Texas Application Exemption Form 2018-2026

What is the Texas Application Exemption Form

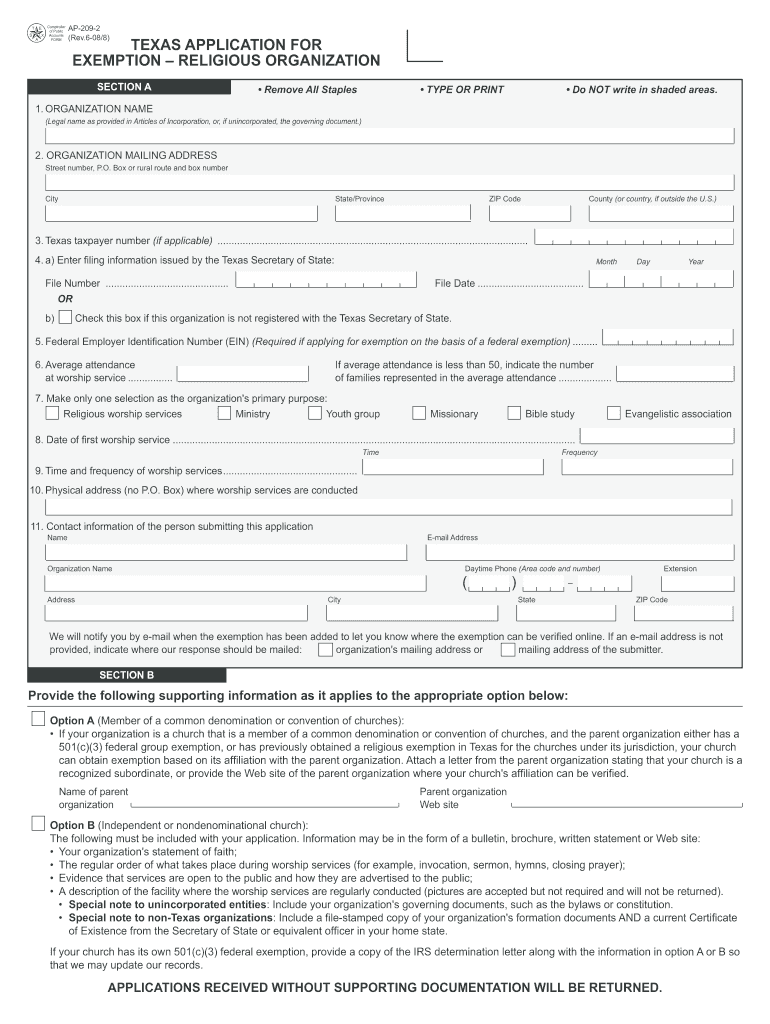

The Texas Application Exemption Form is a crucial document used by residents to apply for various tax exemptions available in the state. This form allows individuals and businesses to claim exemptions on property taxes, sales taxes, and other applicable taxes. Understanding the purpose of this form is essential for anyone looking to reduce their tax liability legally. The form typically includes sections that require detailed information about the applicant, the type of exemption being sought, and any relevant supporting documentation.

Steps to complete the Texas Application Exemption Form

Completing the Texas Application Exemption Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of residency, income statements, and any other relevant records. Next, carefully fill out the form, ensuring that all required fields are completed. Pay special attention to sections that specify the type of exemption you are applying for, such as the homestead exemption or other tax relief options. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Eligibility Criteria

Eligibility for the Texas Application Exemption Form varies depending on the type of exemption being sought. Generally, applicants must be residents of Texas and provide proof of ownership for the property in question. Specific criteria may include age, disability status, or income limits for certain exemptions, such as the homestead exemption. It is important to review the eligibility requirements for each exemption type to ensure that you qualify before submitting your application.

Required Documents

When applying for a tax exemption using the Texas Application Exemption Form, several documents are typically required to support your application. Commonly requested documents include proof of identity, such as a driver's license or state ID, proof of residency, and any relevant financial documents that demonstrate eligibility for the exemption. For property-related exemptions, documentation proving ownership, such as a deed or mortgage statement, may also be necessary. Having these documents ready can expedite the application process.

Form Submission Methods

The Texas Application Exemption Form can be submitted through various methods, depending on the local tax authority's guidelines. Common submission methods include online submission through the official tax authority website, mailing a printed copy of the completed form, or delivering it in person to the local tax office. Each method has its own set of requirements and timelines, so it is advisable to check with the local authority for specific instructions regarding submission.

Legal use of the Texas Application Exemption Form

The Texas Application Exemption Form must be completed and submitted in accordance with state laws to be considered legally valid. This includes ensuring that all information provided is accurate and truthful. Misrepresentation or failure to comply with the legal requirements can result in penalties or denial of the exemption. Utilizing a reliable electronic document solution, such as signNow, can help ensure that the form is completed correctly and securely, maintaining compliance with eSignature laws.

Quick guide on how to complete texas application exemption 2008 form

Manage Texas Application Exemption Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your papers quickly without delays. Handle Texas Application Exemption Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Texas Application Exemption Form effortlessly

- Locate Texas Application Exemption Form and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Texas Application Exemption Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas application exemption 2008 form

Create this form in 5 minutes!

How to create an eSignature for the texas application exemption 2008 form

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What are the guidelines to Texas tax exemptions 96 1045?

The guidelines to Texas tax exemptions 96 1045 provide a framework for businesses to understand eligibility and the application process for tax exemptions. This includes specific criteria, documentation requirements, and how to properly submit an exemption claim. Familiarizing yourself with these guidelines can greatly benefit your tax strategy.

-

How can airSlate SignNow assist with managing Texas tax exemption documents?

airSlate SignNow streamlines the management of Texas tax exemption documents by allowing you to easily create, send, and eSign the necessary paperwork. With our platform, you can ensure that your exemptions align with the guidelines to Texas tax exemptions 96 1045, making the process efficient and compliant. This eliminates the risk of errors and delays associated with traditional methods.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax exemptions?

Yes, airSlate SignNow is a cost-effective solution tailored for small businesses navigating the complexities of tax exemptions, including the guidelines to Texas tax exemptions 96 1045. Our pricing plans are designed to suit varying business needs, ensuring that you receive value without unnecessary expenses. You can manage your documents efficiently while saving on operational costs.

-

What features of airSlate SignNow are beneficial for tax exemption management?

Key features of airSlate SignNow that are beneficial for tax exemption management include customizable templates, real-time tracking, and secure eSignature capabilities. These features ensure that you can efficiently follow the guidelines to Texas tax exemptions 96 1045 while maintaining document integrity. Additionally, our easy-to-use interface makes it accessible for all users.

-

Can airSlate SignNow integrate with my existing accounting software for tax exemptions?

Absolutely! airSlate SignNow offers seamless integration with various accounting software, enhancing your workflow related to tax exemptions. By integrating with platforms that support the guidelines to Texas tax exemptions 96 1045, you can efficiently manage all your documents in one place. This integration reduces manual entry errors and improves overall efficiency.

-

What are the benefits of using eSignatures for tax exemption forms?

Using eSignatures for tax exemption forms provides several benefits, including faster processing times and increased security. By adhering to the guidelines to Texas tax exemptions 96 1045, eSignatures ensure that your documents are legally binding and compliant. This method also reduces reliance on paper, promoting a more sustainable business practice.

-

How does airSlate SignNow ensure compliance with Texas tax laws?

airSlate SignNow is designed to help businesses maintain compliance with Texas tax laws, including the guidelines to Texas tax exemptions 96 1045. Our platform is regularly updated to reflect changes in legal requirements, ensuring that users can navigate the complexities of tax documentation with confidence. We also provide resources and support to facilitate compliance.

Get more for Texas Application Exemption Form

- Worksheet 14 career research form

- Application for burial allowance form

- Robbery description form 292156624

- Financial management prasanna chandra solutions form

- Surat pengesahan kesihatan form

- Drain output record sheet form

- Asia pacific economic cooperation business travel card form

- Form 456 australia short stay business visa bapplicationb form bb

Find out other Texas Application Exemption Form

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free