01 924 Online Form 2017-2026

What is the 01 924 Online Form

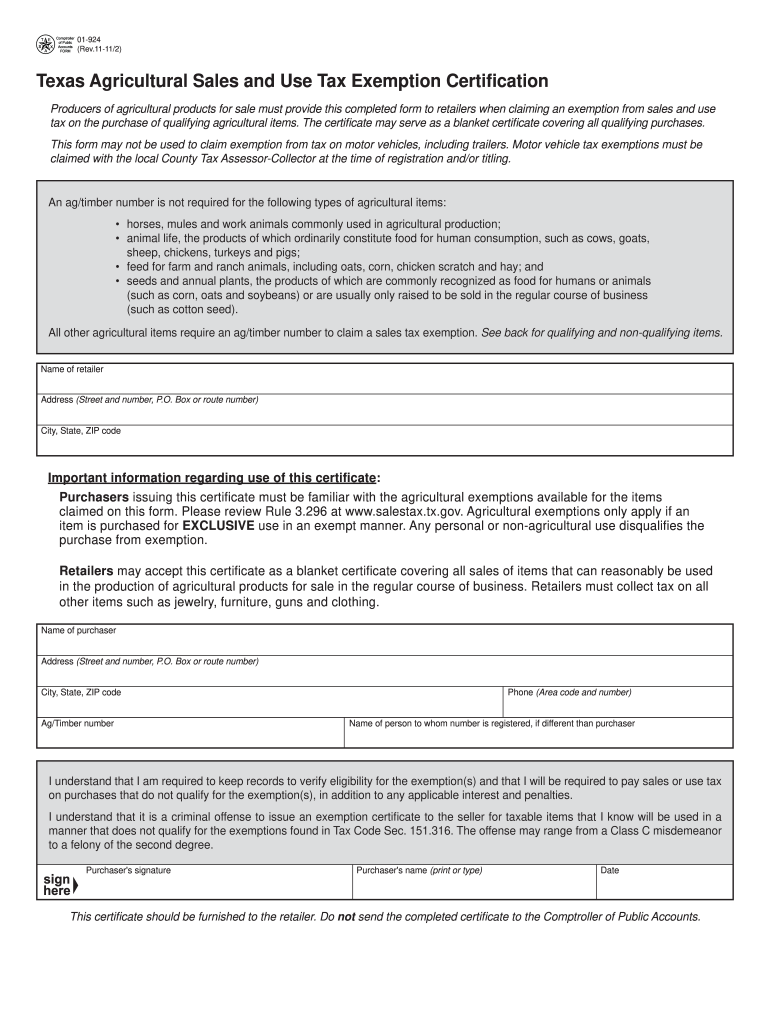

The Texas farm tax exempt form, commonly referred to as the 01 924 form, is an essential document for agricultural producers seeking a sales tax exemption on items purchased for agricultural use. This form allows eligible farmers and ranchers to avoid paying sales tax on qualifying purchases, which can significantly reduce operational costs. The 01 924 form is specifically designed to meet the requirements set forth by the Texas Comptroller of Public Accounts, ensuring compliance with state tax laws.

How to use the 01 924 Online Form

Using the 01 924 online form is a straightforward process. First, access the form through a secure digital platform that supports eSigning. Once you have the form open, fill in the required fields, which typically include your name, address, and details about your agricultural operations. After completing the form, you can electronically sign it. This method not only saves time but also ensures that your submission is legally binding and compliant with eSignature laws.

Steps to complete the 01 924 Online Form

Completing the 01 924 form involves several key steps:

- Gather necessary information about your agricultural business, including your Texas Agricultural Tax Exemption number.

- Access the form through a secure online platform.

- Fill in all required fields accurately, ensuring that all information is up to date.

- Review the completed form for any errors or omissions.

- Sign the form electronically to validate your submission.

- Submit the form as instructed, either through the online platform or by printing and mailing it to the appropriate office.

Legal use of the 01 924 Online Form

The legal use of the 01 924 form is governed by Texas state laws that outline the criteria for agricultural tax exemptions. To ensure the form is used correctly, it is crucial to understand the eligibility requirements and the types of purchases that qualify for exemption. Utilizing a trusted electronic signature solution can help maintain compliance with laws such as the ESIGN Act and UETA, making your digital submission legally recognized.

Eligibility Criteria

To qualify for the agricultural tax exemption using the 01 924 form, applicants must meet specific eligibility criteria. Generally, this includes being an active farmer or rancher engaged in the production of agricultural products for sale. Additionally, the items purchased must be directly related to agricultural operations, such as feed, seed, and farming equipment. It is essential to review the Texas Comptroller's guidelines to ensure compliance with all requirements.

Required Documents

When completing the 01 924 form, certain documents may be required to support your application. These typically include proof of your agricultural business, such as a Texas Agricultural Tax Exemption number, and any relevant identification that verifies your status as a farmer or rancher. Having these documents ready can streamline the completion process and help avoid delays in obtaining your tax exemption.

Quick guide on how to complete 01 924 online form 2011

Complete 01 924 Online Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Manage 01 924 Online Form on any device with airSlate SignNow's Android or iOS applications and enhance your document-driven tasks today.

The easiest way to edit and eSign 01 924 Online Form without any hassle

- Locate 01 924 Online Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tiring form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 01 924 Online Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 01 924 online form 2011

Create this form in 5 minutes!

How to create an eSignature for the 01 924 online form 2011

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the Texas farm tax exempt form?

The Texas farm tax exempt form is a document that allows qualifying agricultural businesses to claim exemption from certain taxes in Texas. This form helps farmers and ranchers reduce their tax burden and is crucial for compliance with state regulations regarding agricultural products.

-

How can airSlate SignNow help with the Texas farm tax exempt form?

airSlate SignNow streamlines the process of filling out and signing the Texas farm tax exempt form. With our easy-to-use platform, you can quickly prepare, eSign, and send your forms, ensuring your documentation is handled efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for the Texas farm tax exempt form?

airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. You can choose a plan that best fits your needs, ensuring that managing the Texas farm tax exempt form remains affordable while benefiting from our robust features.

-

What features does airSlate SignNow provide for handling the Texas farm tax exempt form?

airSlate SignNow comes with essential features like customizable templates, automated workflows, and secure cloud storage. These features enable users to efficiently manage the Texas farm tax exempt form process, minimize paperwork, and ensure timely submissions.

-

Can I integrate airSlate SignNow with other software to manage my Texas farm tax exempt form?

Yes, airSlate SignNow offers seamless integrations with various business tools such as CRM systems and accounting software. This allows you to manage your Texas farm tax exempt form alongside your other business processes, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for eSigning the Texas farm tax exempt form?

Using airSlate SignNow for eSigning the Texas farm tax exempt form simplifies the signing process, eliminates the need for printing, and speeds up document turnaround times. This ensures that you can focus more on your agricultural business while complying with tax regulations.

-

Is it easy to store and retrieve the Texas farm tax exempt form using airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including the Texas farm tax exempt form. This means you can easily store, access, and retrieve your forms whenever needed, keeping your records organized and secure.

Get more for 01 924 Online Form

- Rossetti parent questionnaire pdf form

- Emma has a new bicycle form

- 1099 form pdf

- Mewp risk assessment example form

- Protest petition form r 21001

- P terrys hiring age form

- Jv 817 application for extension of time to file brief juvenile form

- Your personal document organizer as our parents grow older form

Find out other 01 924 Online Form

- Sign Presentation for Procurement Easy

- How Do I Sign PPT for Procurement

- Help Me With Sign PPT for Procurement

- How To Sign Presentation for Procurement

- How Can I Sign PPT for Procurement

- Can I Sign PPT for Procurement

- Help Me With Sign Presentation for Procurement

- How Can I Sign Presentation for Procurement

- Sign PDF for IT Online

- Sign PDF for IT Mobile

- Sign PDF for IT Myself

- Sign PDF for IT Simple

- Sign PDF for IT Safe

- Sign Word for IT Online

- Sign Word for IT Computer

- Sign Word for IT Mobile

- Sign Word for IT Later

- Sign Word for IT Myself

- Sign Word for IT Free

- How Do I Sign Word for IT