Tennessee Estate Inheritance Tax Waiver Form 2013

What is the Tennessee Estate Inheritance Tax Waiver Form

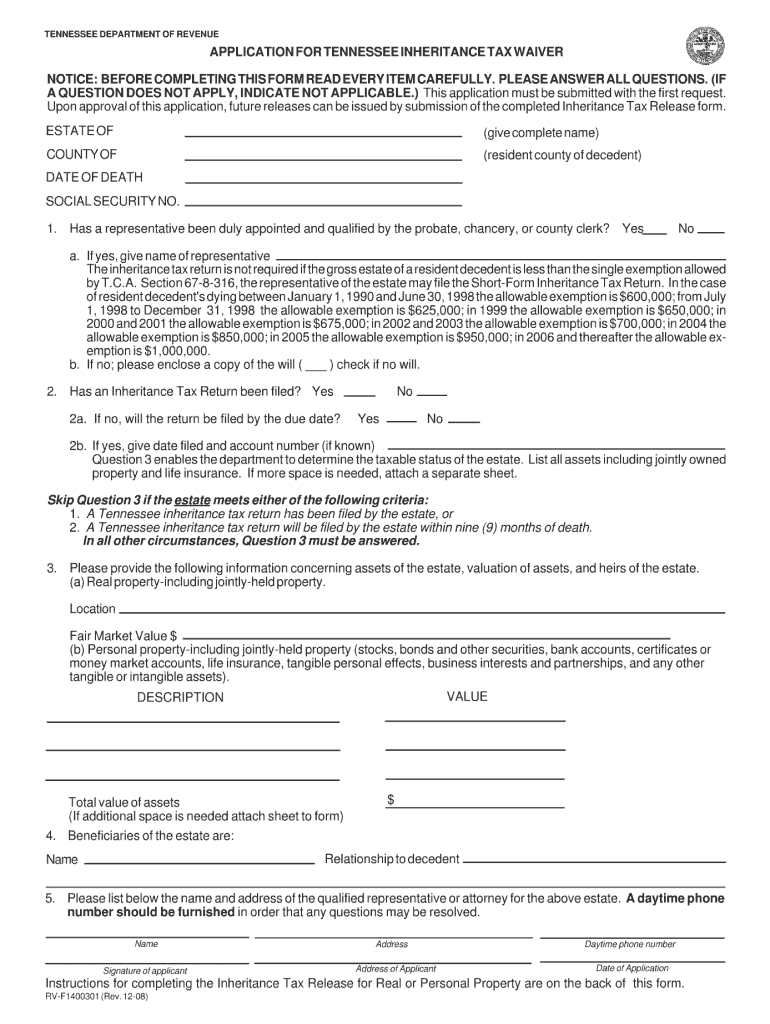

The Tennessee Estate Inheritance Tax Waiver Form is a legal document used to waive the inheritance tax on an estate in Tennessee. This form is typically required when an estate is being settled, allowing heirs to claim their inheritance without the burden of tax liabilities. The waiver signifies that the estate has fulfilled its tax obligations, ensuring a smoother transfer of assets to beneficiaries. Understanding this form is crucial for executors and heirs alike, as it helps clarify the tax responsibilities associated with the estate.

How to use the Tennessee Estate Inheritance Tax Waiver Form

Using the Tennessee Estate Inheritance Tax Waiver Form involves several key steps. First, gather all necessary information regarding the deceased's estate, including asset valuations and any outstanding debts. Next, complete the form accurately, ensuring that all details are correct to avoid delays. Once filled out, the form must be submitted to the appropriate state agency or tax authority. It is essential to keep a copy of the completed form for your records, as it serves as proof of compliance with state tax regulations.

Steps to complete the Tennessee Estate Inheritance Tax Waiver Form

Completing the Tennessee Estate Inheritance Tax Waiver Form involves a series of methodical steps:

- Gather required information about the deceased's estate, including asset values and debts.

- Obtain the form from the appropriate state agency or download it from a reliable source.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or missing information.

- Submit the form to the designated state office, either online or via mail.

Legal use of the Tennessee Estate Inheritance Tax Waiver Form

The legal use of the Tennessee Estate Inheritance Tax Waiver Form is crucial for ensuring compliance with state tax laws. This form must be accurately completed and submitted to demonstrate that the estate has settled its tax obligations. Failure to use the form correctly can result in penalties or delays in the distribution of assets. It is advisable to consult with a legal professional if there are any uncertainties regarding the completion or submission of the form.

Key elements of the Tennessee Estate Inheritance Tax Waiver Form

Key elements of the Tennessee Estate Inheritance Tax Waiver Form include the following:

- Decedent's name and date of death.

- Details of the estate, including asset descriptions and valuations.

- Information about the beneficiaries and their relationship to the decedent.

- Signature of the executor or administrator of the estate.

- Date of submission.

Filing Deadlines / Important Dates

Filing deadlines for the Tennessee Estate Inheritance Tax Waiver Form are essential to ensure compliance with state regulations. Typically, the form must be submitted within a specific timeframe following the decedent's death. It is important to check the current regulations, as deadlines may vary based on the estate's complexity and size. Missing these deadlines can lead to penalties or complications in the estate settlement process.

Quick guide on how to complete tennessee estate inheritance tax waiver 2008 form

Effortlessly Prepare Tennessee Estate Inheritance Tax Waiver Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Tennessee Estate Inheritance Tax Waiver Form on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The simplest way to edit and electronically sign Tennessee Estate Inheritance Tax Waiver Form effortlessly

- Locate Tennessee Estate Inheritance Tax Waiver Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and has the same legal standing as a traditional handwritten signature.

- Review all details and click the Done button to save your changes.

- Choose your preferred method for sending your form, either via email, SMS, or an invitation link, or download it to your computer.

No more worries about lost or misfiled documents, tedious form searches, or errors necessitating reprints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tennessee Estate Inheritance Tax Waiver Form while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee estate inheritance tax waiver 2008 form

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is the Tennessee Estate Inheritance Tax Waiver Form?

The Tennessee Estate Inheritance Tax Waiver Form is a legal document required to waive the inheritance tax in Tennessee. It simplifies the process for heirs and beneficiaries, ensuring that they can receive their inheritance without unnecessary tax burdens. Completing this form accurately is essential for compliance with state laws.

-

How do I complete the Tennessee Estate Inheritance Tax Waiver Form?

You can complete the Tennessee Estate Inheritance Tax Waiver Form by gathering the necessary information about the estate and the beneficiaries. Utilizing airSlate SignNow can streamline this process, allowing you to fill out and eSign the form digitally. This ensures a faster and more efficient completion of your legal requirements.

-

Is there a fee for using the Tennessee Estate Inheritance Tax Waiver Form with airSlate SignNow?

Using airSlate SignNow to complete the Tennessee Estate Inheritance Tax Waiver Form involves a subscription cost, which varies depending on your needs and usage levels. However, many customers find the simple, cost-effective solution well worth the investment for the efficiency it brings to document management. Explore our pricing options to find the plan that fits your requirements.

-

What are the benefits of using airSlate SignNow for the Tennessee Estate Inheritance Tax Waiver Form?

Using airSlate SignNow for the Tennessee Estate Inheritance Tax Waiver Form offers several benefits, including ease of use, document tracking, and secure eSigning capabilities. These features allow you to manage your documents efficiently while ensuring compliance with legal standards. Additionally, you can collaborate with other parties involved in the inheritance process seamlessly.

-

Can I integrate airSlate SignNow with other tools for managing the Tennessee Estate Inheritance Tax Waiver Form?

Yes, airSlate SignNow can be integrated with various productivity tools and applications, enhancing your workflow when managing the Tennessee Estate Inheritance Tax Waiver Form. This allows you to connect with your existing systems and streamline the document preparation process even further. Check our integration options to see what works best for your business.

-

What support is available for completing the Tennessee Estate Inheritance Tax Waiver Form?

AirSlate SignNow offers comprehensive support to assist you with any questions related to completing the Tennessee Estate Inheritance Tax Waiver Form. You can access tutorials, FAQs, and customer support representatives to guide you through any challenges you may face. Our goal is to ensure your experience is as smooth as possible.

-

How long does it take to process the Tennessee Estate Inheritance Tax Waiver Form?

The processing time for the Tennessee Estate Inheritance Tax Waiver Form can vary based on the complexity of the estate and the accuracy of the submitted information. However, using airSlate SignNow signNowly reduces the time needed for document preparation and approval. You can expect a more efficient process with our digital solutions.

Get more for Tennessee Estate Inheritance Tax Waiver Form

- Printable daycare income and expense worksheet form

- Odes 400 atv repair manual form

- You will hear someone welcoming a group of visitors to ocean life sea park form

- Stop the pirates form

- Ankle brachial index form

- Cna live scan form

- Application for subpoena form

- Office use onlyclient no date receivedapplicat form

Find out other Tennessee Estate Inheritance Tax Waiver Form

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement