your budget.

-

Can I integrate airSlate SignNow with my existing systems for handling the 28b tax form?

Absolutely! AirSlate SignNow seamlessly integrates with multiple platforms and applications, allowing you to manage the 28b tax form within your existing workflow. This integration enhances efficiency and ensures that your document processes are synchronized across systems.

-

What features does airSlate SignNow offer for managing the 28b tax form?

AirSlate SignNow offers several features tailored for handling the 28b tax form, including electronic signatures, templates, and document tracking. These features not only expedite the signing process but also enhance security and ensure compliance for all your documents. You can also automate your workflow to save even more time.

-

Is airSlate SignNow secure for handling sensitive information like the 28b tax form?

Yes, security is a top priority for airSlate SignNow. We utilize advanced encryption and security protocols to protect all documents, including the 28b tax form. Our platform ensures that your sensitive information remains confidential and safe from unauthorized access.

-

How can I ensure the 28b tax form is filled out correctly using airSlate SignNow?

AirSlate SignNow provides smart templates and guidance to help ensure that the 28b tax form is filled out correctly. You can leverage our software to highlight required fields and prevent common errors. This reduces the risk of mistakes and expedites the submission process.

Get more for KANSAS DEPARTMENT OF REVENUE 465818 STATEMENT FOR SALES TAX

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages 497299886 form

- Landlord tenant paid form

- Colorado letter landlord form

- Co lease form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497299890 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement colorado form

- Letter about notice form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants colorado form

Find out other KANSAS DEPARTMENT OF REVENUE 465818 STATEMENT FOR SALES TAX

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free