Form 84 Application for Relief from Joint Income Tax Mass Gov Mass 2012-2026

What is the Form 84 Application for Relief from Joint Income Tax?

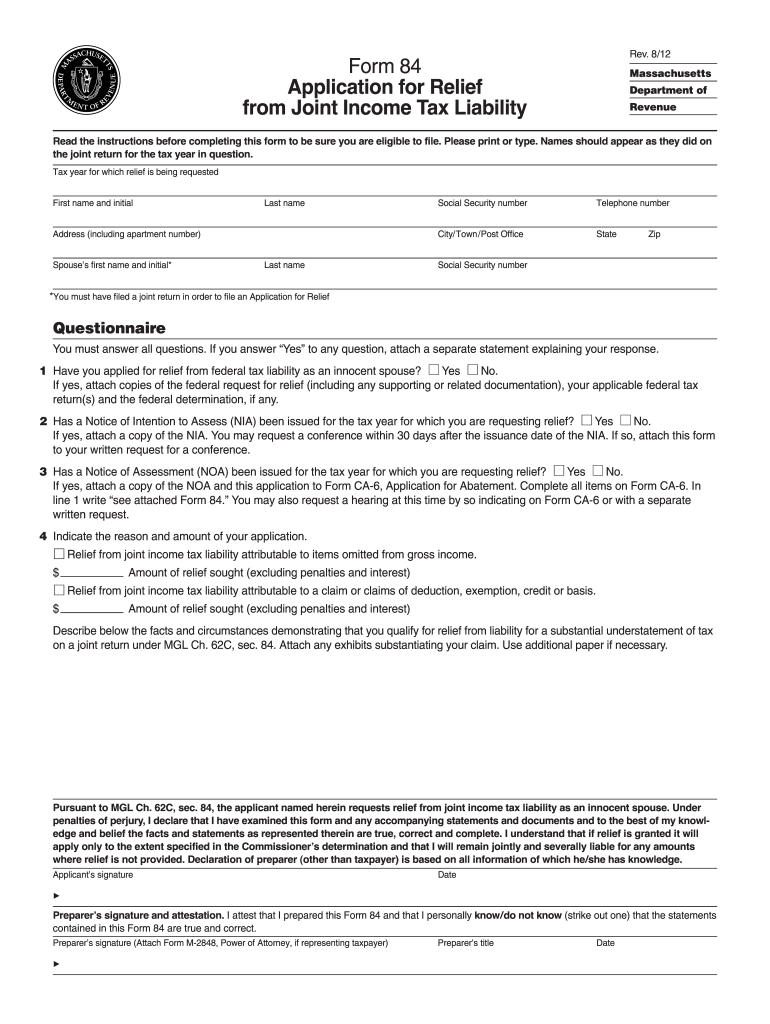

The Form 84 application is a specific document used by taxpayers in Massachusetts to request relief from joint income tax liabilities. This form is particularly relevant for couples who have filed joint tax returns and may be seeking to alleviate tax burdens due to various circumstances, such as divorce or financial hardship. Understanding the purpose of this form is crucial for individuals who find themselves in situations where they believe they should not be held jointly responsible for tax debts incurred during the marriage.

Steps to Complete the Form 84 Application for Relief from Joint Income Tax

Completing the Form 84 requires careful attention to detail to ensure accuracy and compliance with state regulations. Here are the steps to follow:

- Gather necessary documentation, including your joint tax returns and any relevant financial records.

- Fill out the personal information section, ensuring that both parties' names, Social Security numbers, and addresses are correctly entered.

- Provide a detailed explanation of the reasons for seeking relief, including any supporting evidence that demonstrates why you believe relief is warranted.

- Review the completed form for accuracy and completeness before submission.

- Submit the form according to the specified methods, ensuring that you retain a copy for your records.

Eligibility Criteria for the Form 84 Application for Relief from Joint Income Tax

To qualify for relief using the Form 84, applicants must meet specific eligibility criteria set by the Massachusetts Department of Revenue. Generally, eligibility may include:

- Filing a joint tax return for the tax year in question.

- Demonstrating that one spouse was unaware of the tax liability or that the liability was due to the other spouse's actions.

- Providing evidence of financial hardship or other qualifying circumstances that justify the request for relief.

Legal Use of the Form 84 Application for Relief from Joint Income Tax

The legal standing of the Form 84 is supported by various tax laws and regulations within Massachusetts. When properly completed and submitted, the form serves as an official request for the state to reconsider joint tax liabilities. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions or denial of the request.

How to Obtain the Form 84 Application for Relief from Joint Income Tax

The Form 84 can be obtained through the Massachusetts Department of Revenue's official website or by contacting their office directly. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the submission process. Additionally, local tax offices may provide physical copies of the form for convenience.

Form Submission Methods for the Form 84 Application for Relief from Joint Income Tax

Submitting the Form 84 can be done through various methods, ensuring flexibility for taxpayers. The available submission options typically include:

- Online submission via the Massachusetts Department of Revenue's e-filing system.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices, where assistance may also be available.

Quick guide on how to complete form 84 application for relief from joint income tax massgov mass

Prepare Form 84 Application For Relief From Joint Income Tax Mass Gov Mass easily on any device

Web-based document management has become increasingly popular among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Form 84 Application For Relief From Joint Income Tax Mass Gov Mass on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to adjust and eSign Form 84 Application For Relief From Joint Income Tax Mass Gov Mass without hassle

- Obtain Form 84 Application For Relief From Joint Income Tax Mass Gov Mass and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 84 Application For Relief From Joint Income Tax Mass Gov Mass and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

Create this form in 5 minutes!

How to create an eSignature for the form 84 application for relief from joint income tax massgov mass

How to make an electronic signature for the Form 84 Application For Relief From Joint Income Tax Massgov Mass in the online mode

How to create an electronic signature for your Form 84 Application For Relief From Joint Income Tax Massgov Mass in Chrome

How to make an electronic signature for signing the Form 84 Application For Relief From Joint Income Tax Massgov Mass in Gmail

How to generate an electronic signature for the Form 84 Application For Relief From Joint Income Tax Massgov Mass straight from your smartphone

How to make an electronic signature for the Form 84 Application For Relief From Joint Income Tax Massgov Mass on iOS

How to generate an electronic signature for the Form 84 Application For Relief From Joint Income Tax Massgov Mass on Android

People also ask

-

What is the Form 84 Application For Relief From Joint Income Tax Mass Gov Mass?

The Form 84 Application For Relief From Joint Income Tax Mass Gov Mass is a legal document used by married couples in Massachusetts to request relief from joint tax liabilities. This form allows taxpayers to separate their tax responsibilities and can be crucial for those facing financial difficulties. Understanding its purpose is essential for effective tax management.

-

How can airSlate SignNow assist with the Form 84 Application For Relief From Joint Income Tax Mass Gov Mass?

airSlate SignNow provides a streamlined platform that allows users to easily fill out and eSign the Form 84 Application For Relief From Joint Income Tax Mass Gov Mass. With our user-friendly interface, you can quickly create, edit, and securely send your application, ensuring you meet all state requirements efficiently.

-

What features does airSlate SignNow offer for managing the Form 84 Application For Relief From Joint Income Tax Mass Gov Mass?

With airSlate SignNow, you can benefit from features like customizable templates, real-time tracking, and cloud storage for your Form 84 Application For Relief From Joint Income Tax Mass Gov Mass. Additionally, our platform supports electronic signatures, making the submission process faster and more convenient.

-

Is there a cost associated with using airSlate SignNow for the Form 84 Application For Relief From Joint Income Tax Mass Gov Mass?

Yes, airSlate SignNow offers various pricing plans depending on your needs, starting with a free trial. Our cost-effective solution ensures that you can manage the Form 84 Application For Relief From Joint Income Tax Mass Gov Mass and other documents without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for the Form 84 Application For Relief From Joint Income Tax Mass Gov Mass?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Dropbox, enhancing your workflow while managing the Form 84 Application For Relief From Joint Income Tax Mass Gov Mass. This integration simplifies document management and storage.

-

What are the benefits of using airSlate SignNow for my Form 84 Application For Relief From Joint Income Tax Mass Gov Mass?

Using airSlate SignNow for your Form 84 Application For Relief From Joint Income Tax Mass Gov Mass provides numerous benefits, including increased efficiency, enhanced security, and the ability to track document status. Our platform reduces the hassle of paperwork, allowing you to focus on other important aspects of your finances.

-

Is airSlate SignNow secure for submitting the Form 84 Application For Relief From Joint Income Tax Mass Gov Mass?

Yes, airSlate SignNow prioritizes security and utilizes advanced encryption protocols to protect your data. When you submit the Form 84 Application For Relief From Joint Income Tax Mass Gov Mass through our platform, you can be confident that your personal and financial information is kept safe.

Get more for Form 84 Application For Relief From Joint Income Tax Mass Gov Mass

Find out other Form 84 Application For Relief From Joint Income Tax Mass Gov Mass

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple