Form 568 2019

What is the Form 568

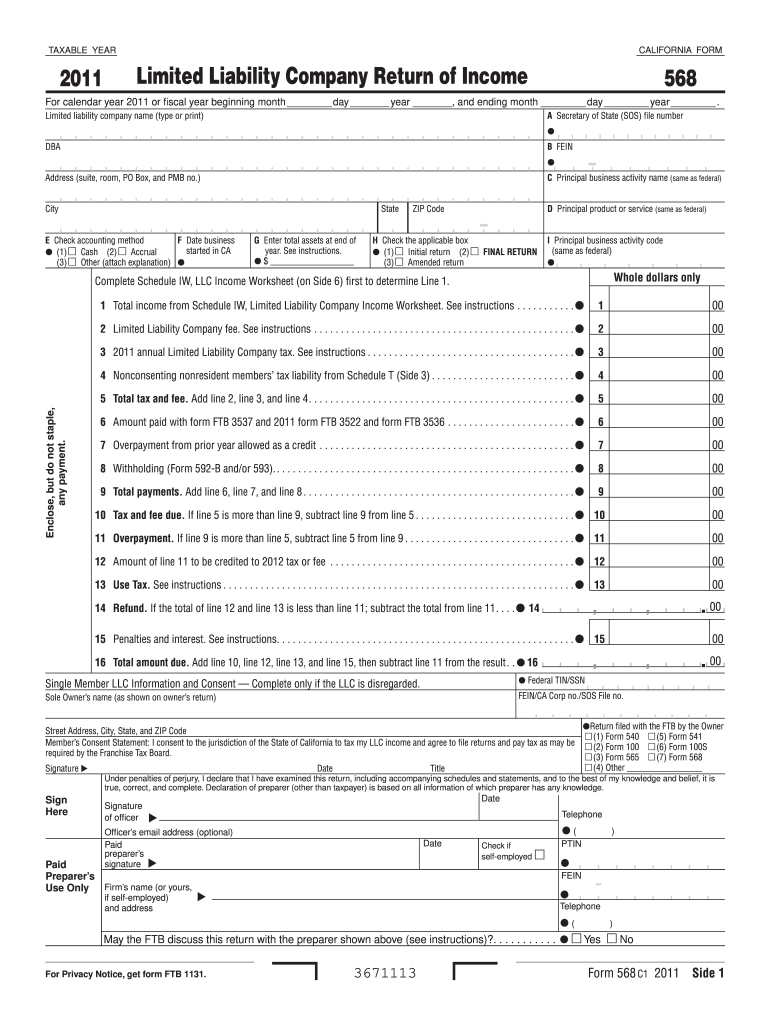

The Form 568 is a tax form used by limited liability companies (LLCs) in California to report their income, deductions, and credits. It is specifically designed for LLCs classified as partnerships or disregarded entities. This form is essential for compliance with California state tax laws and must be filed annually. The information provided on Form 568 helps the California Franchise Tax Board assess the tax obligations of the LLC and its members.

How to use the Form 568

To use the Form 568 effectively, LLCs must gather necessary financial information, including income, expenses, and member details. The form requires accurate reporting of the LLC's total income, deductions, and any applicable credits. After completing the form, it must be submitted to the California Franchise Tax Board by the specified deadline. It is advisable to retain a copy of the submitted form for your records and to ensure compliance with state regulations.

Steps to complete the Form 568

Completing the Form 568 involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the LLC's identifying information, including the name, address, and federal employer identification number (EIN).

- Report total income and allowable deductions on the form.

- Calculate the total tax owed based on the reported income.

- Review the completed form for accuracy before submission.

Legal use of the Form 568

The legal use of Form 568 is governed by California state tax laws. It is crucial for LLCs to ensure that the form is filled out correctly and submitted on time to avoid penalties. The form serves as a declaration of the LLC's financial activities and is legally binding once submitted. Adhering to the filing requirements and deadlines is essential for maintaining good standing with the California Franchise Tax Board.

Filing Deadlines / Important Dates

Filing deadlines for Form 568 are typically set for the 15th day of the fourth month after the end of the LLC's tax year. For most LLCs operating on a calendar year, this means the form is due by April 15. It is important to stay informed about any changes to deadlines or requirements, as failing to file on time can result in penalties and interest on unpaid taxes.

Required Documents

To complete Form 568, several documents are required, including:

- Income statements detailing all revenue generated by the LLC.

- Expense records to substantiate deductions claimed on the form.

- Member information, including names and addresses of all members.

- Federal employer identification number (EIN) documentation.

Penalties for Non-Compliance

Non-compliance with Form 568 filing requirements can lead to significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action by the California Franchise Tax Board. It is essential for LLCs to understand the consequences of failing to file accurately and on time, as this can impact the financial health of the business and its members.

Quick guide on how to complete form 568 2011

Prepare Form 568 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 568 on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 568 with ease

- Locate Form 568 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark essential sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form searches, or errors that require printing new copies of documents. airSlate SignNow meets all your document management needs within just a few clicks from any device of your choice. Modify and eSign Form 568 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 568 2011

Create this form in 5 minutes!

How to create an eSignature for the form 568 2011

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is Form 568 and why is it important?

Form 568 is a tax form used by limited liability companies (LLCs) operating in California. It is important for reporting income, deductions, and paying the LLC annual tax. Understanding how to properly complete and submit Form 568 is essential for compliance and avoiding penalties.

-

How can airSlate SignNow help with Form 568?

airSlate SignNow offers an easy-to-use platform for eSigning and sending documents, including Form 568. With our secure cloud-based service, you can complete and send your Form 568 quickly, ensuring timely submission without the hassle of printing and scanning.

-

Is there a cost associated with using airSlate SignNow for Form 568?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, providing you with the tools to eSign documents like Form 568 and streamline your workflow at an affordable rate.

-

What features does airSlate SignNow provide for managing Form 568?

airSlate SignNow includes several features to assist with managing Form 568, such as customizable templates, secure eSignature technology, and document tracking. These features enhance your ability to efficiently complete and manage regulatory forms while ensuring security and compliance.

-

Can I integrate airSlate SignNow with other business tools for Form 568?

Yes, airSlate SignNow offers integrations with a variety of popular business tools such as CRM systems and accounting software. This allows you to seamlessly manage and submit Form 568 alongside your other business processes, enhancing productivity and reducing manual entry.

-

What are the advantages of using airSlate SignNow for Form 568 submissions?

Using airSlate SignNow for Form 568 submissions simplifies the process by allowing electronic signatures and faster document transactions. This not only saves time but also reduces the risk of errors associated with manual handling of the form, making compliance easier.

-

How secure is the information provided in Form 568 with airSlate SignNow?

AirSlate SignNow prioritizes the security of your documents, including Form 568, by utilizing advanced encryption methods and secure storage solutions. Your sensitive business information is protected, ensuring that only authorized users have access to the documents.

Get more for Form 568

- Nutritional assessment and risk level form

- Football field diagram printable form

- Sar form 5561723

- Blank page notebook online form

- Terminated early unless the agreement contains a break clause or written permission form

- Tupperware order form 46447690

- Application for issue of a duplicate qualification certificate form

- Global market brandon form

Find out other Form 568

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later