Ma Form 96 4 How to 2019

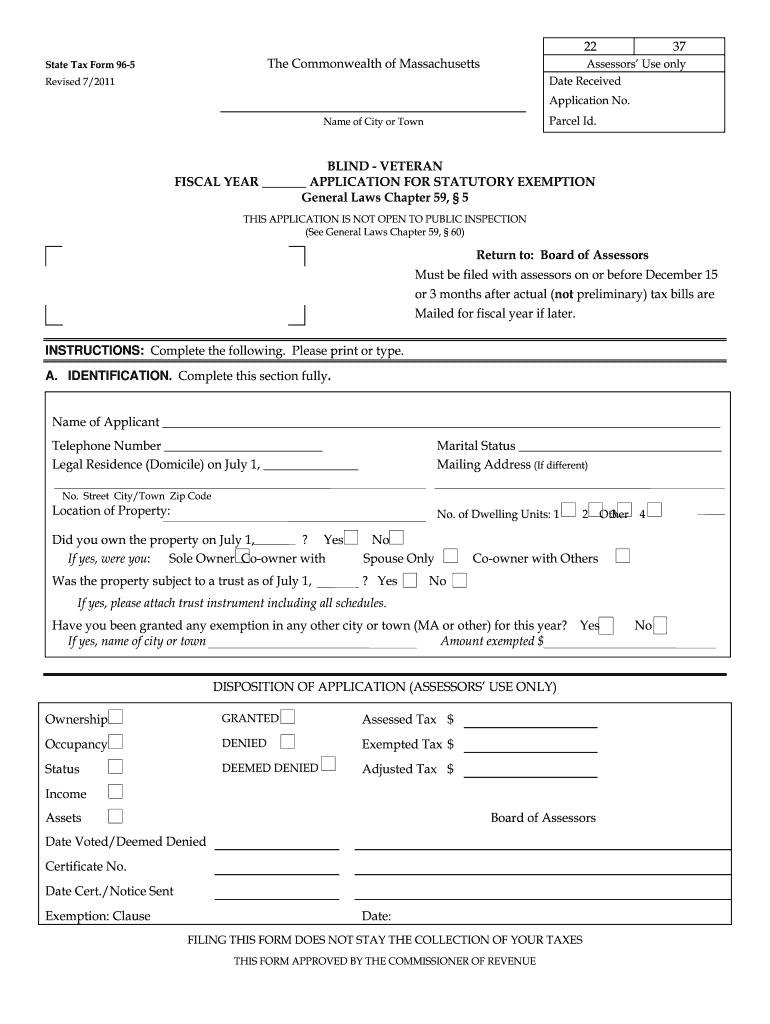

What is the MA Form 96 4?

The MA Form 96 4 is a state-specific tax form utilized in Massachusetts for reporting certain financial information. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It is often required for various tax-related purposes, including income reporting and deductions. Understanding the purpose of this form is crucial for accurate tax filing and maintaining good standing with the Massachusetts Department of Revenue.

Steps to Complete the MA Form 96 4

Completing the MA Form 96 4 involves several key steps to ensure accuracy and compliance. Here is a straightforward process to follow:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions as specified on the form.

- Review your entries for accuracy before submitting.

Legal Use of the MA Form 96 4

The MA Form 96 4 is legally binding when completed correctly and submitted to the appropriate authorities. It must adhere to the regulations set forth by the Massachusetts Department of Revenue. Failing to comply with these legal requirements can result in penalties or issues with your tax status. Therefore, it is important to ensure that all information is accurate and that the form is submitted by the designated deadlines.

Form Submission Methods

There are several methods available for submitting the MA Form 96 4, allowing for flexibility based on individual preferences:

- Online Submission: Many users opt to submit the form electronically through the Massachusetts Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address as specified in the form instructions.

- In-Person: Individuals can also choose to deliver the form in person at designated state tax offices.

Key Elements of the MA Form 96 4

Understanding the key elements of the MA Form 96 4 is essential for accurate completion. Some of the critical components include:

- Personal Information: This section requires your full name, address, and Social Security number.

- Income Details: You must report all sources of income, including wages, interest, and dividends.

- Deductions: The form allows for various deductions that can reduce your taxable income, which must be documented properly.

- Signature: A signature is required to validate the information provided on the form.

Who Issues the MA Form 96 4?

The MA Form 96 4 is issued by the Massachusetts Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. It is important to obtain the most current version of the form directly from the department to ensure compliance with any updates or changes in tax regulations.

Quick guide on how to complete ma form 96 4 how to 56924

Complete Ma Form 96 4 How To effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Ma Form 96 4 How To on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and electronically sign Ma Form 96 4 How To with ease

- Locate Ma Form 96 4 How To and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the paperwork or redact sensitive information with tools that airSlate SignNow specifically provides for such tasks.

- Create your electronic signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Ma Form 96 4 How To to ensure exceptional communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ma form 96 4 how to 56924

Create this form in 5 minutes!

How to create an eSignature for the ma form 96 4 how to 56924

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the ma form 96 4 and how is it used?

The ma form 96 4 is a key document used for various administrative processes in Massachusetts. Understanding how to fill it out correctly is crucial for compliance. By familiarizing yourself with the ma form 96 4 and its requirements, you can ensure a smooth submission process.

-

How can airSlate SignNow help with filing the ma form 96 4?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents like the ma form 96 4. With our intuitive interface, you can complete the form electronically, ensuring that it is filled out correctly and submitted on time. This streamlines the process and minimizes the risk of errors.

-

What features does airSlate SignNow offer for handling the ma form 96 4?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSignature options to simplify completing and submitting the ma form 96 4. Our solution ensures that you have everything you need to manage your documents efficiently and securely. This makes the entire process user-friendly for everyone.

-

Is there a cost associated with using airSlate SignNow for the ma form 96 4?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including options for those who frequently need to complete the ma form 96 4. You can choose a plan that fits your budget while accessing all essential features. Cost-effectiveness is one of the key benefits of using our service.

-

Can I integrate airSlate SignNow with other applications for managing the ma form 96 4?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and Microsoft Office 365. This capability allows you to manage the ma form 96 4 within your existing workflow. Integrating applications can enhance productivity and streamline your document management processes.

-

What benefits can I expect when using airSlate SignNow for the ma form 96 4?

Using airSlate SignNow for the ma form 96 4 provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that sensitive information is protected while making it easy to send and track documents. You'll save time and effort by simplifying your document management.

-

Is airSlate SignNow compliant with regulations related to the ma form 96 4?

Absolutely! airSlate SignNow complies with all necessary regulations, ensuring that your use of the ma form 96 4 adheres to legal requirements. Our commitment to maintaining security and compliance gives you peace of mind when eSigning and managing important documents.

Get more for Ma Form 96 4 How To

Find out other Ma Form 96 4 How To

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed